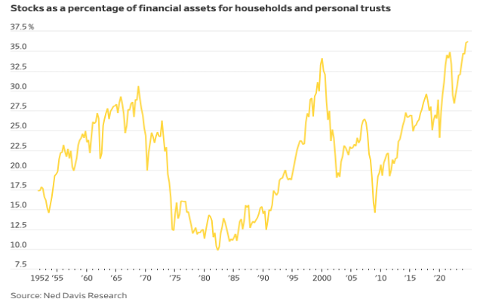

It is estimated that 62% of US households own stocks, a percentage that has increased substantially over the last two decades. Nevertheless, real estate still represents the largest single component of household wealth (and residential mortgages are the biggest factor in household indebtedness.)

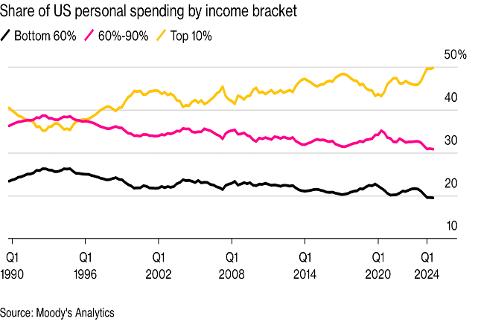

Consumer spending is the $16 trillion gorilla of US economic growth. In recent years, consumer spending growth has been increasingly determined by spending trends in the top 10% income percentile. This percentile also holds the largest share of equity assets, and in April 2024, the St. Louis Federal Reserve estimated that the top 1% of the income distribution held 72.8% of their financial assets in corporate equities and mutual funds.

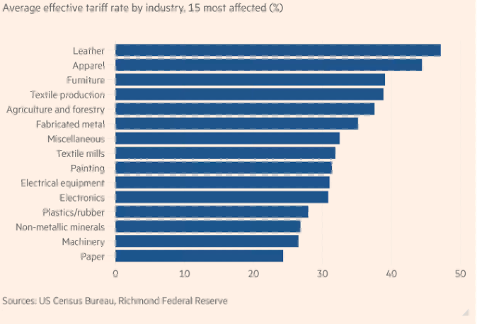

Most of the recently announced tariffs have been paused, but tariffs on China have been increased. Prior to the pause, the effective tariff rates on various industries were estimated by the Richmond Federal Reserve. Many of these industries have significant exposure to China, so despite the pause, it is likely that these effective tariff rates have actually gone up.

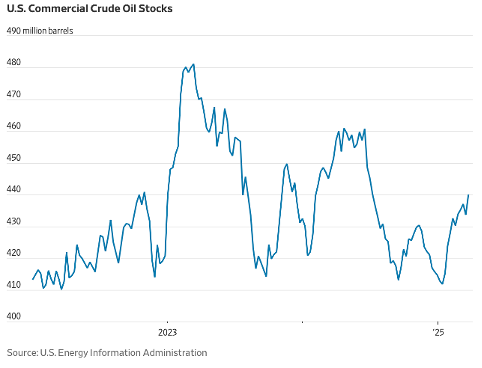

Oil prices have fallen sharply, and oil inventories have increased. Both developments reflect a concern over trade disruption that will slow global growth and reduce oil demand, with US oil inventories indicating that the slowdown in US economic activity in the first quarter is already in place. While falling oil prices should lead to lower gasoline prices and, in turn, reduced inflationary pressures, prices below $60 present problems for producers, who may scale back operations—and employment.

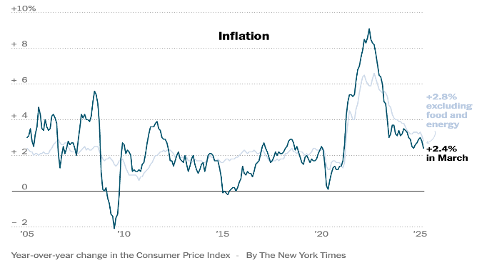

The US Consumer Price Index in March is widely being interpreted as confirmation of the Federal Reserve’s long desired “soft landing.” Unfortunately, an equally large number of analysts and economists believe that this is a touch-and-go landing that will be followed by a tariff-related acceleration in consumer prices in the second quarter. On April 10, the CEO of Amazon was quoted as saying he expected most Amazon vendors would choose to pass along price increases to consumers.

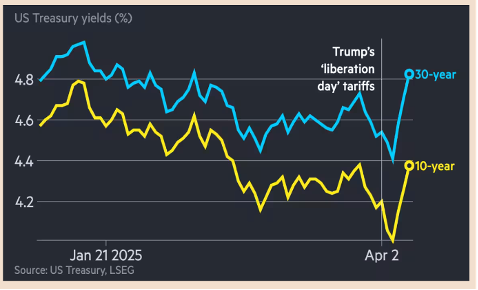

The March CPI numbers would normally be cause for celebration, with a moderation of long term interest rates. Quite the opposite has happened as uncertainty over the longer term outlook for inflation has risen. Additionally, US Treasuries have been unusually volatile, with erratic sales activity related to the turmoil in equity markets (reminder: selling pushes prices down and yields up.) The 10 year Treasury is the key benchmark for business investment and borrowing; the rise in the 10 year Treasury over the last week is, as they say, “not helpful.”

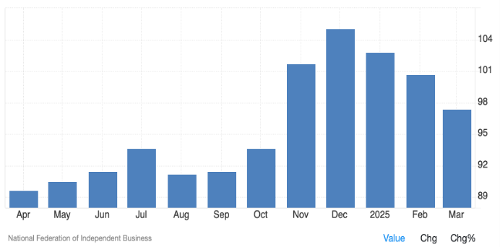

Falling consumer confidence remains in the news, with preliminary figures for the April Michigan Consumer Confidence Survey showing further deterioration from March. There are fewer comprehensive surveys of business confidence, but the National Federation of Independent Business has a long-standing survey of small business sentiment which currently shows an erosion of confidence from a post-election burst of enthusiasm. Many businesses expected a less-regulated business environment that would boost profit margins while sales continued to grow. Although an argument can be made for less regulation and reduced costs in some areas, notably DEI, tariff turmoil has sharply increased costs for some small businesses, and negatively impacted sales.

Finally, as an antidote to the focus on current equity market declines, it is worth looking back at 2024 to recall exactly how exceptional equity markets were last year.