April 11, 2025 – For much of the past decade, the Fed played a central role in the US economy. From innovative programs such as Quantitative Easing (QE) that emerged in the wake of ’08, through the Covid response, and culminating in the interest rate hikes of 2022, investors saw the Fed as a dominant force influencing asset prices from homes to US equities. The first quarter of 2025 saw this role usurped. Not by market forces, as some had hoped, but by the US government. Specifically, policies on trade, immigration, and government spending are reshaping the economy of the US and those of many other countries around the globe.

The current administration’s policies are not happening in a vacuum. The first Trump administration levied tariffs on China, and the Biden admin left these in place; the challenge of illegal immigration has been simmering for years, if not decades; and, the increase in the Federal deficit over the past decade is known to be unsustainable. Still, the speed and magnitude of the policies enacted over the past five months have shocked many and suggested an administration ready to act on its beliefs at the cost of what they see as short-term economic pain.

Trade Policy

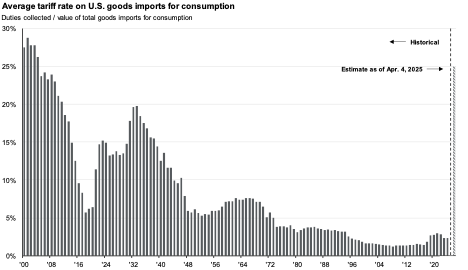

Investors spent Q1 in a state of uncertainty as they awaited news on tariffs. Early tariff announcements suggested limited tariffs on things like steel and cars and on countries allegedly implicit in the fentanyl crises. The optimism proved unwarranted. The decision announced on April 2nd, and later partially suspended for 90 days, sets a 10% base tariff on all goods imported into the US, and an additional tariff meant to offset other countries’ tariffs, taxes, alleged currency manipulation, and other trade barriers.

Based on the administration’s explanations, there appear to be three major reasons behind this decision:

- Revenue collection. Early estimates suggest that tariffs imposed by the administration could raise $2.9 trillion in revenue over the next 10 years.[1] This revenue could be used to shrink the federal deficit, or, more likely, to offset the cost of extending the 2017 tax cuts enacted under the JOBs act that are set to expire this year. The Congressional Budget Office estimates that extending the JOBs act for 10 years would cost the federal government $4.6 trillion.

- Rebuilding the US industrial base. Globalization caused much offshoring of manufacturing to lower cost countries, and allowed the US to specialize in technology and other complex goods and services. However, the economic impacts of this shift were not equally distributed across the country, and it left the US dependent on vulnerable supply chains, as in the case of microchips. In the wake of Covid and the increased tensions with China, these issues have drawn more attention, and the Biden administration sought to address them with subsidies and other incentives for the onshoring of chips, clean energy infrastructure, and domestic auto production.

- Decreasing the trade deficit. The US imports more than it exports, resulting in a trade deficit. This imbalance is, in effect, a loan from the rest of the world to the US, and it’s offset by inflows of capital into US investment assets such as stocks and government bonds. There are many factors that influence the size of this deficit—the strength of consumers and their low savings rate, inflows of capital in the US, the strength and status of the dollar, and the role of US treasuries as a ’risk-free’ asset.

Many of these policies diverge from conventional economic thinking. Tariffs as a form of taxation are complicated to implement and fall more heavily on low income households which spend a greater % of their income than affluent consumers; globalization has increased US economic prosperity, though it’s true that not all communities have benefited from this equally; and, a trade deficit is not necessarily a bad thing, and to a great extent reflect internal factors of the US economy like strong consumer spending, dynamic capital markets, and a need to fund a large government deficit.

If tariffs as a solution are unconventional, the problems they are designed to solve are generally accepted. The US must address its growing government deficit. More needs to be done to increase the prosperity of former manufacturing towns that have not benefited from the tech boom. Further, there are good security reasons to want a strong industrial base right here in the US. Finally, a trade deficit that finances a government deficit (economists refer to this as the Twin Deficit hypothesis) suggests a country living above its means which is unsustainable in the long term.

To what extent tariffs will help address any of these issues remains to be seen. Conventional economic wisdom has many shortfalls, but bucking it is not without risk. At best, the administration is right, and the tariffs cause only a short period of economic pain before ushering in a period of prosperity. At worst, we get a deep recession, a decrease in confidence in the US and the dollar, and little progress on any of the above goals. In any world that doesn’t include a reversal of the tariff policies, we can expect short term growth to take a hit, prices to rise, and consumer and business confidence to fall.

Immigration

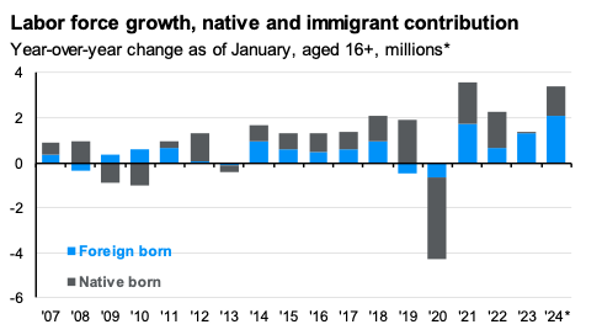

The current administration has drawn much attention to its deportation policies, but the actual number of deportees is in line with the 2024 numbers. The big change however, from an economic standpoint, is the massive decrease in the number of illegal border crossings, which in February hit the lowest recorded level since 2000. This decrease will likely impact labor supply, especially for the agriculture and services industries. The US has also enjoyed significant legal migration in the past years, with over 1.2 million new green card issues in 2024.[2] We don’t yet know how legal migration is changing under the current administration.

Given the important role that foreign born workers have played in the US economy over the past decade (see Chart 2), there’s reason to believe the US will face labor shortages if both legal and illegal immigration remain depressed. While this could result in upward pressure on wages, US employers have proved adept at keeping real wages steady, and especially in periods of slower economic growth, employees are less likely to negotiate for higher salaries.

Government Spending Cuts

The newly formed Department of Government Efficiency (DOGE) has wasted no time in its effort to cut down the size of the Federal government. While this effort has drawn much attention, its ultimate impact remains to be seen. The NY Times estimates that roughly 276,000 federal employees have been fired or accepted buyout options, less than 10% of the more than 3,000,000 workers employed by the Federal government.[3]

Still, these cuts are not without impact on the economy, especially when cuts to government contractors and programs funded by the US government are considered. Shrinking of the government is the reverse of fiscal stimulus, and any reduction in government spending will negatively impact demand for goods and products, at least in short term.

**

All the above changes in government policy are expected to have a cooling down impact on the economy, at least in the short to medium term. While we are still waiting on Q1 GDP numbers, economists expect only muted growth of between 0 and 1%, a sharp decline from 2.8% growth in 2024.[4] The US economy was already slowing down at the end of 2024, and the combination of policy changes and the rapid decline in consumer and business confidence are expected to accelerate this cooling.

The Markets

US stock markets have responded to the above policy changes, and the overall slowing down of the economy, in a predictably negative manner.[5] The S&P 500 ended Q1 down 4.3%, while the tech heavy NASDAQ lost 10.3%. These losses were only a prelude to the impact of April 2nd tariff announcement that sent stocks plunging.

The shining spot for equities was European markets, with the MSCI Europe index up 10.5% in Q1. This unusual decoupling of European and US markets is thought to result from different government policy decisions. While the US is adding trade barriers and cutting government spending, Germany announced massive fiscal spending on infrastructure and military spending. This represents a break from the country’s conservative approach to fiscal spending and government debt and may herald a new policy approach for the long stagnating continent, though major roadblocks remain.

In the bond market, yields on government treasuries came down slightly across maturities, pushing the Bloomberg US AGG up 2.78% for the quarter (recall that when yields go down, bond prices go up). The spread between 1-year Treasuries and Investment Grade bonds remained steady, while the US High Yield spread increased by 60bps, though they remained close to historical lows.

The Outlook

If the tariffs announced on April 2nd are fully implemented, the US economy is likely headed towards a recession. Companies that have set up supply chains based on previous tariff policy now find themselves forced to raise prices significantly, and / or reimagine supply chains, a process that will take years. Worse, significant uncertainty remains around where tariffs will ultimately land, turning decision making into a futile exercise in frustration. The result will be less spending, business investment, and hiring. Economic growth will slow and prices will rise—the only question is how much. Worse, a recession is also possible in Europe, the UK, Canada, Japan, and possibly China, all of whom have significant trade with the US.

Even if the announced tariffs are not ultimately implemented, it’s not clear that the US can avoid a recession. The rapid changes in policy have injected much uncertainty into the decision making of processes of companies and consumers. Hiring is likely to slow, consumers will reconsider non-essential spending, and other countries will seek more reliable trading partners. Further, the tariffs on China, the US’ 3rd largest trading partner, remain in place, and the trade war between the countries is escalating.

Though the US economy is entering this period from a position of economic strength, there is little that can be done to avoid an economic slowdown. Exports are unlikely to go up as countries pose new tariffs on US goods. Consumers are already stretched, and though they may accelerate buying to capture pre-tariff prices, this will likely be a short-lived resurgence.

In response to the tariffs and the impending slowdown, the Fed has assumed a wait-and-see approach. Tariffs are likely to both increase unemployment and raise prices, creating competing demands on the Fed. In response, and despite pressure from the administration, the Fed has stated that they will wait and see the impact of the tariffs before acting. In any event, the Fed’s ability to halt a slowdown is limited, as reducing rates is rarely enough to prevent lenders, businesses, and consumers from reducing their risk.

That leaves the US economy with fiscal stimulus, or government spending. Much is still unknown about the ‘big beautiful’ tax-cut and spending bill, and whether it will increase or decrease the federal deficit. The worse the economy gets, the more likely the bill will include some form of stimulus, possibly even checks to households a la the Covid response. Still, any stimulus will have to pass through a very narrow GOP majority in Congress and pass muster with investors. This is where the sins of past administrations (including Trump I) come into play—the US is entering a recession with a significant deficit and debt load, and this will restrict the administration’s ability to stimulate the economy.

If all the above seems gloomy, that is an accurate reflection of the current outlook. Even the administration has acknowledged that there will be short term pain associated with the tariff ‘medicine’. The pain at this point appears certain, but the payoff is less so.

The bright point in Q1 is that many investment principles worked as intended, and they continue to do so in the volatility of early April. Internationally diversified investors, those exposed to non-US developed and emerging markets, outperformed US only investors. High quality bonds provided a ballast and increased in value, even as stocks declined. These principles, along with intentional portfolio construction that reflects your financial needs and preferences, will be ever more important in the coming days. Periods of uncertainty are uncomfortable by nature, but they also reward discipline, preparation, and the ability to stay opportunistic in the face of change.

Please don’t hesitate to reach out with any questions or concerns. Wishing us all a happy and peaceful spring!

— AMD