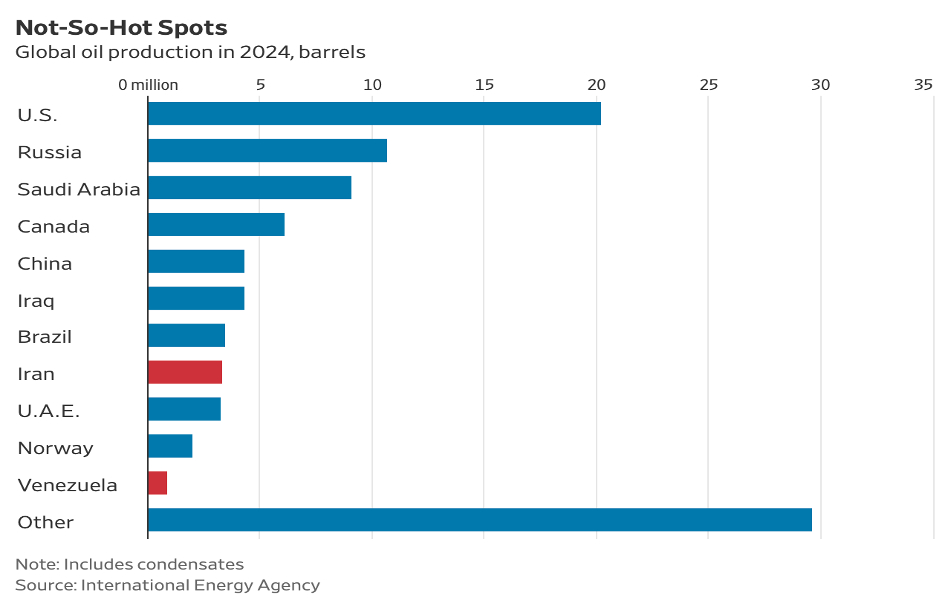

Oil prices started 2026 in very uncertain territory. It is widely believed that there is a substantial glut of oil at the moment, in quantities that can only be speculated because much of the excess supply is floating around the globe in tankers. Developments in Venezuela have only modestly impacted prices, mostly on the downside; with the US taking control of Venezuelan oil shipments it is likely that there actually will be an increase in global oil supply. While this is good news for oil consumers and various consumer inflation metrics, the oil industry is nervously watching as prices drop below the $60 per barrel benchmark commonly thought necessary to support industry investments and long -term exploration and development

Accurate oil production numbers by country are surprisingly difficult to obtain. Economic sanctions on Iran, Russia and Venezuela have turned a portion of the global oil trade into a secretive, high-risk business. Nevertheless, these 2024 crude oil production numbers are a reasonably good illustration of the dominance of the US, Russia and Saudi Arabia in the global oil trade—and the degree to which Iran, Norway and Venezuela have become shadows of their former selves. Of course, the concept of a single commodity called “oil” overlooks the fact that there are many types of oil with different refining characteristics. Venezuela’s crude oil, for example, is a “heavy” crude for which oil refineries on the US Gulf Coast were purpose-built. If the US takes control of Venezuelan oil and also encourages long-overdue investment in Venezuelan oil fields (the country’s oil reserves remain very large), Gulf Coast economies stand to benefit.

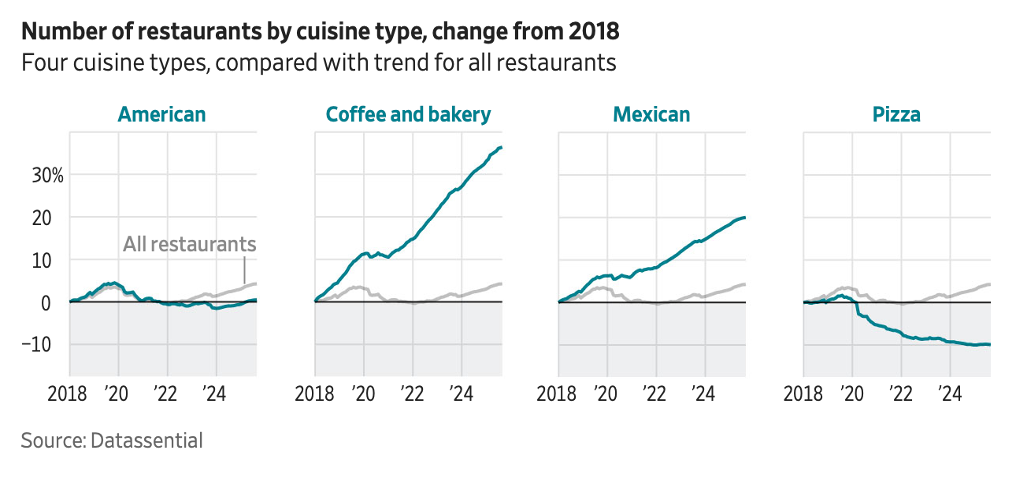

Falling prices at the pump due to plentiful supplies of oil provide consumers with spending money that, in the short term, they will direct somewhere else. There is considerable evidence that the $10-$15 dollars “saved” when filling up the tank at today’s lower retail gasoline prices will end up as food and entertainment dollars. One of the more interesting developments is that apparently it is unlikely to turn into pizza dollars—and the pizza industry is feeling the pressure. The narrative on pizza is, supposedly, that a pizza for a family of four has become “too expensive”; $15 of gasoline savings doesn’t buy an extra-large cheese pizza anymore but it does buy a lot of french fries.

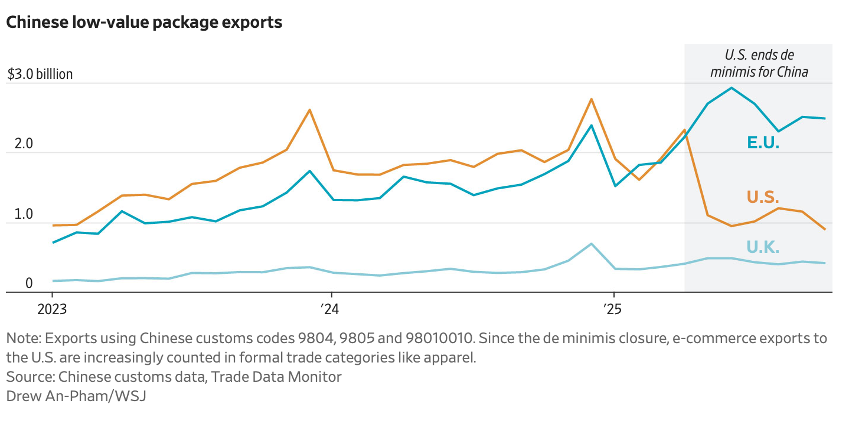

Another way to spend a few extra dollars is on lower value online purchases, some of which may be household necessities and many of which historically come from non-US suppliers. The so-called “de-minimis allowance” allowed small value (under $800) items to be sold in US markets without the imposition of price-hiking tariffs and customs duties. This special treatment was ended on April 29, 2025, with very different and very noteworthy consequences for Chinese exports to the US and to Europe. Chinese exports are best thought of as a balloon, which when squeezed in one area will bulge out in another. And China continues to blow into the balloon to make it bigger.

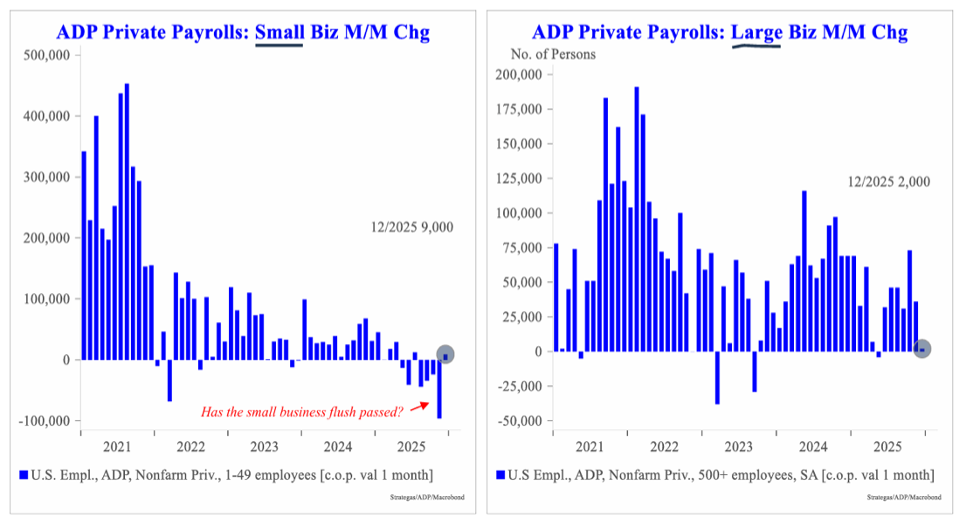

Nonfarm Payroll employment numbers released by the Bureau of Labor Statistics (BLS) on Friday morning were consistent with messages delivered by other data sources such as ADP, S&P Global (via the Survey of Purchasing Managers) and Challenger (Challenger, Gray & Christmas Employer Survey). The BLS-reported creation of 50,000 jobs in the month of December will probably be revised downwards, as were the October and November numbers, by an eye-popping 76,000 combined. Nevertheless, the picture is clearly one of employment creation that has slowed substantially but a labor market that has NOT crashed and burned. The unemployment rate continues to hover at an extremely low 4.4-4.5% (4.4% in December.) Taking a longer view is instructive: over the course of 2025, the US economy saw 584,000 net new jobs created, compared to approximately 1.5 million jobs in 2024. Based on the robust economic growth and consumer spending witnessed in 2025, this appears to be enough job growth to allow businesses to function and profit and households to survive (though perhaps not thrive)– with a modicum of help from things like lower gasoline prices.