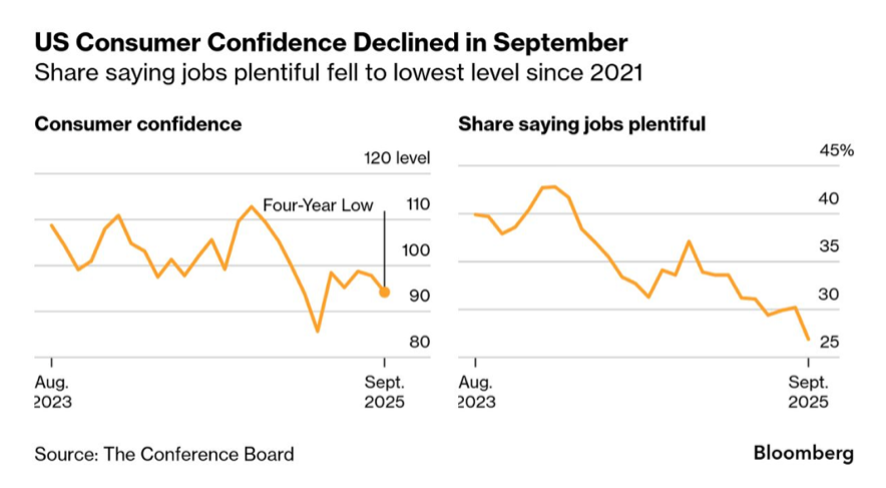

Convincing consumers that the US economy is growing in excess of 3% (the latest reading from the Atlanta Federal Reserve GDPNow project) is a bit of a challenge at the moment. Irrespective of what various job and inflation reports show, there seems to be a general and growing belief that the economy is weakening, jobs are becoming increasingly difficult to find, and prices are still uncomfortably high.

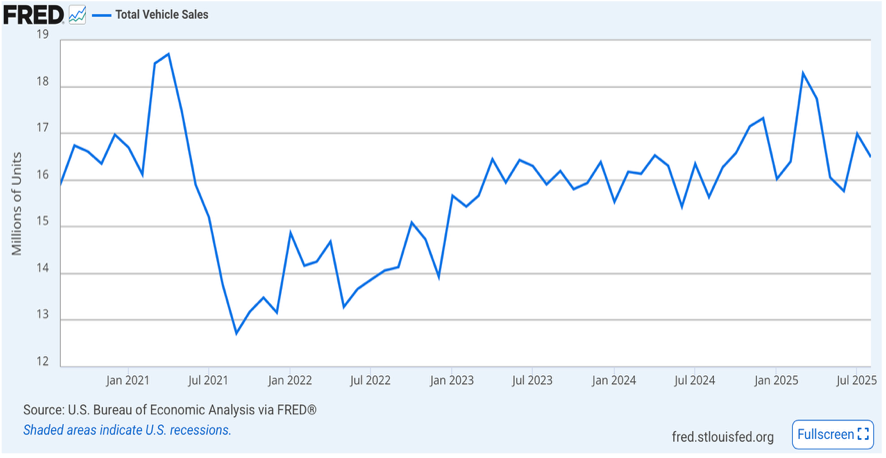

US total vehicle sales have been especially erratic this year, but well within the normal sales range of the last 30 months. New car sales have been unexpectedly strong, rising by an estimated 6% in the third quarter, as buyers tried to “get ahead” of various auto tariffs and changes in government subsidies for electric vehicles. Electric vehicle sales in September are expected to set a record, while the average new car price in future months is also expected to set records. Thus, it may be surprising that the business story of the week was NOT the federal government shutdown, but the bankruptcy of OE (“original equipment”) auto aftermarket supplier First Brands. Many companies have shown considerable resilience in dealing with the uncertainty and shocks of the 2025 tariffs; First Brands is not one of them, with more than $10 billion in debt (possibly as much as $50 billion) and a head-spinning organizational structure proving impossible to manage.

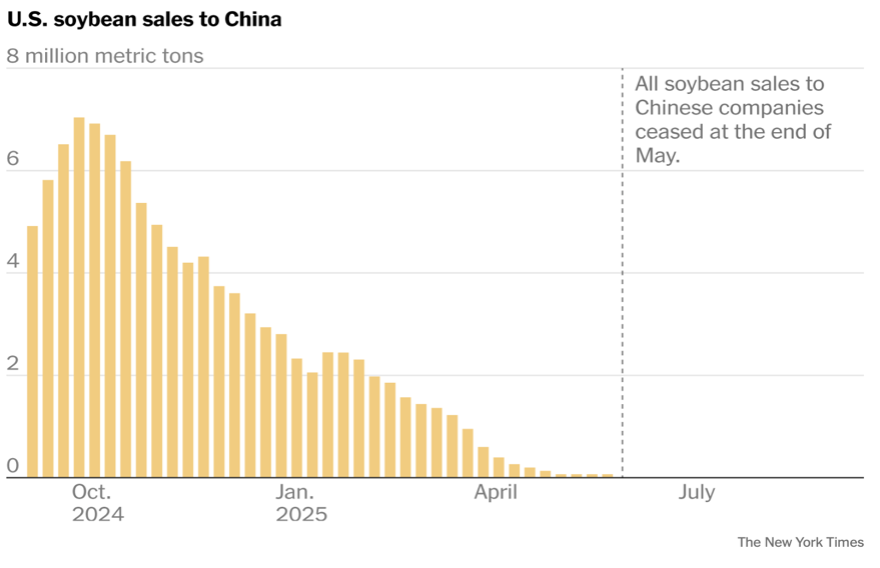

Tariff-related pain has also risen to uncomfortable levels in the US agricultural sector. Soybean farmers have the worst of the lot. China has shifted its purchases to other suppliers, including Argentina, and there are few alternative markets for US soybeans that are large enough to absorb US production. While some sort of relief has been discussed, in the form of payments to soybean farmers out of tariff proceeds, nothing has yet been agreed to, and the government shutdown may make it difficult to provide any substantial help soon enough.

Lower oil prices have helped moderate consumer price inflation. Yet, the consequences of a return to supporting carbon fuel production (“Drill Baby Drill”) without an attendant increase in consumption and with a notable increase in OPEC+ supply are decidedly challenging for US drillers. Small and mid-sized shale oil producers are under considerable financial pressure, and bankruptcies and restructurings have been increasing gradually. Major US oil producers have been quietly announcing layoffs and force reductions, although these announcements are less-than-quiet in some US regions. In the Sept. 24 Energy Industry Survey by the Dallas Federal Reserve Bank, one respondent said, “The U.S. shale business is broken. What was once the world’s most dynamic energy engine has been gutted by political hostility and economic ignorance.” (All survey responses are anonymous, by intention.)

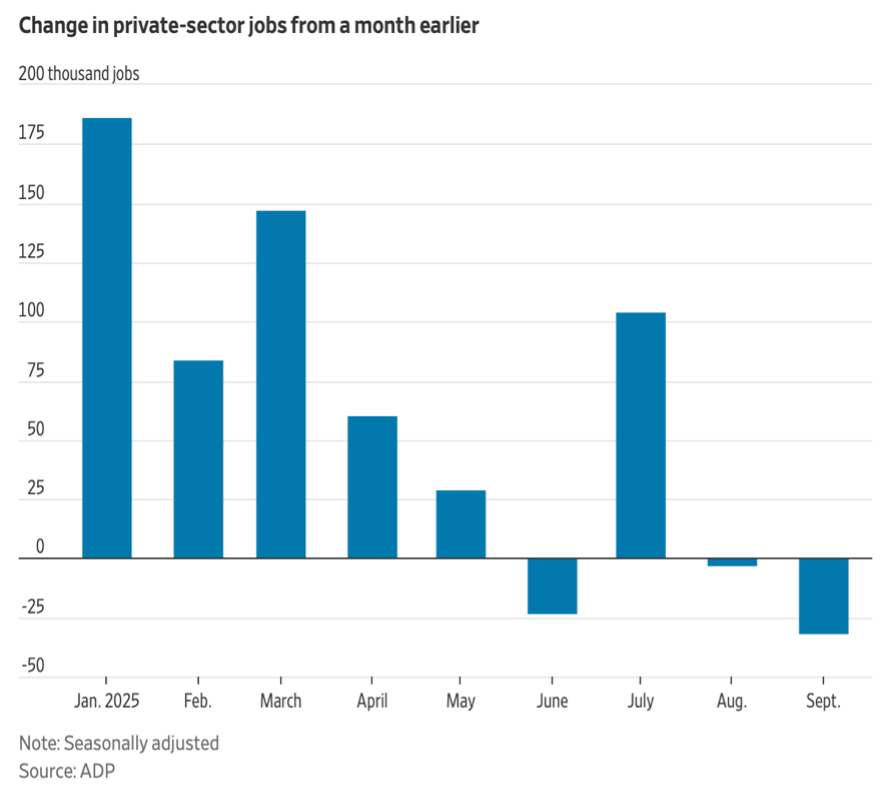

You may have read that the US Federal Government has shut down, and that one of the casualties will be the eagerly awaited September Nonfarm Payrolls report from the Bureau of Labor Statistics. Analysts hate an information void, however, and the private sector, various trade groups, and the internet remain ready to step in. One must be careful about the incompleteness of such data, but the ADP employment report has been a reliable source of insight for many years. ADP September employment, released on October 1, was consistent with the more circumstantial evidence that, as companies adjust to the higher costs of operating in 2025, jobs are under pressure. It remains difficult to see a trend line in the data yet, and there had been an expectation of a job increase in September of as much as 50,000, not a loss of 32,000. The job losses appear to be concentrated in small businesses, with the largest sector decline being in leisure and hospitality.