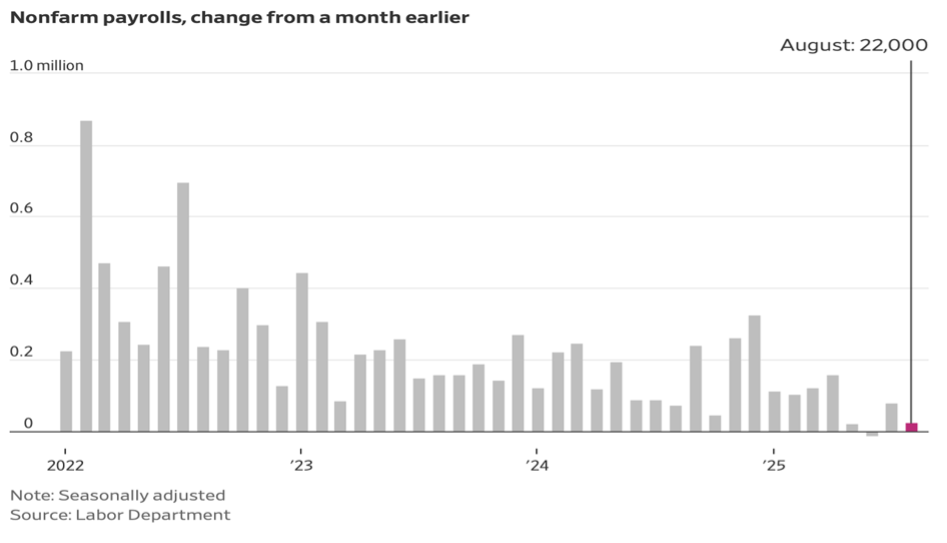

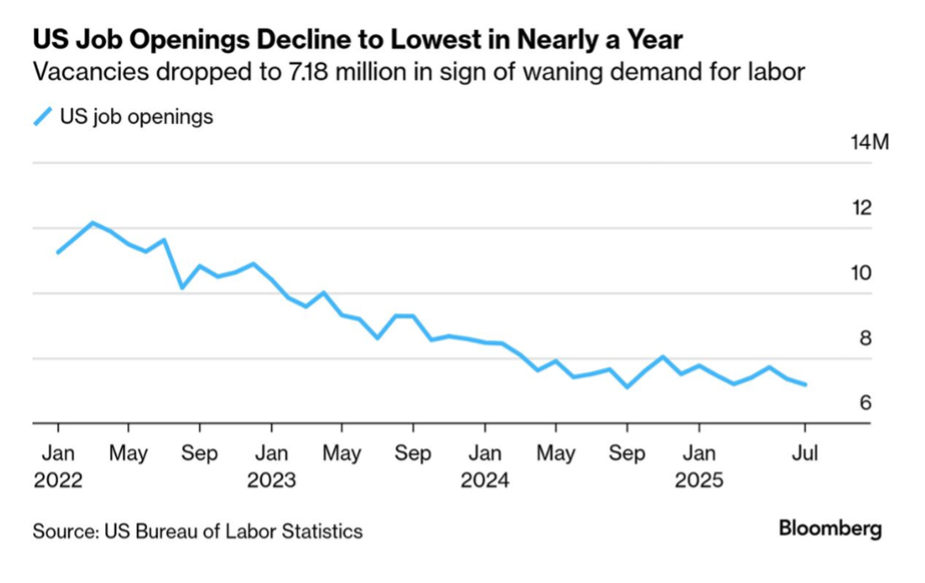

The much-anticipated nonfarm payrolls report for August showed that 22,000 net new jobs were created – and 13,000 jobs were lost in June. Seasonal adjustment factors (to pick up swings in employment associated with college and school sessions) and the ongoing problem of delayed completion of the survey reports by company respondents continue to be a problem. Nevertheless, the sharp slowdown in hiring from the beginning of the year is echoed in other employment data, including the ADP employment report released on September 4.

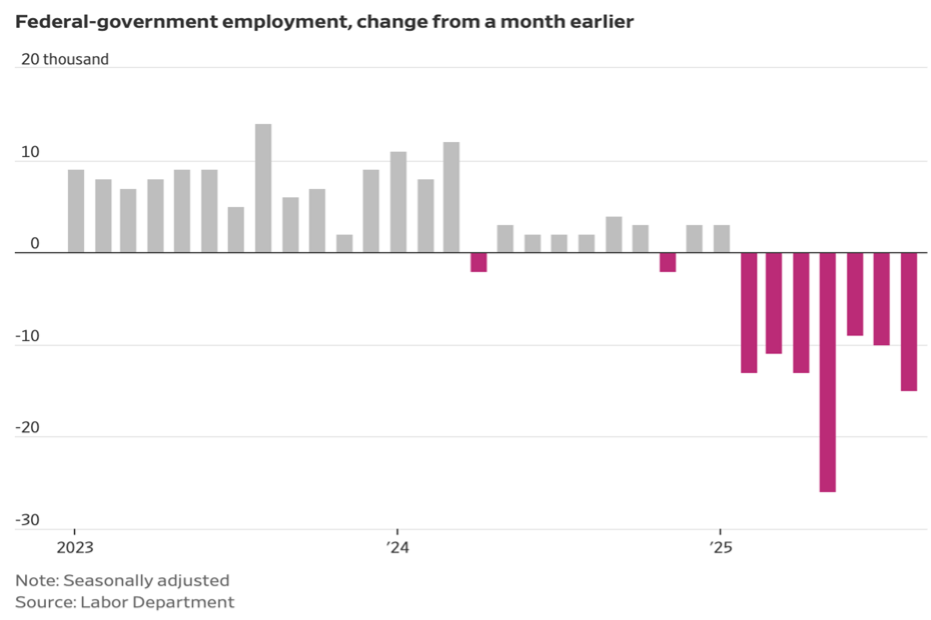

Changes in Federal Government employment have contributed mightily to the recent slowdown in overall job creation. By some estimates, another 300,000 to 400,000 federal government employees will leave their jobs in the next few months, possibly concentrated in September, when the Federal fiscal year ends.

Terminated or departing federal employees, many with considerable experience, will be competing for private sector jobs at a time when private employers are adopting newfound caution about business expansion. Some may fill state and local jobs where demand is still fairly high. Few of them will fill the construction and agriculture industry needs, where the lack of available labor is reaching crisis proportions.

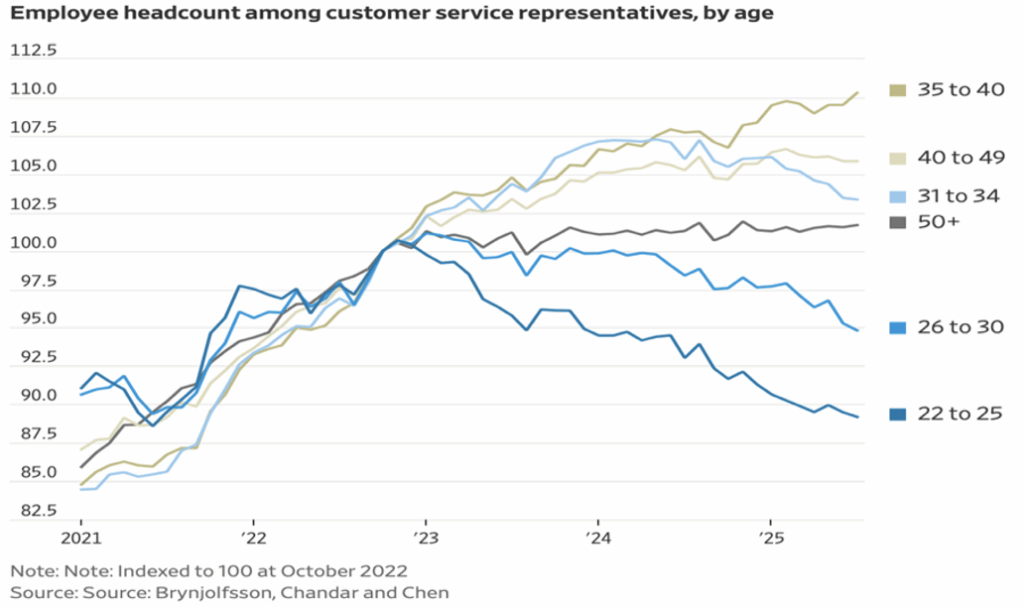

A recent study by the highly respected economist Erik Brynjolfsson, and others at Stanford University’s Human-Centered Artificial Intelligence Institute (HAI), which he leads, is thought to provide the first convincing evidence that artificial intelligence is impacting the availability of entry-level jobs. The study attempts to “control” for a number of factors that might provide alternative explanations for the decline in new labor force entrants (ages 22-30) in industries as disparate as customer service and software programming. While wages and salaries are generally lower in entry-level jobs, they can be surprisingly expensive to employers due to necessary training costs and high levels of turnover. If more experienced workers can fill these jobs or if artificial intelligence can reduce the number of entry-level employees required, costs to employers can be significantly reduced.

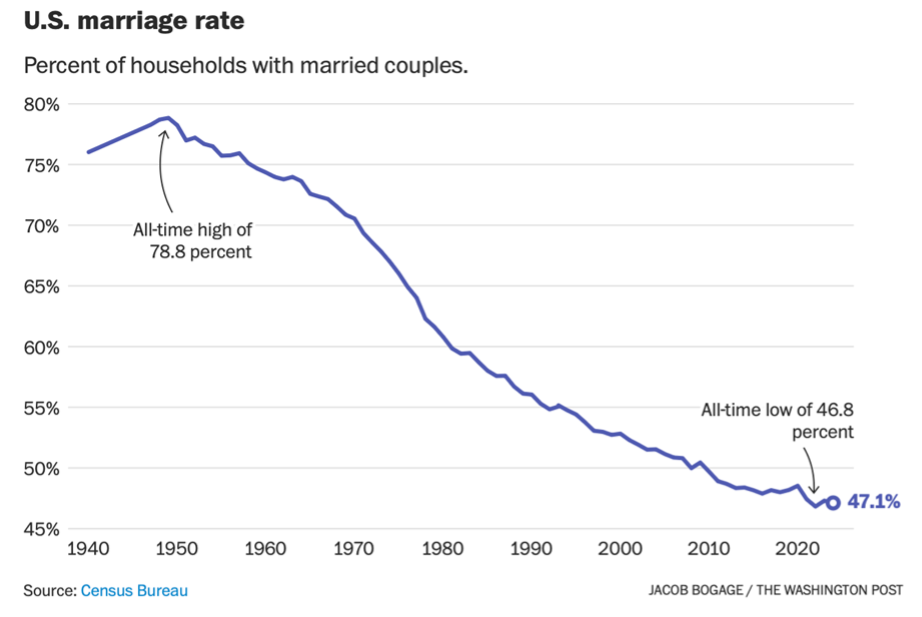

Employment and the outlook for employment opportunities are known to have an impact on marriages. Clearly, however, there is more going on with the declining rate of marriage than simply job availability, given the long-term trend nature of the decline. Some observers have related changes in marriage rates to the cost of buying a house, but this, too, seems to be an insufficient or incomplete explanation. Others have noted that the aging population of the US has a high number of widows and widowers, living alone. Various proposals are being advanced in an attempt to address what is judged to be an undesirable situation, but many ideas may prove fruitless if root causes are not better understood.