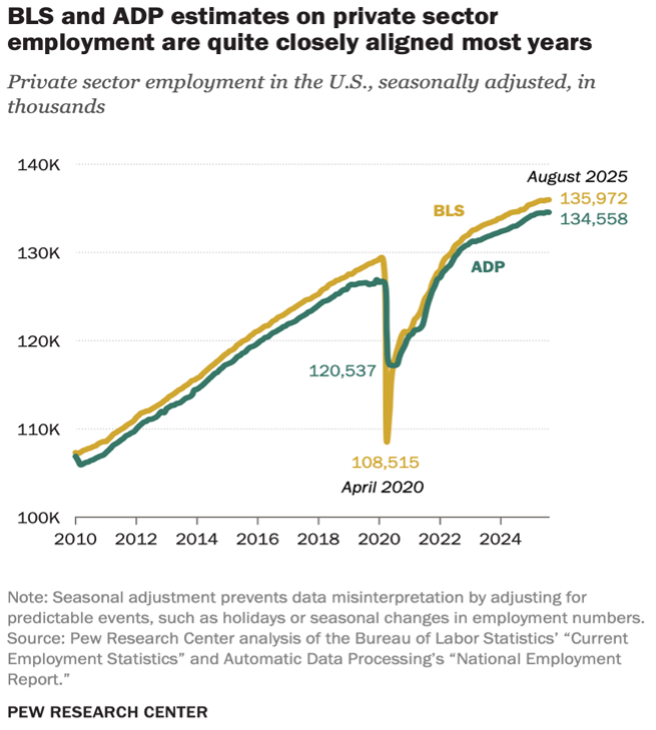

The federal government shutdown continues, and the monthly employment report from the Bureau of Labor Statistics (BLS) is still missing in action. ADP measures employment very differently from the BLS and does not attempt to measure government payrolls at all. Nevertheless, the monthly ADP report has a long track record and has been shown over time to be a reasonably accurate indicator of broad employment developments. The ADP report for October, released on November 5, showed a somewhat surprising increase of 42,000 jobs, after two months of decline. The payroll report also provided wage growth data, indicating continuing wage growth strength across a wide variety of industry sectors; 12-month wage growth averaged 4.2%-4.8%.

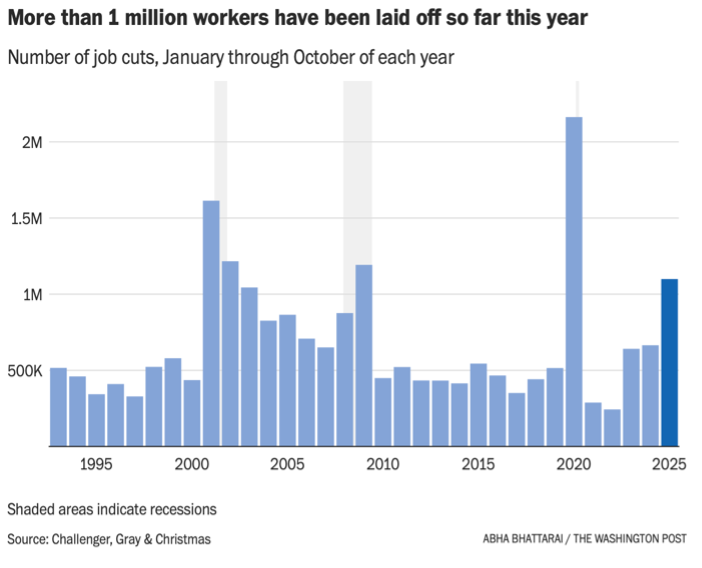

Another private sector source of employment data is Challenger, Gray & Christmas, the venerable executive outplacement firm founded by James Challenger in Chicago in 1966. Challenger had a lifelong interest in the health of the US labor market and in corporate approaches to managing a company’s most valuable resource: human capital. The Challenger, Gray & Christmas report this week indicated that layoffs soared in October to the highest level (153,000) since 2003, pushing total layoffs for the year to 1.1 million, up 65% over 2024, garnering much attention. This report is not inconsistent with the ADP report, but rather an example of how much is going on under the surface of the very dynamic US jobs market. Notably, many layoffs occurred in the technology sector and business and professional services.

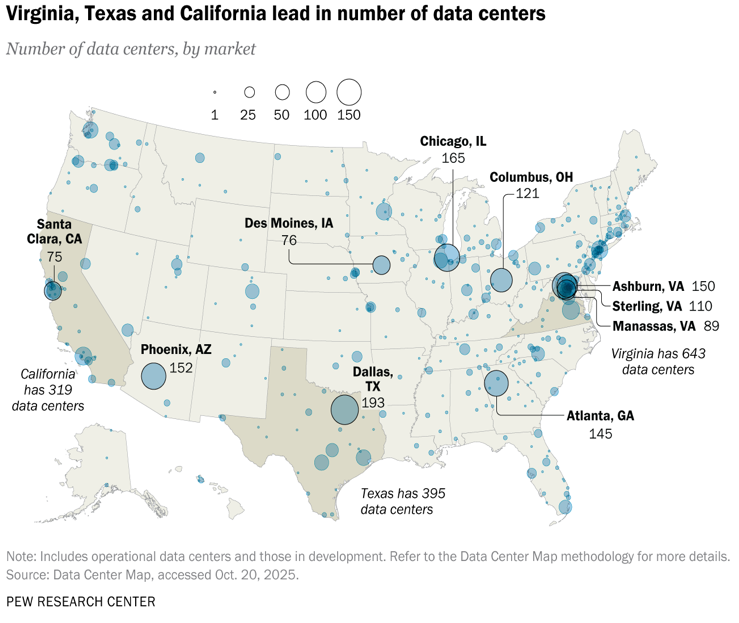

Almost every discussion of current labor market trends in the United States seems to quickly turn into a discussion of AI and its impact on labor demand. Building the infrastructure to support AI is also impacting electricity demand (and prices) and presenting burdens as well as opportunities for communities welcoming data centers into their midst. Unlike other industrial developments of the size and scope of data centers, however, job growth is not one of the primary benefits; construction jobs increase during the building phase, but few permanent operational jobs materialize over the longer term.

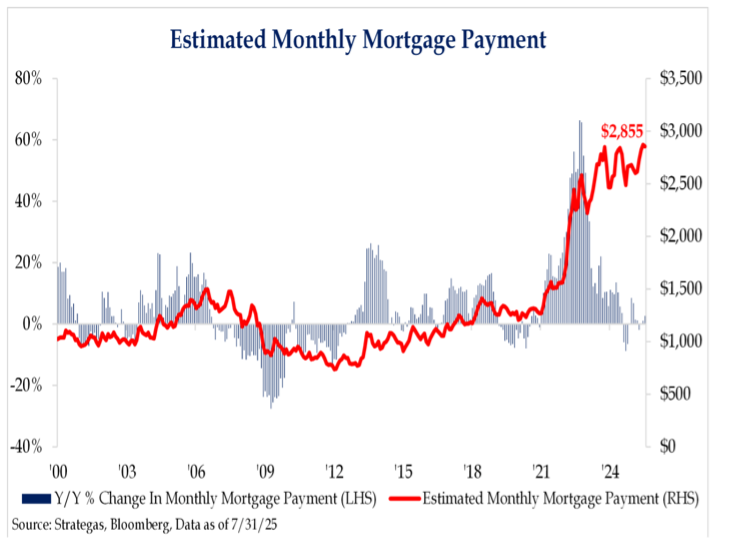

US employment and wage growth have been key factors supporting the home sales market in the face of high home prices and high mortgage rates. As the Federal Reserve lowers interest rates and inflation remains relatively under control, albeit at a too-high level, some relief from the high mortgage payments of this summer has materialized. Home sales have increased modestly as a result, but it is important to remember that interest rates are only one part of the critical equation; income and income growth, in particular, are required to facilitate the joys of home ownership.

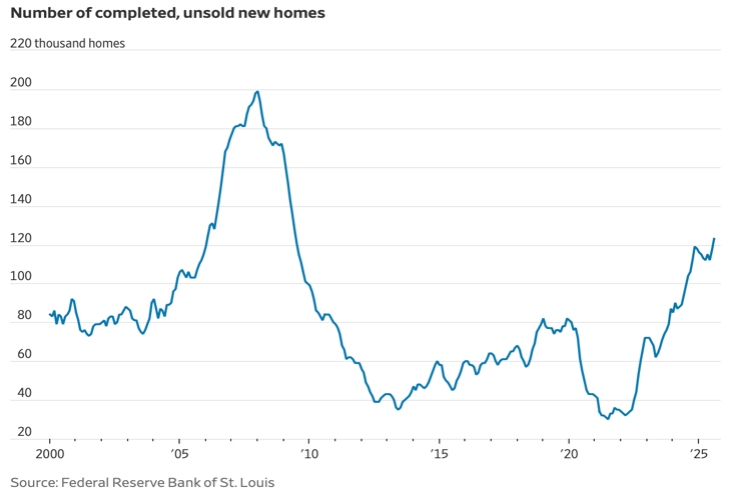

Sales of newly built homes, as opposed to sales of existing homes, represent only an approximate 25% of home buying, with considerable geographic variation. Yet, the dynamics of this market segment in 2025 are proving more than interesting. With the overall inventory of homes for sale well exceeding demand, home builders have found themselves forced to offer a variety of sales incentives; unlike owners of existing homes, home builders do not have the option to simply remove the houses from the sales market. Many of these newly built homes target entry-level buyers; however, those buyers are specifically the ones who appear to be most concerned about near- and medium-term job prospects. Investors may ultimately come into the market, but newfound caution appears to be impacting these buyers as well.