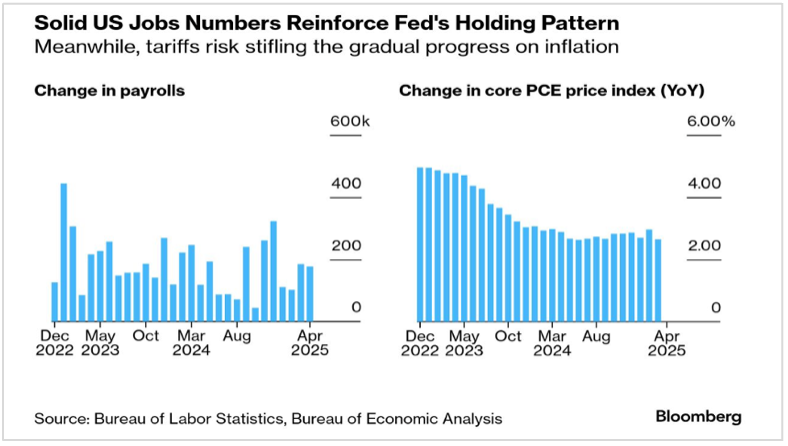

At the press conference on May 7, following the FOMC’s announcement to hold interest rates steady, Fed Chairman Jerome Powell emphasized that the US economy is currently in good shape. Although recession and inflation risks have increased, cracks are not yet seen in the “hard data,” such as US nonfarm payrolls.

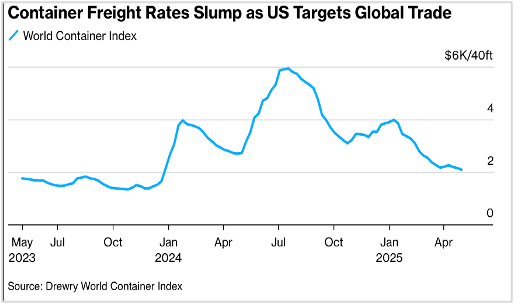

When economists refer to “soft data”, they usually mean survey data, such as those for consumer and business sentiment. However, there is another category of data, often overlooked, that might be called “non-traditional data”, such as measures of port activity, small package deliveries, and rail car loadings. Former Fed governor Wayne Angell, who died in late April at the age of 94, was famous for watching commodity prices and railroad freight rates for more real-time insight into economic activity and inflation.

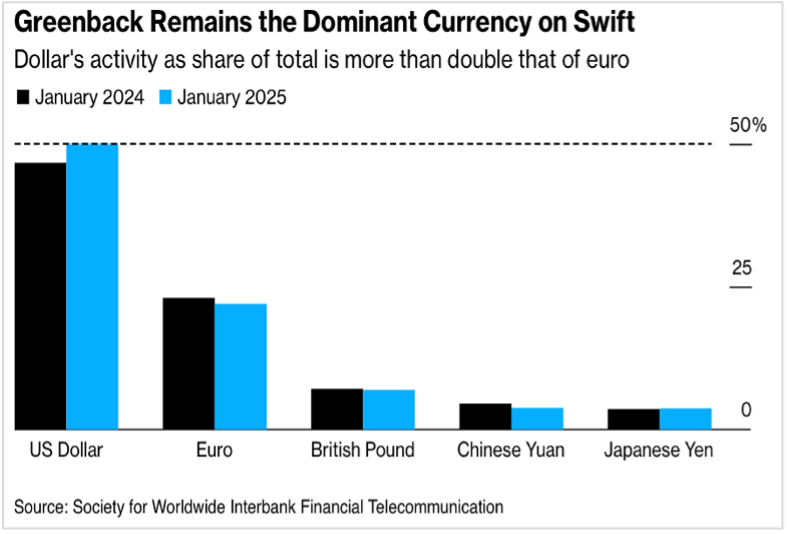

There has been much discussion about the rest of the world seeking an alternative to the US Dollar as a reserve currency (i.e., the primary currency used for global transactions). Although there has been some slight movement away from the dollar, especially as the US stock market and policy volatility have (temporarily?) discouraged foreign investment, the dollar remains dominant in global transactions. In April, use of the Chinese Yuan rose slightly compared to the data in this chart. Still, as a heavily government-managed currency, it is generally not considered a viable option.

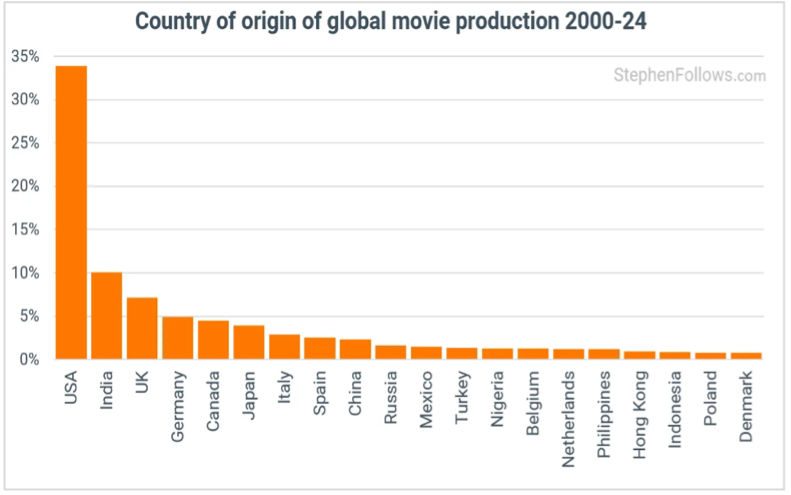

Using IMDb data to identify movie production country-of-origin, movies produced in the United States dominate the business. However, it is exceedingly difficult to identify production locations as a tariff on foreign movie production might demand; parts of US-produced movies may be filmed outside the US, and various services, such as editing and casting, may occur outside the US. A similar problem arises should other countries wish to establish retaliatory tariffs on US movies, though the data makes this look like a big, fat target.

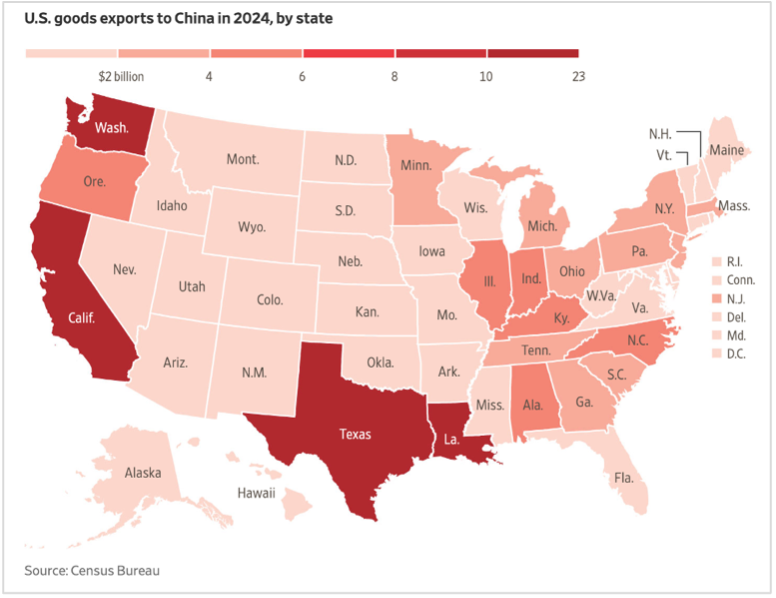

States with large, important ports are heavily exposed to reduced trade with China. In addition to the volume of goods from other parts of the country passing through these states, the infrastructure of ports, warehouses, distribution centers, rail lines, and trucking services represents a substantial portion of regional employment. Nevertheless, it is generally felt that the states most exposed to a US-China trade war are in the US heartland, where exports of seed oils and grains are a critical part of the economy. In upcoming talks between the US and China, agricultural products will be an important part of the discussion, with China holding most of the leverage.