By Jeanette Garretty, Chief Economist

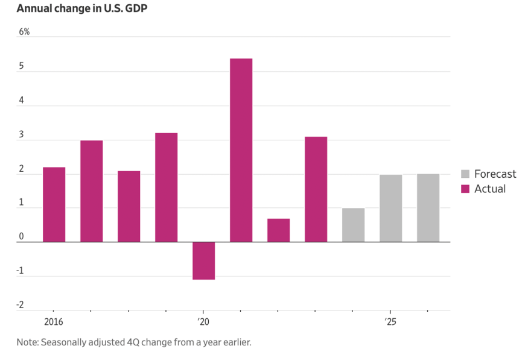

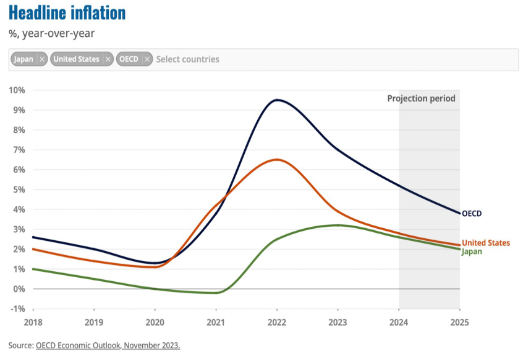

The fourth and final quarter of 2023 saw a resolution of a number of important questions: Would inflation decelerate as hoped? Would the US economy falter? Would the Federal Reserve ever stop raising interest rates? These three questions dominated investor sentiment for much of 2023 and, in keeping with economics being called the dismal science, most economists were exceedingly skeptical about a scenario best described as “Fed Success”. Yet, in fact, this is exactly what the fourth quarter confirmed. By the end of the quarter, it was clear that inflation had fallen below 3% while the US economy grew a robust 3%+, and the Federal Reserve was done with interest rate hikes. A strong labor market growing at a somewhat slower (but more sustainable) pace than earlier in the year lifted consumer and business confidence over the course of the final months of 2023, and supported household income growth that fueled a surprisingly positive holiday sales seasons. It should also be noted that a few storm clouds gathered on a far-off horizon, however. US consumer debt rose to levels higher than before the pandemic, and while credit delinquencies have risen, banks profess not to be concerned. Also, economic growth at the end of 2023 for some of our major trading partners — Europe, the UK, and China—came in much weaker than once-expected, with the economic problems in China being especially worrisome because they appear to be structural, i.e. related to demographic and governance changes that may not be easily resolved. Finally, the geo-political developments of the past few months have reminded us that we live in a very uncertain, fractious world, although the US economy thus far has weathered these global storms quite well.

Source: Bureau of Economic Analysis (BEA); OECD Economic Outlook – November 2023

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2023 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.