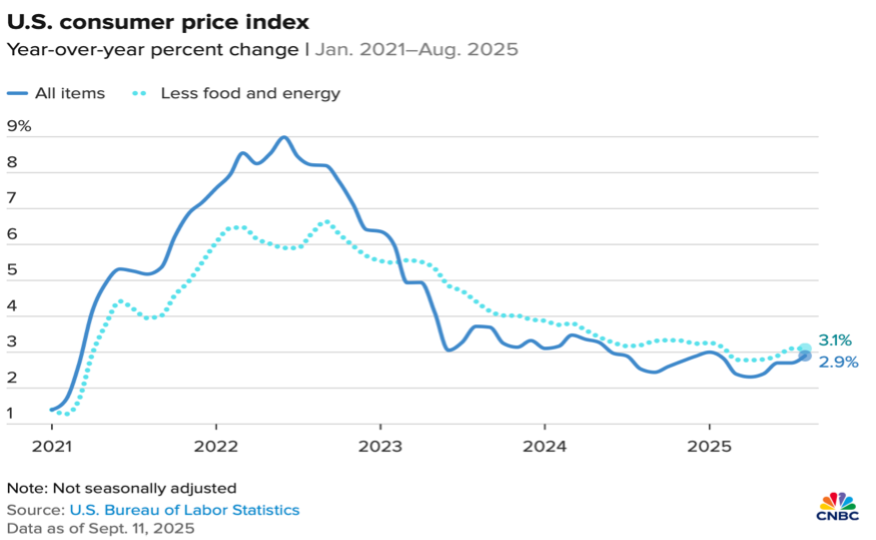

Contrary to some fears earlier in the year, US inflation is not skyrocketing. In fact, there are a number of products and services—lumber, trucking– where prices have sharply decelerated as the economy has slowed. Nevertheless, inflation is not going in the right direction either, having increased slowly but steadily in the last few months and remaining well-above the Federal Reserve target inflation rate of 2%.

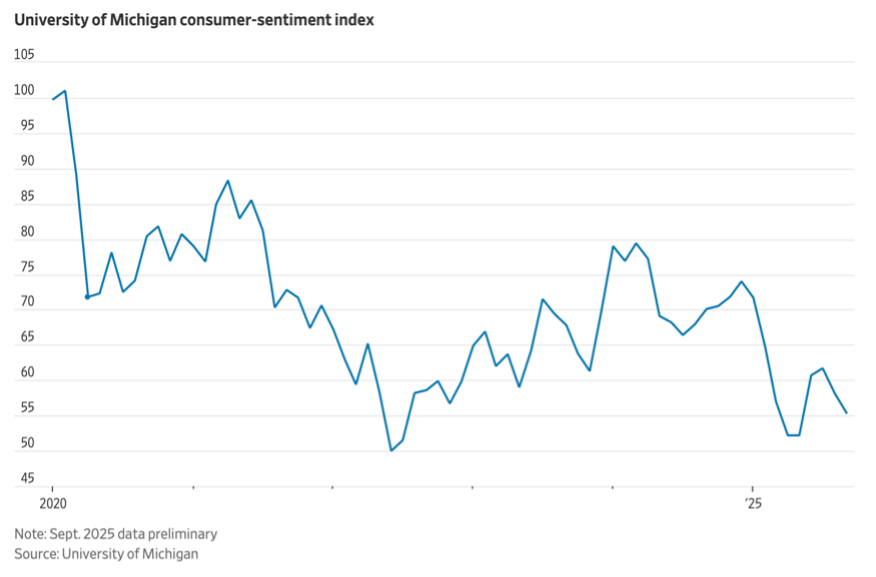

The preliminary reading on consumer sentiment in September by the University of Michigan implies that consumers are quite aware of the persistent inflation pressures and the uncertainty over economic growth. Although the consumer sentiment survey often reflects the tenor of the headlines, inflation expectations for the next 12 months started rising months ago and remain close to 5%. The sharp decline in this preliminary consumer confidence number for September has been described as “surprising.” It shouldn’t be.

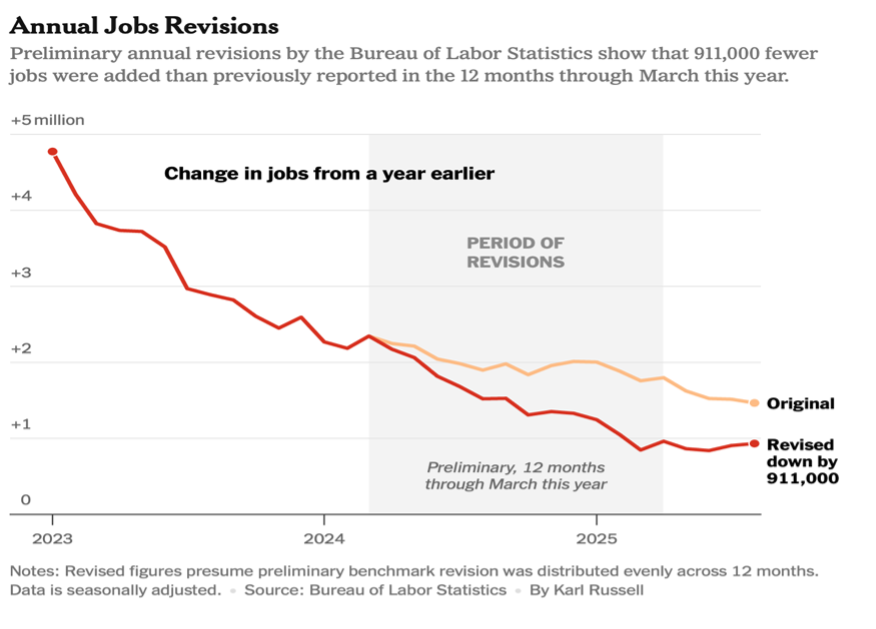

Every year, the Bureau of Labor Statistics does a “true-up” on the level of employment for a benchmark 12-month period, in this case, April 2024 through March 2025. The adjustment allows for a more thorough evaluation of all the available information regarding the number of jobs in the US economy. Although this does not affect the monthly job creation figures reported over the last few months, or those that will be reported in the coming months, the reduction in the job level does shed light on the strength of economic growth and the issues facing both employers and job-seekers. For much of 2024 and early 2025, there was much puzzlement as to where the people were coming from to fill the reported jobs created, given declining immigration and nonexistent labor force growth. Now the figures make more sense, highlighting also that labor force productivity was probably higher than commonly perceived.

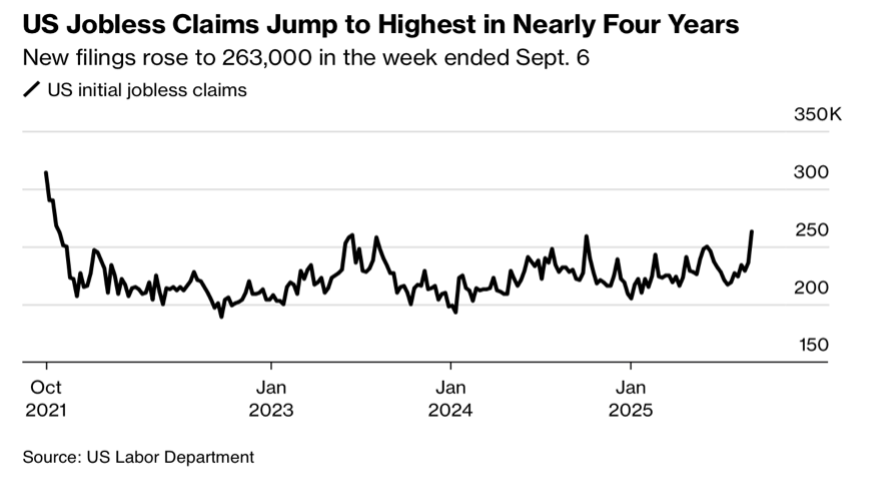

New jobless claims have steadily increased, but as yet do not represent a major concern. Notably, the data also indicate that an increasing number of people are experiencing bouts of unemployment, with the average duration of unemployment now rising to 24.5 weeks. Little wonder that employees are choosing to stay in their jobs longer (if possible) and that household concerns over labor market weakness have escalated.

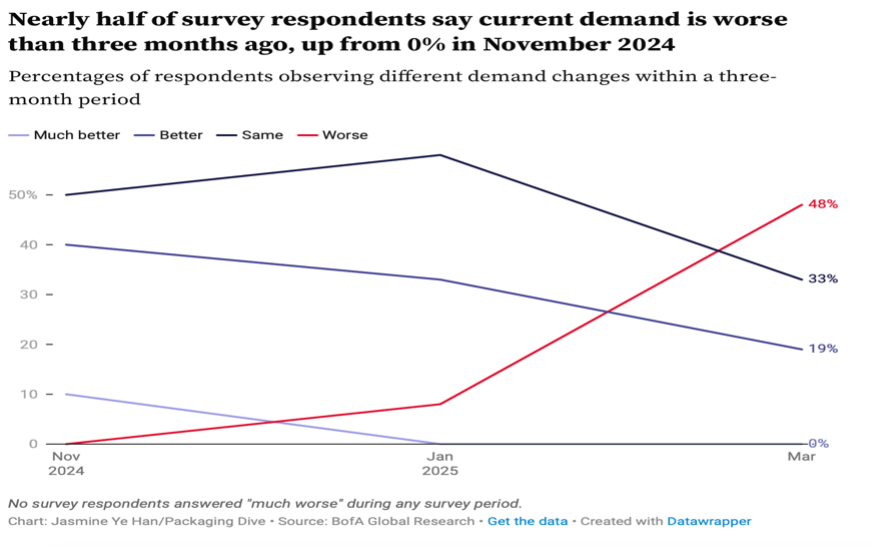

It has been apparent for some time that consumers are curtailing their purchases of goods, while possibly maintaining their purchases of services (think of this as air-fryers vs. fast food). Imports represent a substantial portion of goods demand, and thus, goods are where the impact of tariffs has been most pronounced. The associated demand for corrugated cardboard boxes (see chart) has worsened noticeably as a result. Major shippers, such as Amazon, have been attempting to reduce their packaging costs by consolidating shipments and substituting alternative packing materials; however, the cardboard box industry is still seen as a bellwether for consumer spending trends. Another sign that this might be a tough holiday sales season.