October 25, 2023 – As if the atrocities of the Ukraine War were not enough, we woke up to a new reality this month in the Middle East. The threats of annihilation that Iran, Hamas, and Hezbollah have projected and promoted for decades is a reality in technicolor in the age of social media. I won’t get into the politics of current events — this is not the place for those discussions — but there is no human excuse for murdering families in their homes, kidnapping of scores or people, nor using their own citizens as human shields and cannon fodder. It is disgusting on every level.

On that lovely note, allow me to hit on the main topics we are facing as we go into the final quarter of a truly disheartening year.

The Markets

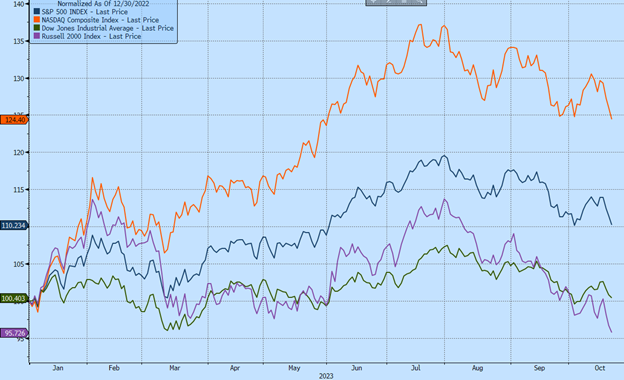

The markets as we normally think of them have been ripped to pieces by the global situation. Equities in the U.S., as shown in Chart A, vary wildly depending on which sector you are looking at. The technology-heavy NASDAQ is up 27% YTD[i] – a phenomenal return in any situation. The S&P 500, however, with its broader range of industries has done just half of that amount at 13%[ii] while the Dow 30 with just the 30 largest stocks across all sectors is up only 2%[iii]. And if you look at the Russell 2000 with a small-cap composition, you haven’t gained anything this year. The explanation is very simply — 80%[iv] of the returns this year have been generated by just seven tech companies. If you have exposure to some of those seven, then you did fine.

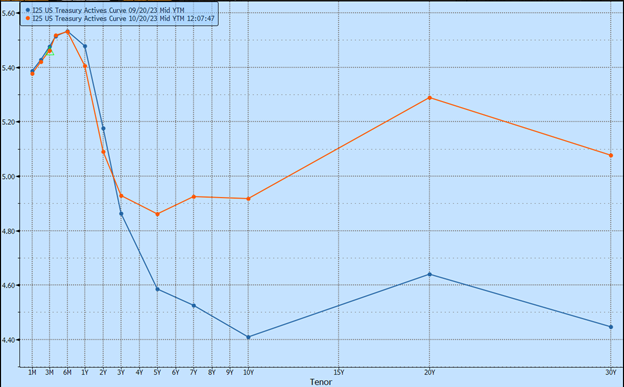

Bonds have a similar narrative. As holders of 30-year U.S. Treasury debt, you saw a shellacking on a price basis as yields finally moved up from historic lows. With declines of 53%[v] on individual Treasury bonds, it was the largest rout in modern history. The yield curve inversion on the widest points (30-year less 2-year) was an unspeakable 117 basis points[vi]. This is the first time it has inverted since 2000 and the widest since the early 1980s. And as of this writing, you can get nearly 5% guaranteed income on Treasuries for almost any duration. Ultimately this will sap the life out of stocks as folks seek safety.

Chart A: The four major indices YTD: SPX, Nasdaq, Dow, Russell 2000

U.S. Economy

Our own economy continues to show remarkable resilience despite the many predictions (including my own) of a recession by now. That said, we are far from out of the woods and given the current global events it is increasingly likely that we do experience a moderate recession. Given the delayed correction, it is also increasingly likely that if there is a recession, it will be more than just mild. Had that correction occurred this year, the conditions would have supported a quick recovery.

Resilience is, however, the theme that continues to explain the narrative. Inflation has been resilient to — or resistant to — abating. We recovered from the sky-high inflation of last year, which in hindsight may have been a self-correcting event all along, but we have yet to get to a level that is considered manageable by the Fed. Their goal of 2% makes sense, but it is still an open question as to whether we can get there without a more restrictive monetary policy.

Debt levels, corporate earnings, and trade disputes are the perennial favorite topics for market pundits, all of which we will address in the Live Market Update. But in summary, corporate debt levels are high (although consumer debt is still manageable), corporate earnings need to increase rapidly to support company valuations, and trade will be the ultimate determinant for which economies continue to thrive outside of the U.S.

The wildcard that has yet to truly bite the markets hard is the U.S. total debt. We are swimming in debt at levels entirely incomprehensible ($33 trillion). That debt is supported by the issuance of new bonds (Treasuries) and at some point, there needs to be a reckoning: either the government finds a way to tame the debt over the next generation or the cost of debt will increase as buyers become harder to find. The latter would put the markets into uncharted territory.

Chart B: U.S. Treasury Yield Curve

Overall, we have a lot to contend with in an environment that is increasingly tenuous. The U.S. is still the standard bearer economy and promises to be so for a long time to come. That said, there are a lot of adjustments and corrections that we will endure as it finds a stable long-term footing. All that said, I haven’t tiptoed into the problem of climate change, a looming crisis that will ultimately cost us tens of trillions to resolve and maintain our current standard of living.

It will be a difficult period ahead with quite a bit of short-term “medicine” that is needed in the different markets. Long-term, however, presents tremendous opportunities for those willing to look beyond the immediate and recognize where change will happen.

-DBM

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2023 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.

[i] Bloomberg Finance, Nasdaq Composite, December 31, 2022 to October 19, 2023

[ii] Bloomberg Finance, S&P 500 Index, December 31, 2022 to October 19, 2023

[iii] Bloomberg Finance, Dow Jones Industrial Average December 31, 2022 to October 19, 2023

[iv] Bloomberg Finance, S&P 500 ETF Trust Attribution, December 31, 2022 to October 18, 2023

[v] Bloomberg Finance, US Treasury Bond due 5/2049 paying 2.875%, April 21, 2020 to October 19, 2023

[vi] Bloomberg Finance, United States government bond 30 to 2 spread (swap)