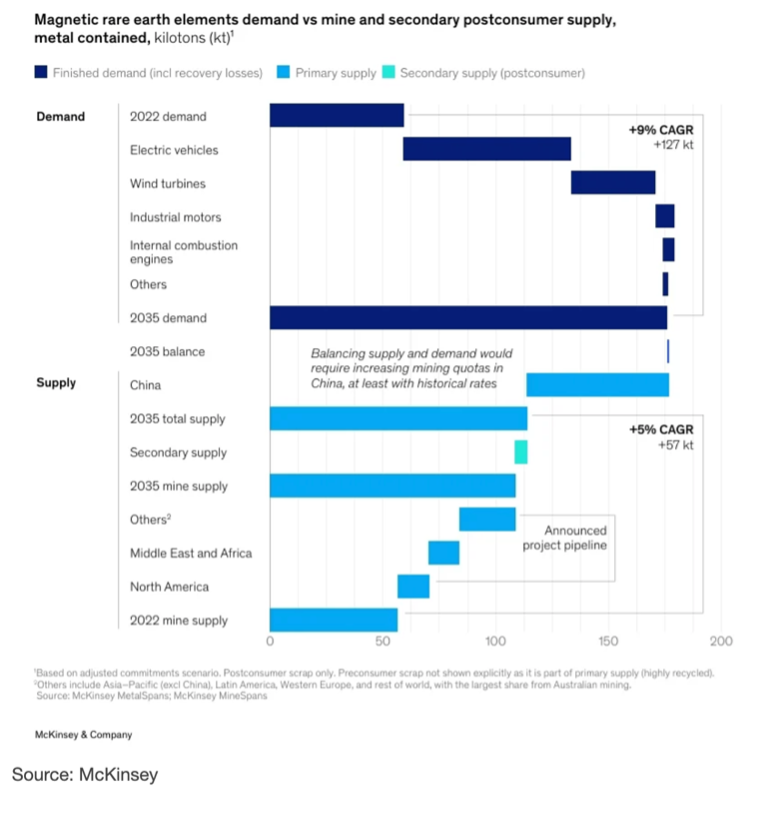

First, a big, complicated chart for a very big, complicated issue: rare earth elements. President Trump has scheduled a much-anticipated meeting with China’s President Xi for next Thursday, October 30. Rare earth supplies will not be the only subject, but they loom largest in the discussion. In the immortal words of the Rolling Stones, “You can’t always get what you want, but if you try sometimes, well, you might find you get what you need.”

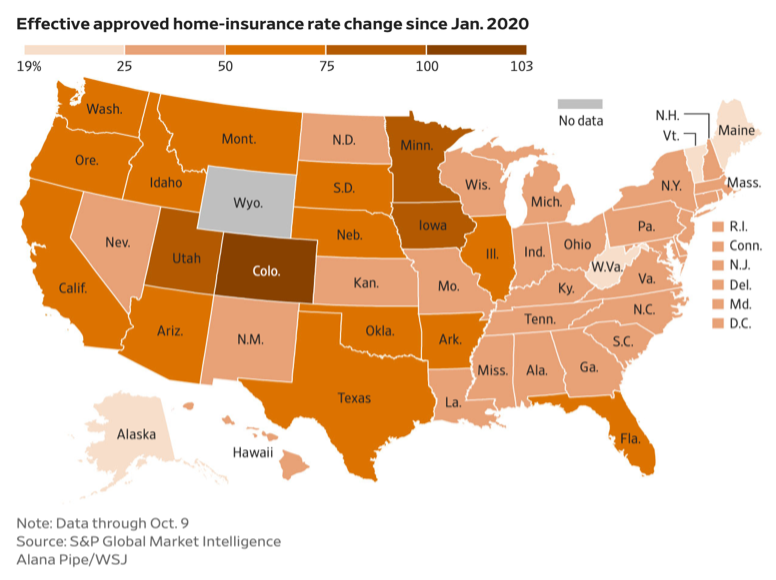

A lot of people—most people—need home insurance. The price increases have been a pain point, though they are not evenly distributed across the country.

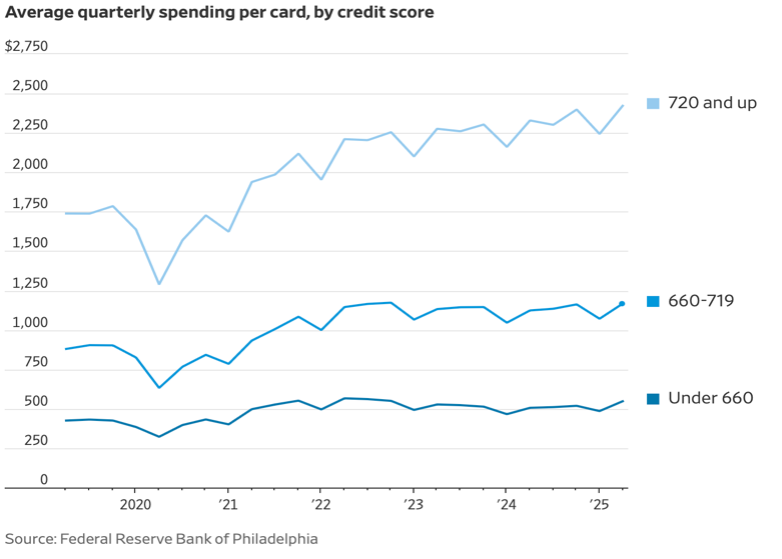

Americans have a remarkable ability to adjust to many varied economic pressures, assuming labor markets are relatively stable and investment portfolios (including those held in 401ks and IRAs) are rising. Of course, increases in credit card spending are often associated with increases in credit card delinquencies. Credit card delinquencies have been rising across this decade, but continue to hover at approximately 3% of all commercial bank credit card loans.

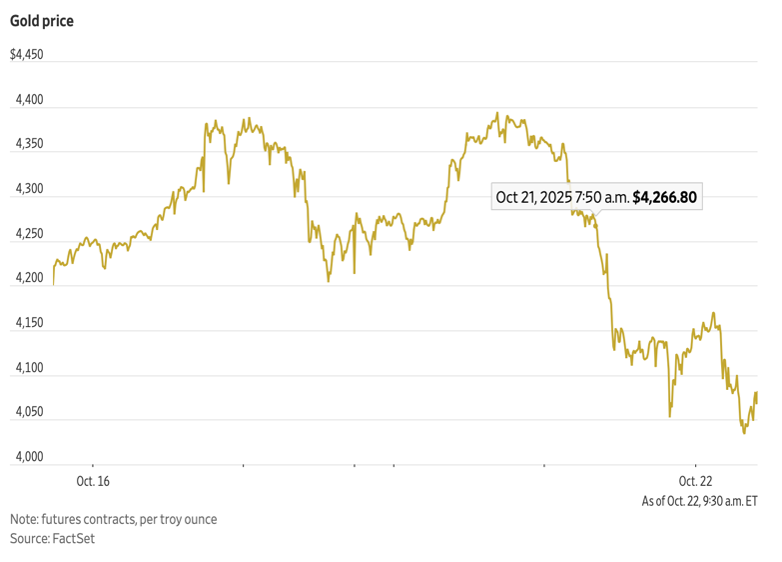

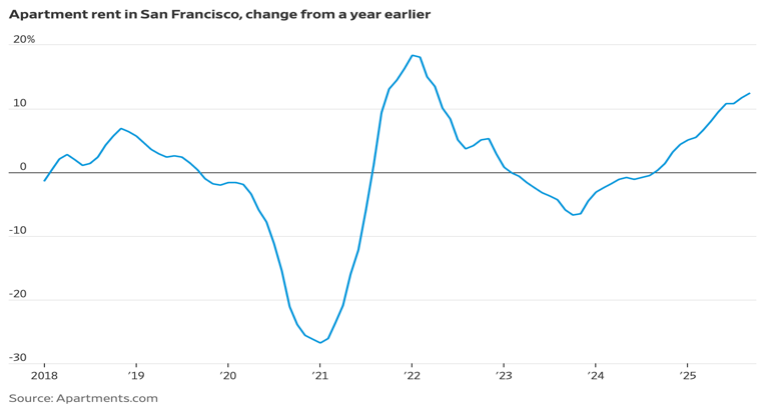

Finally, two charts from the “What Goes Up Might Go Down” file. Gold had a notable sell-off earlier this week, possibly due to a broad re-thinking of what is called the “debasement trade.” Specifically, the idea that the value of the dollar would be seriously eroded by high inflation and rising government deficits has become increasingly difficult to support with available data (of course, due to the government shutdown, there are serious limits on how much data is actually available). At the same time, San Franciscans (of whom we have a few at Robertson Stephens) are pleasantly surprised to see that the debasement of San Francisco may have ended, in no small part due to the growth of AI companies and associated industries. Both charts also convey the message that it’s volatile out there, arguing for caution and a careful consideration of economic fundamentals.