March 5, 2025 – The wave of economic optimism that prevailed at the end of 2024 has crashed on the shores of a complicated economic and policy landscape. Here’s what’s happening.

First, a bevy of economic indicators suggests that the economy could be slowing faster than previously expected. Consumer spending declined in January for the first time since March 2023, and consumer inflation expectations have risen, with projections for the next 12 months climbing to 4.3%, up from 3.3% in January.[1] Business activity growth also stalled to start the year, with the S&P Global’s Purchasing Managers’ Composite Index falling to 50.4 in February, a 17-month low.[2] Any number below 50 would indicate a contraction in business activity.

Much of the change in sentiment appears tied to political uncertainty. If December and January represented optimism around the new administration’s economic policies and a hope that lower taxes and deregulation would stimulate economic growth, that grace period has come to an end. February highlighted uncertainties around the impact of cuts to the federal government, shifts in immigration enforcement, and a rapidly evolving geopolitical landscape.

But perhaps the biggest driver of policy uncertainty is trade. After a month-long delay, the administration moved forward this week with a 25% tariff on imports from Canada and Mexico, and an additional 10% tariff on imports from China. All three countries have promised to retaliate, threatening a further escalation. This move marks a dramatic shift from decades of free trade advocacy by the US to a protectionist mindset that will challenge the hyper-globalized economy that companies have come to rely on.

Beyond the immediate economic impact of tariffs, which most economists view as inflationary, rapid changes in trade policy deter business investment as firms adopt a ‘wait and see’ approach. Tariffs will also significantly impact Canada and Mexico and may signal a change in the relationship between these countries and the US. Even if the tariffs are lifted, which they could be in the future, the uncertainty and bitterness they create are likely to linger.

Investors have been quick to react to these developments, bringing increased volatility to both equity and fixed-income markets. On Monday, the S&P 500 posted its largest daily decline of 2025,[3] with cyclicals and small-cap stocks underperforming, while defensive sectors have held up better. Treasury yields, which had been declining on expectations of rate cuts, have started to creep back up as inflation concerns resurface, though they remain down for the year.[4] Corporate earnings guidance has also turned more cautious, with Walmart’s recent warning about weakening consumer demand adding to concerns about slowing economic momentum.[5]

The combination of a slowing economy and policy uncertainty puts the Fed in a difficult spot as it looks to keep the economy humming while also managing inflation. Fed governors may soon find themselves in the unenviable position of choosing which of their two mandates—full employment or price stability—to prioritize, all under the administration’s watchful eye. Perhaps the only silver lining here is that tariffs represent a one-time price shock—albeit one that will take time to filter through the economy—and should not fundamentally alter the downward inflation trend.

With sentiment running high, it’s important to stay focused on the data. Economic data for Q1 is often messy as companies raise prices to start the year and adjust inventories. Even the weather is said to have played a role in January’s disappointing consumer spending. The U.S. ended 2024 with a strong if slowing, economy, and some of that momentum is likely to carry into 2025. February’s employment numbers, expected on Friday, should provide more clarity on the state of the economy.

As we await more data on both the economy and the impact of tariffs, it’s worth remembering that volatility is an inherent feature of public markets. Large price swings are to be expected as more information comes to light. Still, for long-term investors, there are good reasons to stay invested—history has shown that the best market days tend to cluster around the worst. As always, investors should ensure their portfolio allocations align with their goals and risk tolerance to ride out these periods of volatility without being forced into unfavorable selling decisions.

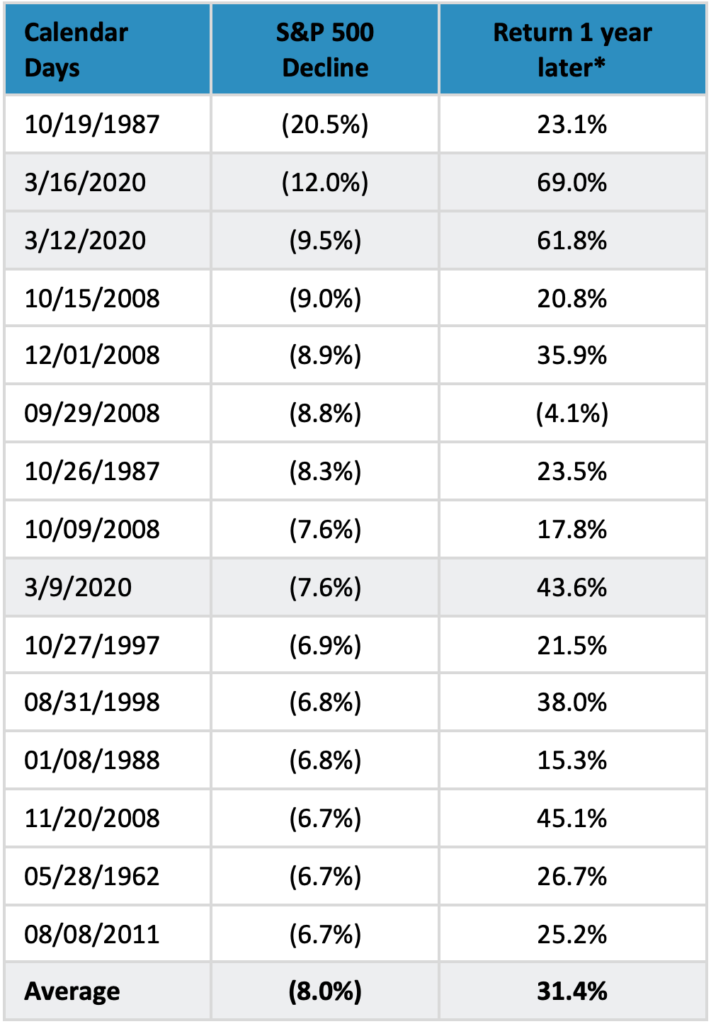

Worst days for the S&P 500 (January 1950 – April 2020)

During this time, the S&P 500 rose in the year following 14 of its 15 worst days.

Please don’t hesitate to reach out with any questions or concerns.

– AMD

Footnotes:

[1] University of Michigan Consumer Sentiment Survey, February 2025.

[2] S&P Global Purchasing Managers’ Composite Index, February 2025.

[4] Bloomberg Market Data, S&P 500 Weekly Performance, March 2025.

[5] U.S. Treasury Yield Curve Data, Federal Reserve Bank of St. Louis (FRED), March 2025.

[6] Walmart Earnings Report, Q1 2025, Investor Relations.’t hesitate to reach out with any questions or concerns.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2025 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.