We are reaching out to address the recent equity market volatility. Heightened volatility can naturally be stressful, especially amid a steady stream of market headlines. These short-term fluctuations, however, are a normal and expected part of the investment landscape.

What remains unchanged, however, is the structure of your portfolio. It was built to align with your long-term objectives and tailored to your specific risk profile. Temporary market pullbacks, while often uncomfortable, are an inherent part of the market cycle, and your investment strategy is designed to be resilient and to navigate these periods of uncertainty.

The Power of Perspective and Time

The core of our strategy is built on time horizons, and short-term noise should not distract from your long-term financial objectives. As the legendary investor Warren Buffett advises, these periods of pessimism often present opportunities: “Be fearful when others are greedy, and greedy when others are fearful.” We believe the current market volatility provides an opportunity to apply this wisdom and reaffirm our discipline.

Patience Pays Off

The biggest mistake investors make is trying to do something when markets get shaky. But here’s the thing: the longer you stay invested, the less these short-term swings actually matter. Our job is to help you stay calm and stick with the plan, even when it feels uncomfortable.

To illustrate these principles clearly, please review the two key charts below.

Visualizing Investment Discipline

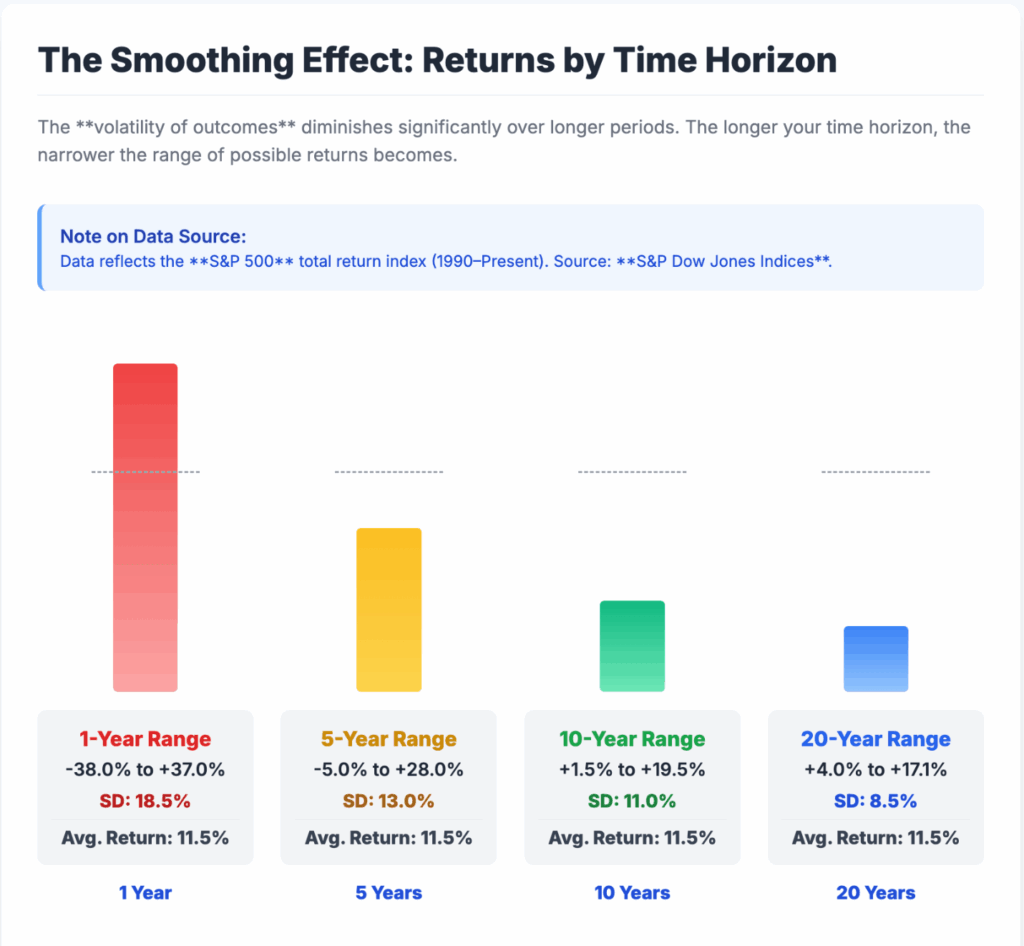

- Time Smooths Out the Bumps

When you look at stock market returns over just a few months, the markets jump around wildly. But if you look at returns over 5, 10, or 20 years, the picture becomes much clearer. The longer you hold your investments, the smaller those bumps become. Notice how the Standard Deviation (SD), which measures risk, dramatically shrinks over time.

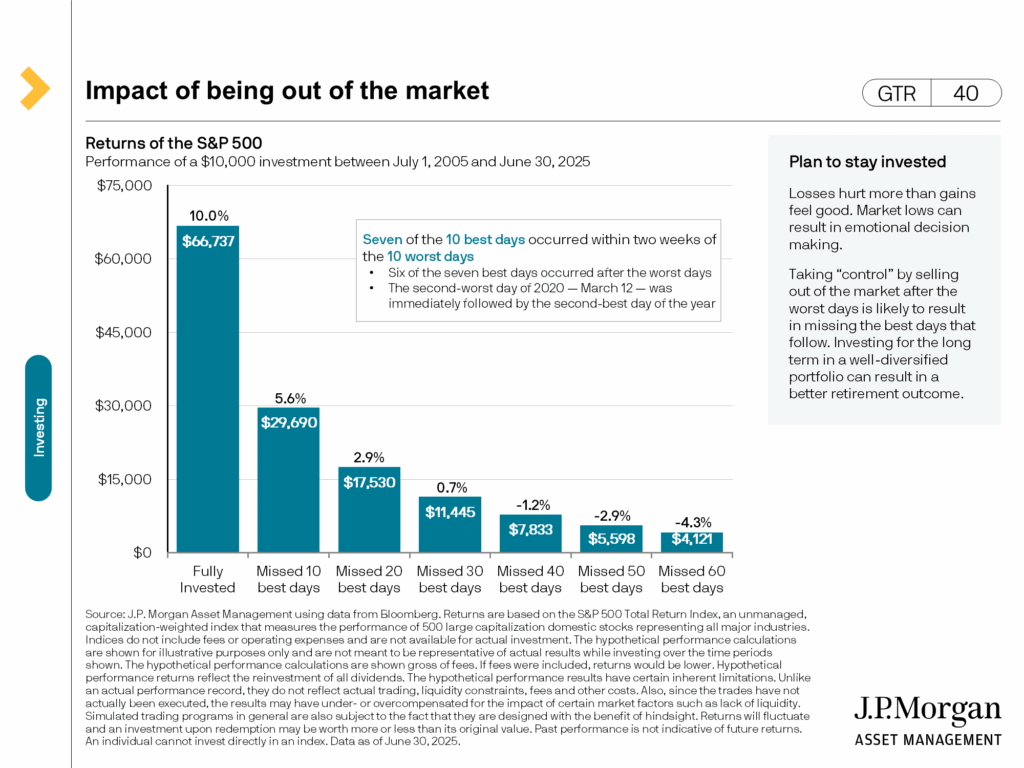

- Staying Invested Beats Timing (The Timing Trap)

Many investors try to sell before markets drop and buy back in when they think it’s safe. This rarely works. Missing just a few of the best days—and these often happen right after big drops—can seriously hurt your long-term returns. Simply staying invested almost always beats trying to outsmart the market.

Separating Market Noise from True Risk

By segmenting market events, we distinguish between quick, routine Non-Recessionary Corrections (market noise) and severe, protracted Recessionary Crashes, demonstrating that, again, time, not timing, is the key to managing your equity risk.

This chart illustrates the average market decline and recovery in non-recessionary and recessionary periods for the S&P 500, spanning the years 1990-2024.

| Metric | Value | Notes |

| All Years (Annual Max Decline) | -13.7% | The average maximum decline experienced within any calendar year. |

| Non-Recessionary Corrections | ||

| 🟢 Average Decline | -8.9% | Average decline of 30+ corrections ($\geq 5\%$) outside of NBER recessions. |

| 🟢 Average Time to Recovery | 1.8 Months | Extremely short time to climb back to the prior peak. |

| Recessionary Declines | ||

| 🔴 Average Decline | -38.9% | Average decline of the four major bear markets (2000, 2007, 2020, etc.). |

| 🔴 Average Time to Recovery | 2.86 Years | Long-term commitment required to recapture prior peak value. |

Source: S&P Dow Jones

Conclusion for the Long-Term Investor

The table serves as a reminder that volatility is the price of compounding and superior long-term returns.

The average non-recessionary correction of -8.9% is the cost of admission for equity returns, and with an average recovery time of just 1.8 months, attempting to “time” these dips is futile and harmful. These events should be treated as noise.

Your low-risk assets (liquidity reserves, bond allocations) should be designed to absorb the 38.9% drawdowns without forcing you to sell high-quality assets. The only guaranteed way to overcome recessionary periods is to remain invested through the entire 3-year recovery cycle. Your investment horizon must be longer than the average recovery period of a bear market.

Next Steps

Our commitment to you is to serve as a rational guide during emotionally charged times, driven by economic and political volatility. Every portfolio review we conduct confirms that staying invested through these cycles is the surest path to capturing equity outperformance and achieving your ultimate financial goals.

If you have any questions, please feel free to reach out.