February 7, 2025 – In the complex power dynamics between nation-states, governments employ a spectrum of foreign policy tools to influence the behavior of other nations. These range from soft power instruments like international aid, cultural exchange programs, and economic collaborations, to more muscular measures such as diplomatic treaties and conditional financial assistance. At the most aggressive end of this spectrum lies military power—the use of force to achieve policy objectives.

This week marks a significant shift in how the US wields these tools and against whom. It represents a departure from the norms that have governed the post-WWII global order, and especially the neoliberal approach prevalent among developed countries over the past half century. Whether this signals a new era in US foreign relations or a short detour remains to be seen, but for now, the US appears to be on a new path.

The week began with the administration announcing a 25% tariff on goods imported from Mexico and Canada, which were quickly reversed on Monday, and a 10% tariff on Chinese goods that remains in place. Remarkably, the explanation for the tariffs on Canada and Mexico focused not on economics or trade, but on the issues of migration and fentanyl smuggling. While economic policy has long been a tool of foreign policy, it is rare to see it used against allies to address non-economic issues.

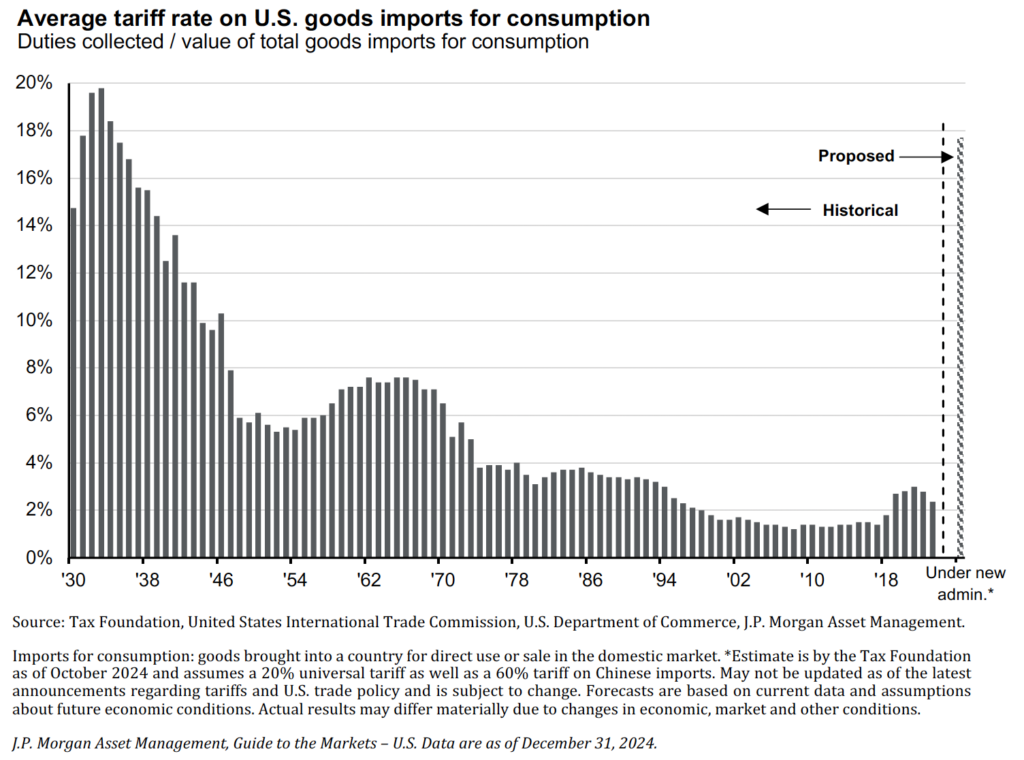

Tariffs represent a potent challenge to generations of free trade advocates. Most economists argue that free trade allows economies to specialize in areas where they have a competitive advantage, benefiting all parties involved. However, this analysis often overlooks the uneven distribution of these benefits. Not everyone has gained equally from globalization, and the backlash against its real and perceived injustices has fueled populist movements in the US and Europe. Viewed through this lens, imposing tariffs on our largest trading partners challenges the status quo that views trade as an absolute good and appeals to segments of the administration’s base.

Economic and Market Impacts

News of the tariffs roiled markets on Monday. Most economists believe tariffs have a stagflationary impact. First, they raise prices of imported goods, leading to price inflation. Second, they hurt companies that rely on imported goods and lower demand for US exports when retaliatory tariffs are implemented. The nonpartisan National Bureau of Economic Research estimates that the 2018 trade wars resulted in losses of $51 billion, or 0.27% of GDP, to US consumers and firms that buy imports. However, government revenue from tariffs and gains by domestic firms that benefited from the tariffs offset all but $7.2 billion of this loss, effectively making tariffs a tool for taxation and the subsidization of select industries.

Viewing tariffs as both a tax and a targeted incentive, while also serving as leverage in international negotiations—helps explain their appeal to the administration. Revenue from tariffs could help extend or enable new tax cuts without increasing the deficit, potentially appealing to deficit-conscious lawmakers. But this approach is not without tradeoffs. Beyond the economic impact and the effect on US relations with other states, these types of rapid changes in policy and a shift away from the US’ historical position as an advocate of free trade could impact the long-term investment decisions of corporations.

In all, the markets appeared to shrug off the possible impact of tariffs. After a rocky Monday, stocks pared some of their losses on Tuesday, and credit spreads remained stable. Some amount of tariffs are likely priced in by investors, and a retreat from the tariffs on Mexico and Canada may have convinced investors that it was all a negotiating bluff after all. Still, more market volatility around tariffs is likely instore for us.

What Comes Next

It’s clear that tariffs are playing an important role in the administration’s trade, foreign, and fiscal policies. Nothing has been resolved with Mexico and Canada, we’re only at the beginning stages of negotiations with China, and we haven’t even talked about Europe yet. Boring, it will not be.

While it is difficult to find an economic silver lining in protectionist trade policies, they must be viewed within the broader context of the administration’s overall agenda. This, in turn, will be shaped by public opinion, the reactions of investors and business leaders, and the actions of legislators. The quick reversal of the tariffs on Monday is a case in point.

Tariffs were not the only foreign policy disruption this week. The dismantling of USAID, the US’ longstanding international development arm, marks a shift away from a tool of soft power diplomacy. The withdrawal from several U.N. bodies shows a willingness to question longtime commitments to international organizations in which the US has played a key role for decades. Then we had the administration’s proposal to ‘take over’ Gaza, a marked break from decades of US policy. What was, is not what will be.

The administration’s mindset and approach this week tell us a little bit about what to expect in the coming years. Many long-standing norms are being questioned, and things are changing quickly. In this environment, it’s especially important to maintain investment discipline. Investors should have a financial plan and an asset allocation that matches their goals. In an uncertain world, maintaining a disciplined process is more important than ever. Please don’t hesitate to reach out with any questions or concerns.

— AMD

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2025 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.