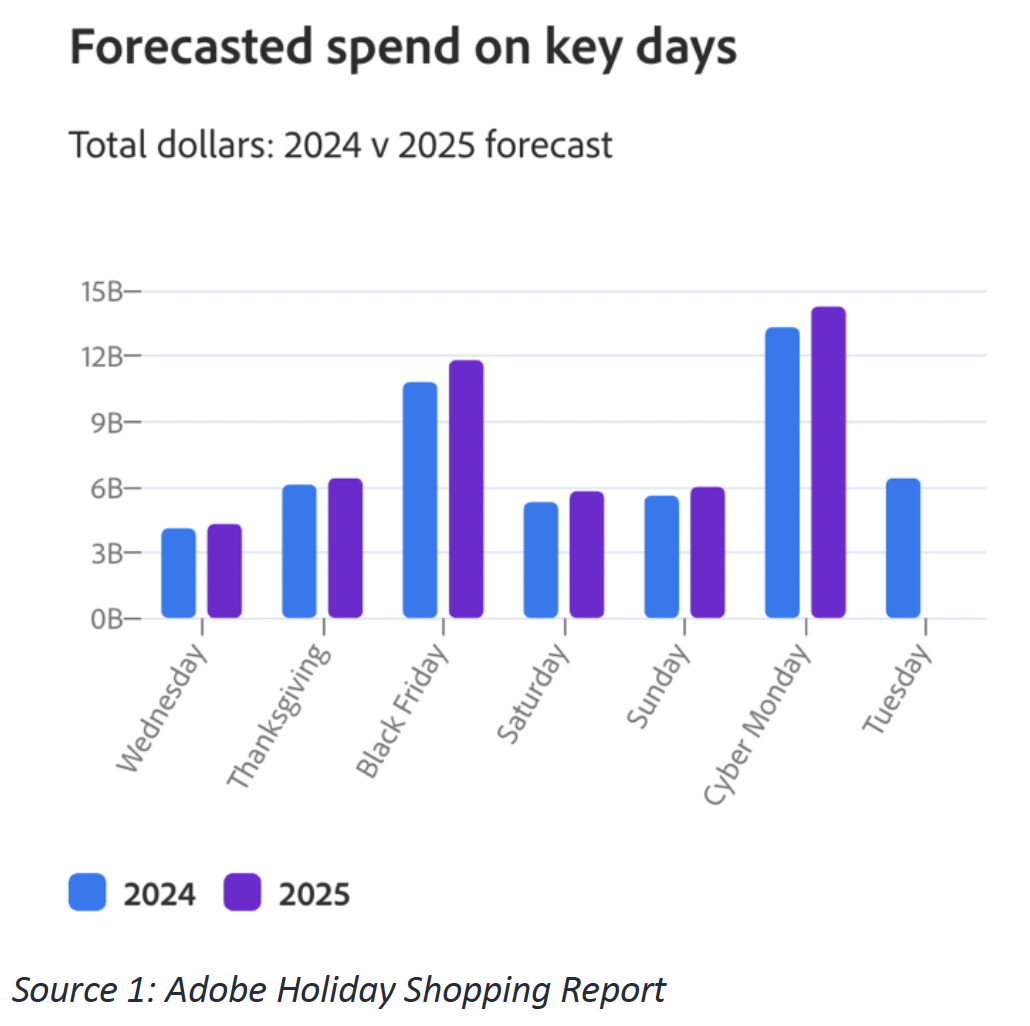

Thanksgiving remains the traditional start of the holiday shopping season, though everyone knows Black Friday promotions begin long before then. Consumers blew away expectations by increasing spending more than 7% over the same time period last year. Of course, six days do not a holiday season make, but it appears that households intend to introduce holiday cheer to a somewhat uncertain environment by whatever means they can.

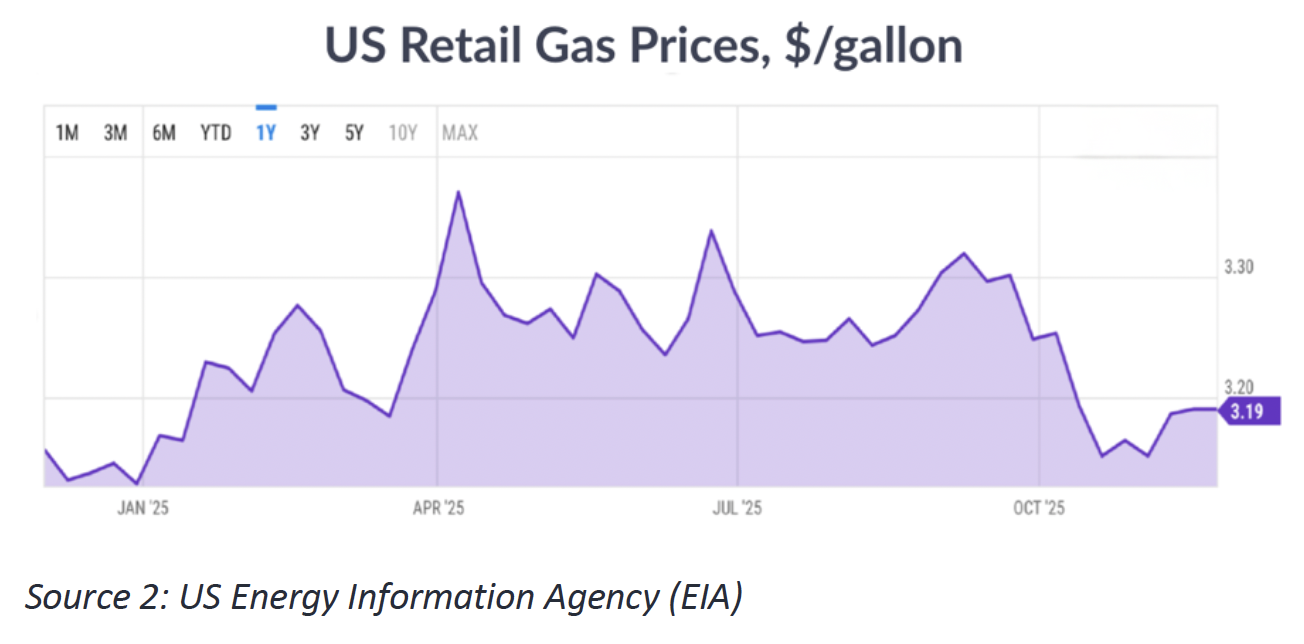

The decline in at-the-pump gasoline prices is helping put extra money in consumer pocketbooks and should impact (positively) the reported inflation numbers for the end of 2025. Although gasoline can possibly encourage more holiday travel, it is likely that the most significant effect, at the moment, is additional spending money, which will be spent.

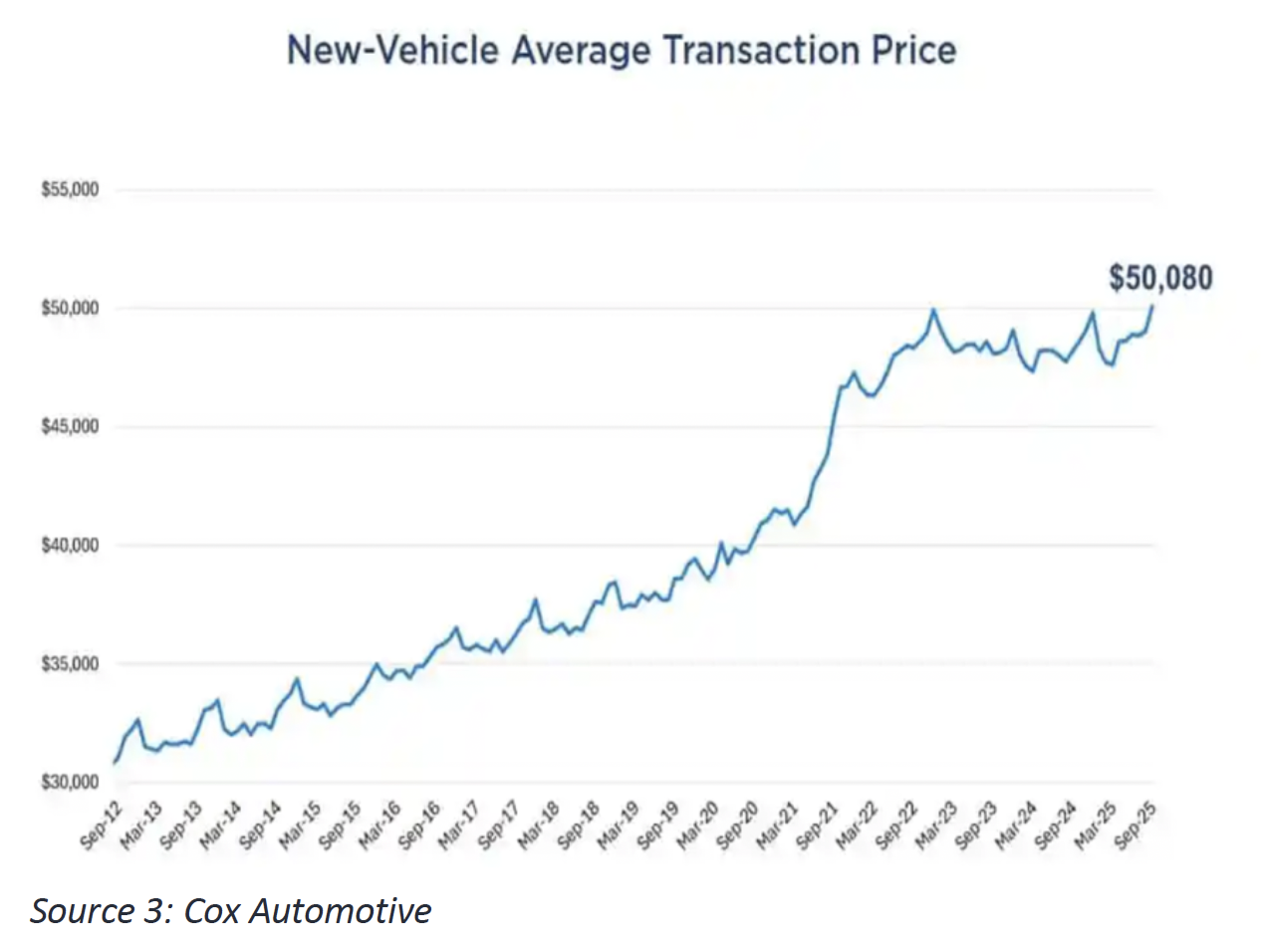

Lower gasoline prices are not encouraging increased spending on new cars, however. US new car prices have clearly hit an uncomfortable level, and buyers are “protesting” by shifting to used car sales. This kind of swing has been observed numerous times in the last five years, playing a major role in the calculation of transportation cost increases in the Consumer Price Index (CPI). At the present moment, the consumer response to new car prices is reflective of the increasing focus on price levels, as opposed to price increases. Policy makers may talk “inflation” but consumers are talking “prices.”

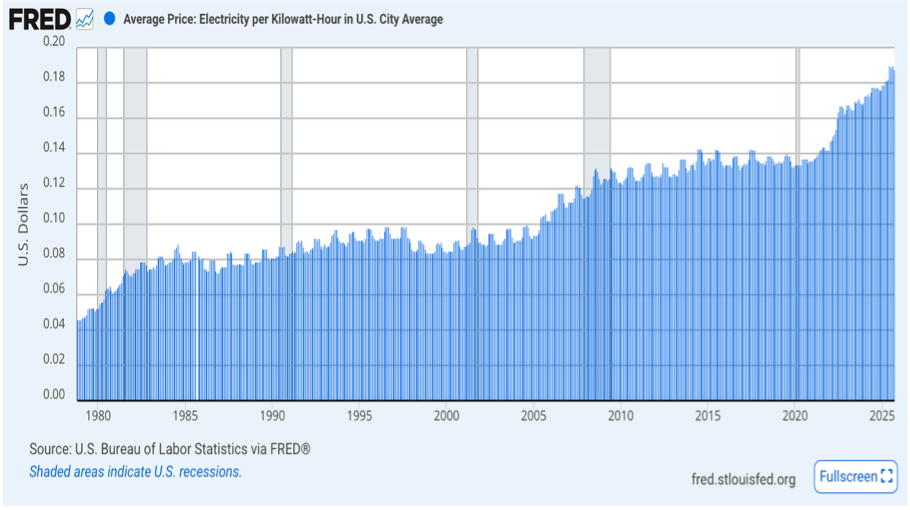

Another reminder of the complicated environment for policy makers (including politicians) comes from the US Energy Information Administration (EIA), which is charged with tracking electricity prices as well as oil/gasoline prices. US retail electricity costs are taking away from consumer spending power, some of what is being perceived as having been gained by falling gasoline prices. It is unclear how consumers are processing these costs at this time of year, but the winter months certainly tend to drive the point home. When January credit card statements for December spending arrive, it would not be surprising to see a course correction prompted by the simultaneous arrival of must-pay utility bills.

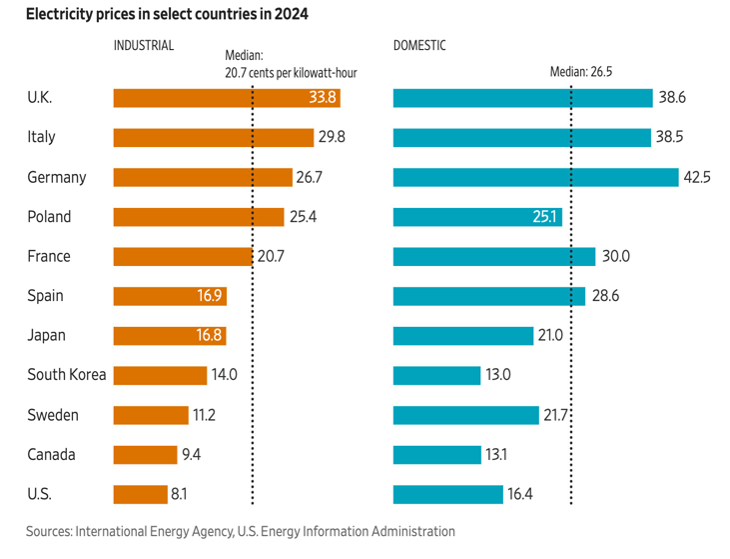

US electricity costs are by no means the highest in the world; quite the contrary. In Europe, various policy initiatives— as well as the war in Ukraine — have made energy costs uncomfortably high, prompting a re-examination of economic policy. European businesses are acutely conscious that access to “reasonably” priced energy is critical to being competitive in the global marketplace. The issue of electricity cost is going to become more and more important everywhere as AI-driven demand rises and well-intentioned policies collide with a broad-based need for economic growth.

But please don’t let this stop you from lighting those holiday lights if that is your tradition. Tremendous joy can be found in small, significant actions. Happy holidays!