US Federal Government Shutdowns

Some of the federal government’s activities are set to shut down if Congress cannot agree to fund them by October 1, 2025

What is a government shutdown?

A shutdown occurs when non-essential federal government activities close temporarily because Congress has not approved funding to keep them open.

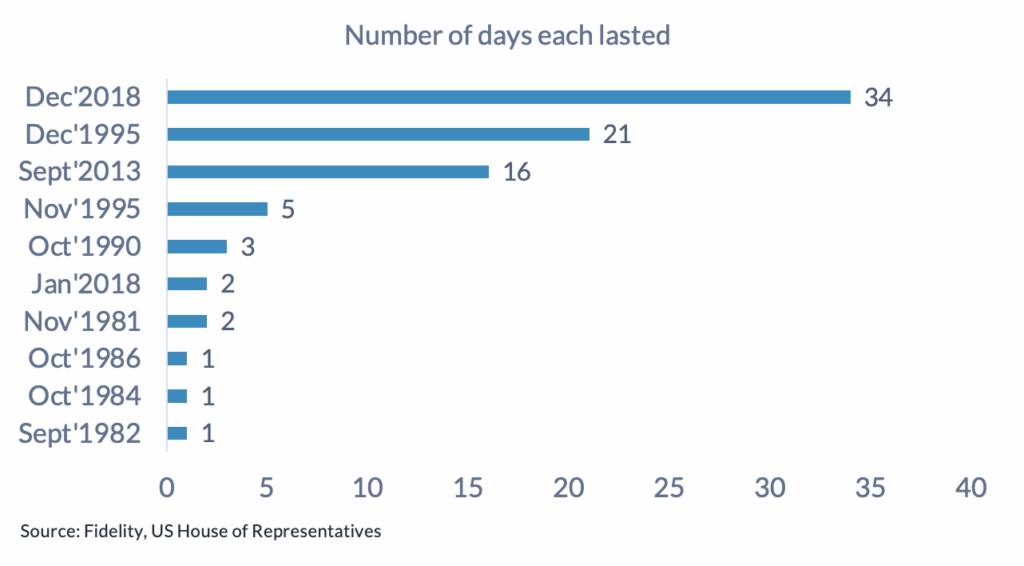

There have been 10 government shutdowns since 1980. Other funding gaps have occurred, but the gaps were either too short or occurred over a weekend, so affected agencies did not begin to shut down before Congress restored funding.

Market & Economy Impact

Impact on:

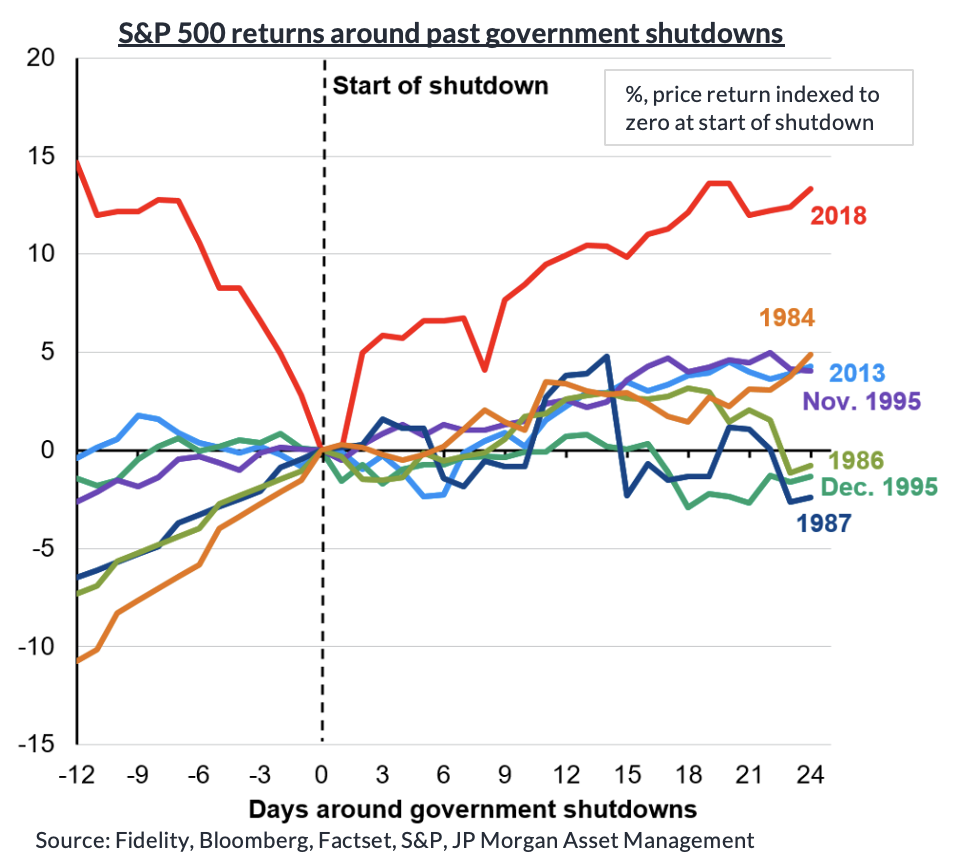

- Stocks: Historically little/no impact; prior shutdowns (2013, 2018) saw markets rise afterwards.

- Bonds: Treasury payments continue; minimal risk; some short-term volatility possible.

- Credit Rating: Greater risk from agency downgrades; could lift borrowing costs & rates.

- Economy: Small drag if short-lived; prolonged shutdown hurts GDP, confidence, spending.

- Govt. Services: Essential programs (Social Security, Medicare, law enforcement, USPS) continue. Historically, “nonessentional” federal workers are furloughed (unpaid temporarily) but rehired with “backpay” upon termination of the shutdown.

- Is this time different? The administration has indicated the shutdown may trigger permanent job losses.

Should you worry about investments during a shutdown?

Historically – no. Shutdowns make headlines but have little lasting market impact. Avoid temptation to overreact to those headlines and make personal financial decisions based on fear and uncertainty. Stick to your near-term and long-term strategies.

Markets Have Looked Past Government Shutdowns

Government shutdowns are generally short-lived and have a limited impact on markets. The Congressional Budget Office (CBO) analyzed the 2018–2019 shutdown and found that the five-week closure shaved 10–15 basis points off GDP per week. However, economic output rebounded quickly once operations resumed, as federal workers returned and government functions restarted.

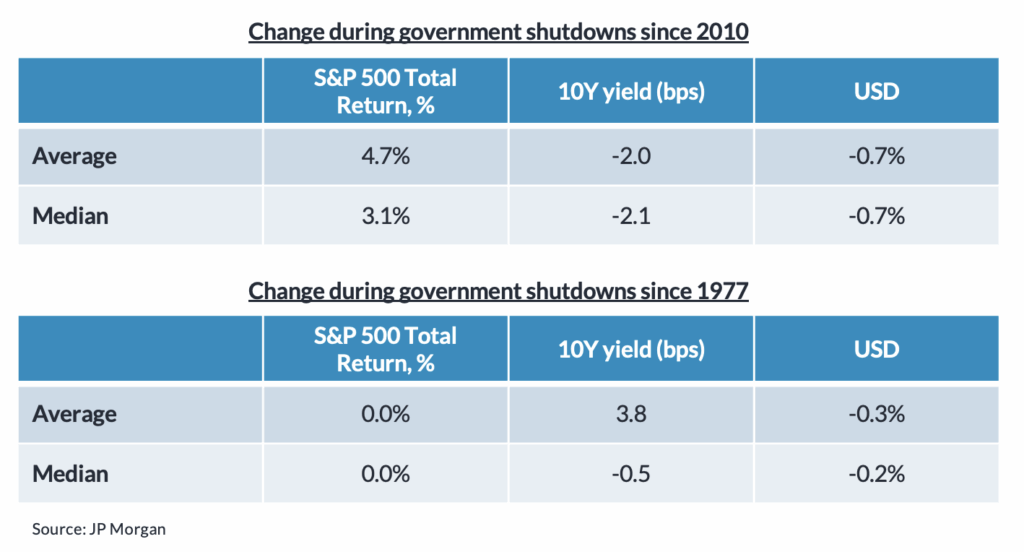

Markets typically “look through” these shutdowns, recognizing their temporary nature. Historical data since 2010, which includes three shutdowns, shows that the S&P 500 actually gained an average of 4.7% during shutdown periods, including a 10.3% gain over the 35-day 2019 shutdown. Bond yields were slightly lower on average, while the U.S. dollar generally weakened.

Extending the analysis back to 1977, covering 20 shutdowns, yields a similar conclusion. On average, stocks and core bonds showed little movement, Treasury yields edged slightly higher, and the dollar declined by less than 0.5%.