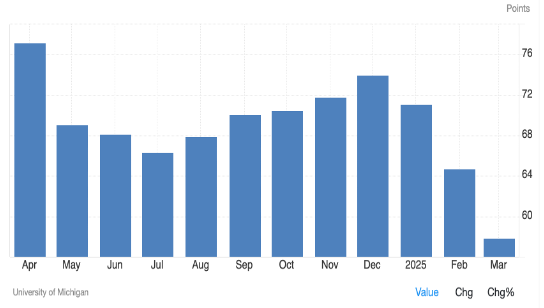

The Big Story: Consumer Confidence Craters

The most unexpected and attention-grabbing development in the first quarter was the sharp decline in US consumer confidence in the outlook for general economic conditions and inflation. In the March University of Michigan Consumer Confidence Survey, one-year forward inflation expectations rose to 5%. Conference Board surveys of consumer confidence have documented the same trend. Business confidence surveys are expected to reveal a similar dynamic in the second quarter.

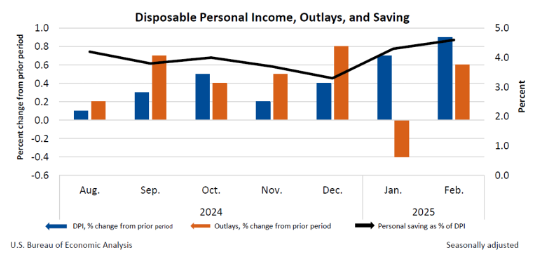

And Yet . . . Personal Income Growth Remains Strong

Wage and salary growth continue to exceed the general rate of inflation, supporting ongoing spending and a certain amount of increased savings. However, it is less clear that consumer spending strength holds up when disaggregated, with lower-income households registering budgetary stress, primarily from higher prices on basic goods. Total consumer spending in the quarter has favored spending on services, though spending on some services, such as airline travel, softened. Both trends – rising income and spending accompanied by an unusual amount of cautionary behavior—are expected to continue in the second quarter. However, downside risks to employment and income are becoming increasingly apparent.

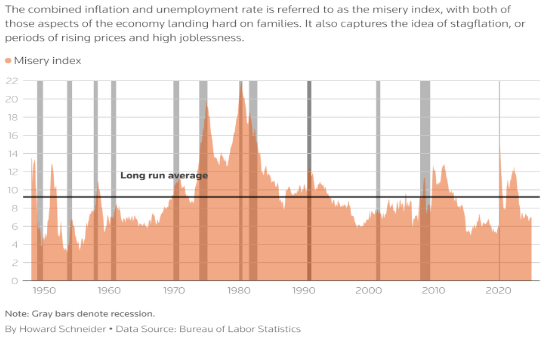

The Misery Index Confirms The Current, Relatively Positive Environment

Robust US job creation has been the key to first-quarter economic health. In February, nonfarm payrolls added 151,000 jobs, slightly below expectations but consistent with general economic activity and weak labor force growth. However, the broader Household Survey of Employment showed a decline in jobs as the quarter progressed, a trend that will be closely monitored in the second quarter and possibly signals future job market weakness.

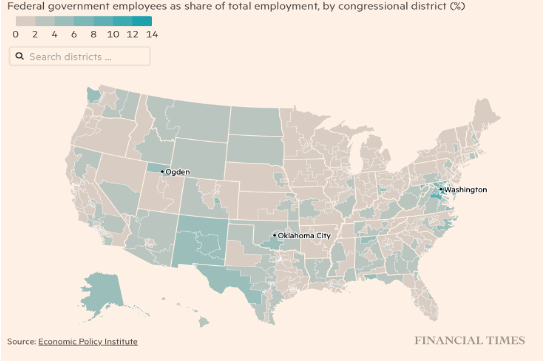

Federal Government Employment Becomes a Big Story

The Federal Government employs over 3 million people and supports employment in many private-sector industries via government contracts for goods and services. Across the first quarter, significant reductions in federal employment and spending were discussed and, in some cases, effected. It seems clear that the economic impact of proposed federal labor force reductions will be witnessed in future quarters and with considerable geographic diversity. Local economic effects will be far more pronounced than for the national economy, at least in the near term.

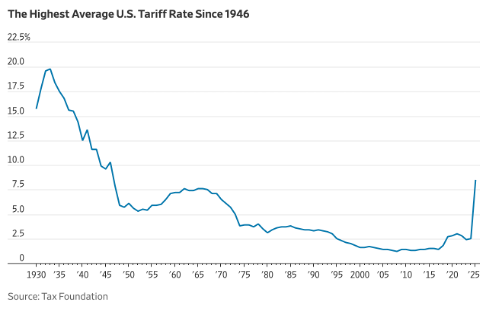

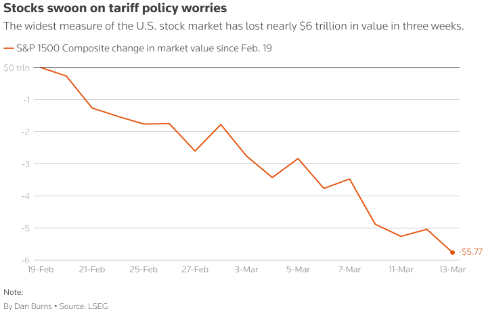

It’s All Tariffs, All the Time

The dominant economic story of the quarter has been tariffs imposed and threatened. The major tariff action is yet to come, scheduled for the second quarter and with economic impact anticipated later in the second quarter and throughout the year. However, steel and aluminum tariffs imposed in late February have already had an impact on business operations, increasing costs and slowing business activity in some sectors. By the end of the first quarter, the average tariff rate in the United States, estimated at a modest 2.3-2.5%, had risen to 8%. While the Federal Reserve remains vigilant for the impact of tariffs on inflation, the longer-term concern is the negative impact on consumer spending and employment.

Outside the United States, A Mixed Bag

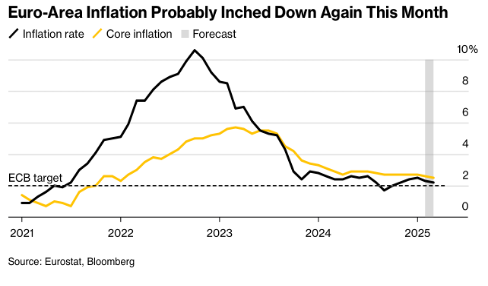

The first quarter’s focus on tariffs has served to put a spotlight on the economic standing of US trading partners such as Canada, Mexico, Europe, and China. Elections in Canada and Germany were heavily influenced by economic fears and hopes, with the most interesting story coming out of the stagnant German economy and the proposal to greatly increase fiscal spending, especially on defense. Moderating European inflation allowed the European Central Bank (ECB) to continue to reduce interest rates, further boosting economic growth prospects. While it had been anticipated that the ECB would pause on interest rate cuts in the second quarter, given that inflation is still judged “too high,” the negative impact on European economies from tariffs may cause the ECB to continue easing monetary policy.

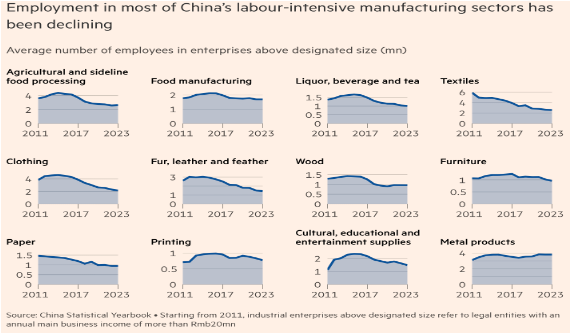

China is a different story, similarly influenced by changing US trade policy. Domestic demand continues to falter, which becomes an even greater problem for Chinese authorities contemplating curtailment of their key export markets. Although domestic consumption and employment weakness is not new for China, the first quarter saw many numbers go in the wrong direction after some improvement at the end of 2024. Of particular note was commentary that deflationary forces have returned, requiring the Chinese government to take substantive fiscal action. Big announcements should be anticipated in the second quarter, though they may be more show than substance.