The following is your May 2025 Robertson Stephens Monthly Performance Report.

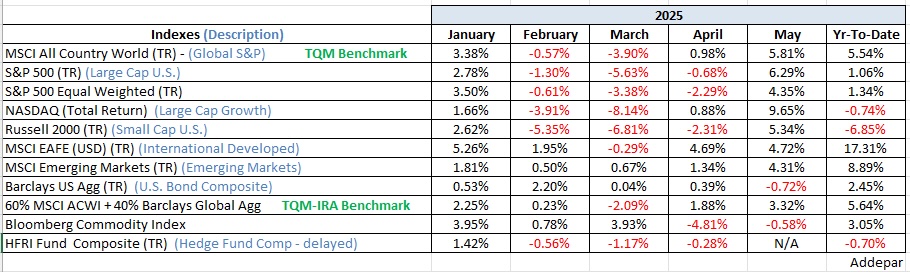

Looking at the May returns in the chart below – markets across the board extended their recovery. Fixed Income was the exception and experienced its first month of the year with negative returns (higher yields).

Markets picked up in May, right where they left off in April. Consumer sentiment improved, and trade tensions took a breather. Progress in U.S.–EU trade negotiations, along with a temporary delay in planned tariff hikes, eased global recession fears and encouraged risk-takers to step back in, fueling broad-based gains across risk assets.

Back in early April, stocks were in free-fall, and the “Tariff Tantrum” had pushed most equity indices into bear market territory. At that point, a U.S. recession this year or next had become the base case for most economists. But now that markets have rebounded—and it’s become clearer that the tariffs were more a negotiation tactic than final policy—those same economists have started to walk back their recession calls. Recent Wall Street surveys now peg the odds of a recession in the next 12 months at 40–50%. That’s down meaningfully from a couple of months ago, and while it feels better, a roughly even-money chance of a 35%+ S&P 500 drawdown (typical in recessions) is still a serious risk that shouldn’t be ignored.

As the S&P 500 climbs back toward its all-time highs, valuations are also back near their extremes. This is what’s often called a “priced-to-perfection” market—where all the good news is already priced in, and very little bad news is accounted for. While economists are divided on the recession/no recession outlook, how many are actually calling for meaningful economic expansion over the next few months—the kind that justifies 23x forward earnings? I haven’t seen one.

The sharp 20%+ bounce off April’s lows has triggered some positive technical signals and a few breadth thrust indicators—not enough to confirm a new bull market, but enough to cancel the prior bear signal. That calls for some open-mindedness about further upside. Still, overvaluation, overbought conditions, and rising yields—alongside a still-nonzero recession risk—all suggest there’s more risk than reward at these levels.

With no clear trend (bullish or bearish), portfolios have been moved back to neutral vs. their benchmarks where tax-efficient, and new investment cash remains on the sidelines—for now.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research