The following is your June 2024 Robertson Stephens Monthly Performance Report.

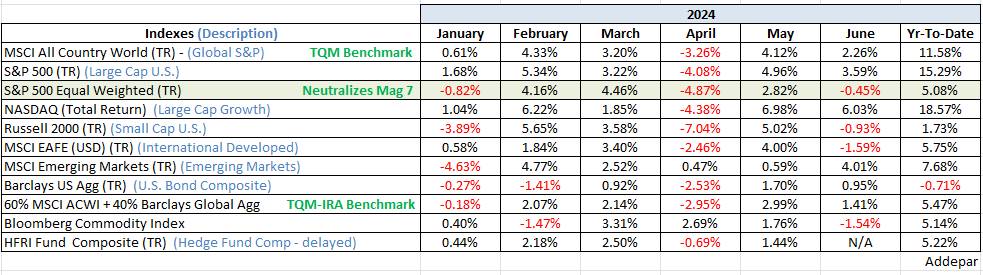

For the month of June, the stock market continued to show a gradual upward trend for most of the major indices, led once again by the AI theme and the Magnificent 7 stocks (the 7 Mags were up +9.85% on average in June with little mean variance). However, concerns about the economic outlook began to surface, and the non-Mag stocks noticed. Let’s do some if/then napkin math – if 7 stocks representing 32% of the S&P 500 by market capitalization were up +9.85% on average, then 493 stocks were up +.64% on average since the SPX ended the month up +3.59%. Note below that the Equal Weighted S&P was down -.45% on the month, squaring that circle.

Despite the economic slowdown signals, the Fed’s stance remained cautious, with a focus on maintaining current rate levels for longer to combat inflation. This didn’t seem to effect market expectations though; the market is still pricing in between 1 and 2 rate cuts by year-end – unchanged from last month.

For most of the first half of the year, we stuck to our clear sailing into the summer for stocks and bonds theme but expressed some economic slowing and recession fears for year-end. Since it is mid-year, our favorite independent research firms (NDR – Ned Davis Research and BCA – Bank Credit Analyst) have updated their 2nd Half forecasts – it’s getting very interesting.

Recall NDR’s 360-degree analysis approach that synthesizes fundamental, macroeconomic, technical, and behavioral analysis into their models. They are model driven and while they set forecasts, they don’t rely on them. If the models change, the forecasts are thrown out. All that said, the balance of evidence from their models leans bullish today, so they set a 5725 SPX target for year-end, provided models hold. That is +4.85% from Friday’s close. They believe the 2nd half will mirror the 1st half of the year, with Q3 looking like Q2 and Q4 like Q1. Embedded in that message is the expectation of another correction like April’s, followed by a post-election rally into year-end. A guarded, but positive overall forecast (with all their model changing disclaimers attached).

BCA’s market forecasting approach looks through the lens of an economist, looks further out in time, and is less technical than NDR’s. The two approaches complement one another and can be validating when both line up on similar sides of a forecast. Unfortunately, that is not the case presently. BCA’s 2024 Third Quarter Strategy is titled; “Here Comes the Pain” and opens with “The consensus soft-landing narrative is wrong”. It includes an equities downgrade – a tactical downgrade to underweight on stocks after being neutral-weight since January and over-weight before that. They “conservatively expect the SPX to drop to 3750 during the coming recession.” That would be down 31% from Friday’s close.

I am reminded of the famous quote; Economists are never wrong, they’re just early sometimes. BCA’s 3750 is not a December target like NDR’s, it is a target for the next recession they think is coming late Q4-24 or early next year. Throw in NDR’s zero signs of recession over the next 6 months, and we could justifiably push BCA’s recession forecast further out again, like last year.

From an asset allocation perspective, it would seem like a good time to tactically overweight durable fixed income and pump the brakes on deploying fresh capital to equities. At least for now.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.