January 13, 2026 – As I reflect on the past year, it’s hard to escape the sense that we are living through geopolitical changes that will take years to fully understand. Power dynamics are shifting not only between hemispheres and continents, but also within them. As the post–Cold War era fades, an emerging world order appears increasingly shaped by force and self-interest rather than rules and alliances.

In Europe, internal divides are deepening. Far right gains have destabilized coalitions and toppled governments—just as the need for unity in the face of Russian aggression and shifting U.S. security priorities becomes more urgent. Tensions between the U.S. and its NATO allies, including disputes over Greenland, add further strain and leave the Western alliance more fragmented.

In the East, China’s economic slowdown continues to challenge its geopolitical ambitions, compounded by its already fraught relationship with the U.S. As China probes the defenses of its maritime neighbors—particularly Taiwan—a new right leaning Japanese government, elected after the Liberal Democratic Party lost its majority in both houses of parliament, is taking a firmer stance and moving to revive Japan’s long dormant military posture.

In the Middle East—a longstanding flashpoint between East and West—the war between Israel and Hamas may have subsided, but not before exposing deep tensions among legacy powers such as Egypt and Turkey, revisionist Iran, and the rising Saudi Arabia, United Arab Emirates, and Qatar. Saudi Arabia and the UAE ended the year in near direct conflict over Yemen. And let’s not forget the summer’s broad hostilities between Israel and Iran, which culminated in U.S. strikes on Iranian nuclear facilities.

Across the Americas, the U.S. administration has increasingly sought to assert influence through economic measures, political interventions, diplomatic pardons, and ultimately direct military involvement in Venezuela (more on this later). These moves have strained longstanding alliances and raised new questions about historical partnerships. At home, the U.S. remains economically and technologically dynamic yet deeply polarized. Political violence has become disturbingly routine, and polarization and institutional dysfunction show no signs of easing.

Taken together, the picture is one of a global order in transition. The U.S. remains powerful but more defiant and inward focused. Europe faces social, political, and economic tests that will shape its standing and its partnership with the U.S. China’s ambitions are colliding with demographic and economic headwinds even as it fields a growing military. And the Middle East remains what it has long been—volatile, unpredictable, and a crossroads where civilizations from East and West compete over land, values, and influence.

U.S. Economy and Markets: A Split View

The defining narrative of 2025 was the widening divide between Wall Street and Main Street. Markets climbed to record highs even as consumer confidence evaporated. As is often the case, the reality of the U.S. economy lies somewhere in the middle. Despite tariffs and an immigration crackdown, the U.S. economy grew strongly. Inflation held below 3% despite significant new tariffs, and while the labor market showed strain—especially among younger workers and recent graduates—unemployment stayed below historical averages. So why the pessimism?

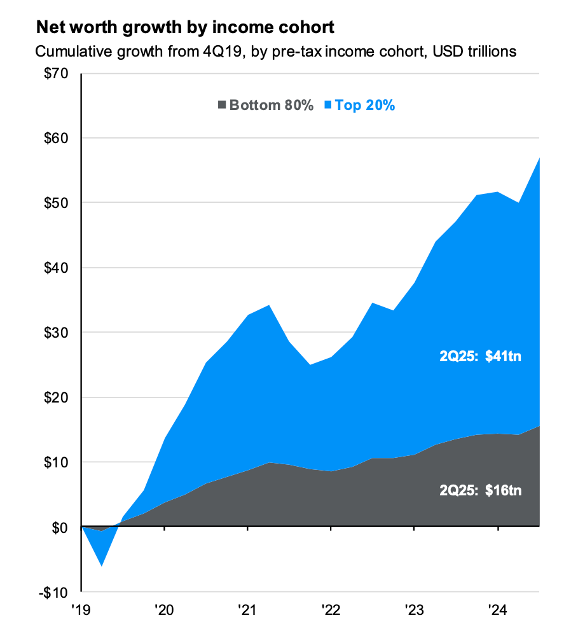

Part of the frustration is tied to political polarization and to media—especially social media—designed to provoke. But concerns about income inequality are also playing a central role. Research from JPMorgan indicates that between 2020 and mid-2025, the top 20% of earners saw their net worth rise by $41 trillion, while the remaining 80% saw gains of only $16 trillion (see Chart 1). These diverging outcomes are becoming more widely discussed, and the cost of living is likely to dominate the coming election.

The markets, meanwhile, looked past these pressures. The S&P 500 rose 18%, marking a third straight year of double-digit gains. Strong earnings—expected to grow 11% in 2025—helped, as did broad optimism about AI. A quieter set of structural forces continues to push assets toward equities: longer lifespans, the decadeslong decline of defined benefit pensions and rise of 401(k)s, increased retail investor participation, stock buybacks, and embedded capital gains. These dynamics support valuations but also introduce fragility should any of them reverse.

The Outlook: Politics Remain at the Center

Fiscal and monetary policy are likely to shape the economic landscape in 2026. In the first half of the year, many taxpayers will receive refunds tied to the 2025 tax bill, providing a meaningful cash injection. Later in the year—particularly if the economy softens—a Tariff Rebate check becomes increasingly likely, potentially timed around the election. These transfers can lift short-term demand but also add to a growing federal deficit.

In the first quarter, the Supreme Court is expected to rule on the legality of the current tariff regime. Whatever the outcome, we expect a gradual easing of tariffs as political pressure to address cost of living concerns rises. Looking ahead to November, the odds favor a split Congress, with Republicans holding the Senate and Democrats retaking the House, an outcome that would likely produce legislative gridlock through 2028.

On the monetary front, we expect the Federal Reserve to continue easing carefully, with a focus on supporting a cooling labor market. This will require caution: inflation remains close to 3%, above the 2% target, and tariff related costs may not yet be fully reflected in prices. Underlying all of this is the question of Fed independence and the long-term credibility of U.S. monetary policy. Jerome Powell’s term ends in May, and the incoming chair—appointed by the current administration—will face pressure from the White House to keep rates low and pressure from markets to demonstrate independence.

The largest uncertainty heading into 2026 is geopolitical. U.S. actions and messaging around Venezuela leave many questions unanswered. How events unfold will shape the lives of Venezuelans and influence how allies and adversaries interpret U.S. intentions, especially given America’s history with regime change. Venezuela’s oil future is no clearer; infrastructure needs and legal constraints suggest it will be years before significant production reaches global markets.

More broadly, as we re‑enter a world less anchored by shared rules, outcomes once considered unlikely must be taken seriously. Uncertainty on this scale calls for resilience, personal, financial, and social. The world is changing, and we must be ready to adapt.

Wishing you a cozy and peaceful winter,

— AMD