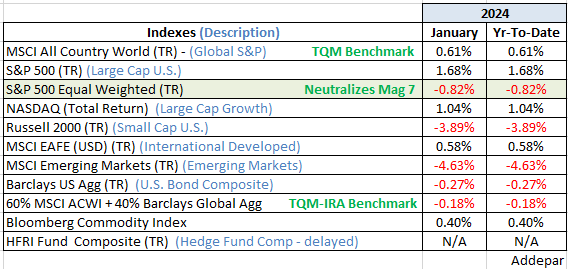

Following the everything-rally that was the last two months of last year, performance across asset classes was mixed in January. Stronger than expected economic growth data and strong pushback from central bankers against the market’s overly enthusiastic expectation for rate cuts produced a tough environment for fixed income (U.S. Agg – chart below). Even though lower rates at the end of last year fueled gains in equities, segments of the equity market were buoyed against rising rates in January by the stronger economic growth data. One of those segments was mega-cap growth – an echo of last year’s Magnificent 7 phenomenon. Compare the returns of the cap weighted S&P 500 Index to its equal weighted sibling and the small cap Russell 2000 Index. Emerging market equities were down -4.6%, despite newly announced stimulus from the People’s Bank of China (PBOC). A mixed month, indeed.

Given the geopolitical backdrop, the development of an unknown unknown(s) (aka Black Swan event(s)) has a higher probability than usual. However, financial markets discount known unknowns (macroeconomic trends mostly). Investors just have to live with the possibility of a Black Swan and react to them when they do arrive (Q12020’s COVID is the most recent example).

All that said, barring an unexpected shock to the global financial system, I suspect January’s mixed results may be foreshadowing the next six months. Rate cuts are coming, but the people who cut them are saying the second half of the year. Economic growth looks good for now but the credit environment is tightening (New York Community Bank) and rounds of layoffs are being regularly announced. Should a “soft landing” turn into a no-landing event, we can cancel the rate-cut party.

I do not see a trap door for the equity market to free-fall down through (no Black Swan disclaimer), but similarly, I do not see much bull market fuel in an environment where the Fed is braking the economy in order to tame inflation.

There is still opportunity in Mixed.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, Dorsey Wright & Associates, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.