Soft and hard economic data are back in the news as trade policy changes. Soft data, such as surveys, measures sentiment, expectations, intentions, and how respondents feel about the economy. In contrast, hard data measures actual results and activity, such as production, spending, and job growth. While they typically move together, there are periods of heightened uncertainty where they can diverge. On May 15th, Walmart’s CFO, the world’s largest retailer, stated it will have to start raising prices later this month due to the high cost of tariffs.

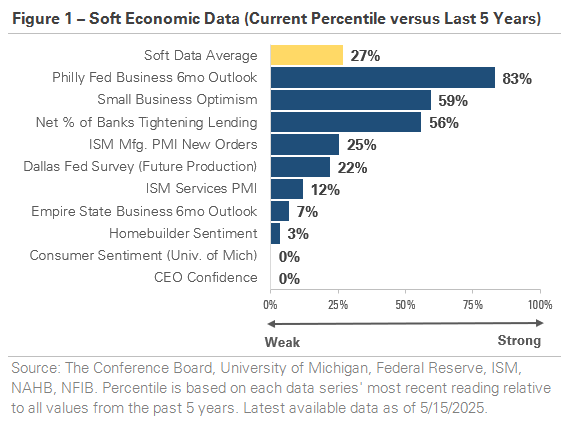

Figure 1 ranks ten soft economic indicators as a percentile relative to the past five years. The yellow bar shows the average soft dataset ranks in the 27th percentile, highlighting broad-based weakness in sentiment and expectations. Starting at the bottom, consumer sentiment and CEO confidence surveys rank in the 0 percentile, reflecting increased uncertainty. In the housing market, builder sentiment is weak as high mortgage rates and home prices weigh on home demand. Further up the list, the Dallas and New York Fed surveys reinforce the cautious business outlook. The Philadelphia Fed survey at the top appears notably less optimistic than the other two surveys, but it’s important to note that the Philadelphia survey was conducted in early May, after the 90-day tariff pause was announced. The divergence is a good example of how quickly soft data can change in response to new information. Bank lending standards and small business optimism are also near the top and appear to be outliers, but that is because they have both recovered from weaker periods in 2022-2023, when the Fed was raising interest rates.

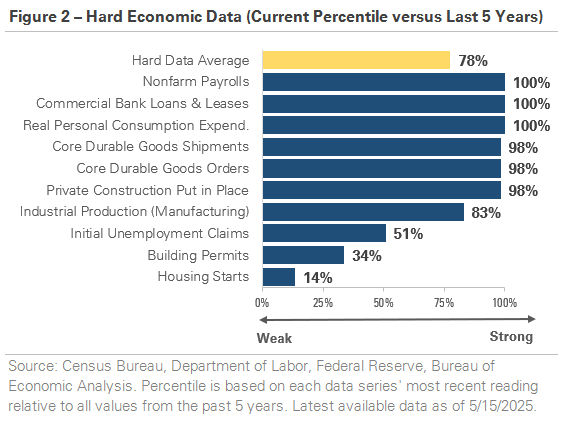

In contrast, Figure 2 tells a more optimistic story based on ten hard economic indicators. The yellow bar shows an average rank in the 78th percentile, signaling continued economic growth. At the top, company payrolls, bank lending, and consumer spending all rank in the 100th percentile, reflecting steady job growth, active credit markets, and solid consumer spending. Manufacturing and industrial data, along with construction activity, are also strong, with durable goods orders and shipments and construction spending all in the 98th percentile. Moving toward the bottom, we start to see areas of softness. Jobless claims rank in the 51st percentile, with unemployment claims still low but rising. In the housing market, building permits and housing starts show the pace of activity continues to slow from pandemic highs.

The data tells a mixed story: soft data indicates sentiment is cautious, while hard data shows actual economic activity remains solid. Both types of data are valuable, but it’s important to understand their limitations. Soft data can influence sentiment and behavior, but hard data ultimately drives corporate earnings and economic growth. Soft data is like next week’s weather forecast. It gives you a sense of what to expect, but it’s not always accurate. Hard data is like looking out the window. It tells you what’s happening now. Given how quickly conditions are changing, we are tracking both plus fundamental earnings announcements such as Walmart.