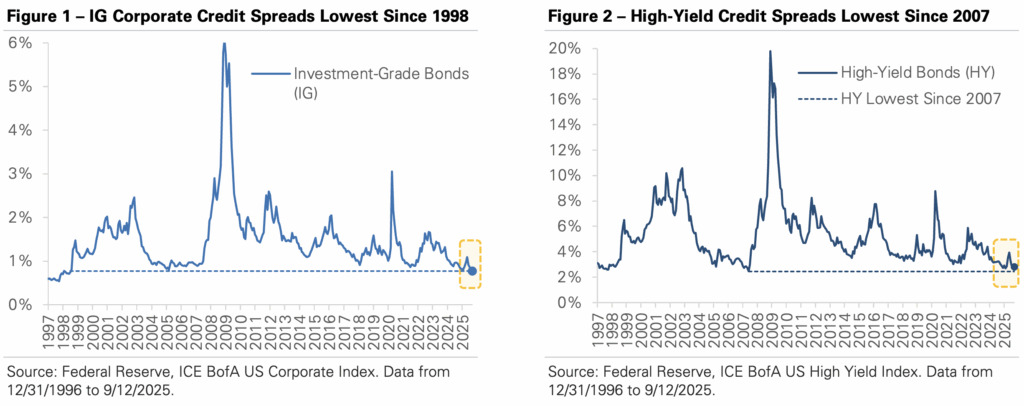

September 17, 2025 – Corporate credit spreads are at levels not seen in decades. Investment-grade credit spreads, which measure how much more a top-rated company pays to borrow compared to the U.S. government, have fallen to 0.77%, a level last seen in 1998 (Figure 1). Historically, the spread is closer to 1.30%, a half percentage point higher. High-yield spreads are similar but not as extreme. The current high-yield spread is 2.79%, the tightest since 2007 and well below the median of 4.59% since 1996 (Figure 2). Today’s credit spreads stand out for how tight they are compared to history, with companies paying a significantly smaller risk premium to borrow.

Several factors explain why credit spreads are so tight. First, overall corporate bond yields remain high in absolute terms compared to the past decade. Investment-grade and high-yield bonds yield 4.80% and 7.03%, respectively, making them attractive even with tight credit spreads. Second, corporate fundamentals are healthy, with strong earnings growth, manageable debt loads, and high interest coverage ratios. In contrast, the market is concerned about the current trajectory and sustainability of government finances. In a reversal of roles, the government—not corporations—is paying a higher risk premium, with concerns over fiscal policy keeping Treasury yields elevated. Third, the market is more confident that the Federal Reserve will continue cutting interest rates into 2026. As a result, investors are moving to lock in today’s yields, anticipating that interest rates will decline in the coming year.

While spreads are low by historical standards, extreme valuations don’t always correct quickly and often need a catalyst to normalize. What could shift the balance of risk and change the market’s view on credit risk? Two scenarios stand out. First, an economic slowdown or decline in profit margins could cause the market to demand a higher risk premium, leading spreads to widen. Second, if companies take advantage of tight spreads and borrow more, it will increase the supply of corporate bonds. An increase in supply, whether to fund mergers, stock buybacks, or capex, without a corresponding rise in investor demand, could cause spreads to widen and bond prices to fall.

Today’s yields present a compelling opportunity for income-focused investors, but they also come with important trade-offs. Credit spreads are at multi-decade lows, and when spreads are this tight, there’s less room for error. For investors, this means understanding the risks, emphasizing public investment-grade quality, and maintaining diversified exposure, including Treasury, corporate, and municipal bonds. The market isn’t signaling danger, but credit selection is critical. In this environment, it pays to invest in disciplined public and private market strategies.