The following is your February 2025 Robertson Stephens Monthly Performance Report.

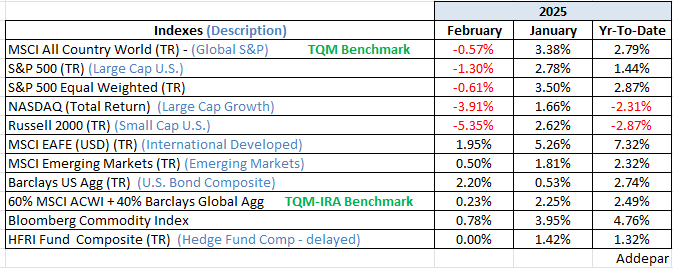

Looking at the chart below, although the year started strongly, it did not necessarily begin where last year ended. The big trend change from the last 2 years was the loss of U.S. stock’s global dominance. January foreshadowed February, and the Mag 7, which led all for almost 2 years, turned into the point of a market correction spear—assuming, for now (4 pm – March 6th), that we are only in a correction and not something worse.

As I type, the S&P 500 is -6.65% below its recent high, has turned red with a negative return year-to-date, and today it crossed below the level it opened at on election day. The other major U.S. indexes are worse. The NASDAQ Composite and Russell 2000 are down -10.6% and -11.2% from their recent highs, respectively. The U.S. stock market is in correction. International markets are not. That may be the first hint that this is indeed a correction and not something worse. Secular bear markets have always been a global affair in the past (not a guarantee of the future, but comforting, nevertheless).

I have had several client conversations this week where the sense of hopelessness was palpable. There is a lot hitting investor psyches. Uncertain tariffs, an uneven path of inflation and Fed policy, and recent weaker-than-expected economic data have quickly swung the sentiment pendulum from excessive optimism just after the election to extreme pessimism today – the short-term (weeks) sentiment gauge is on the floor. When this gauge reverses upward from the floor (as mentioned in Morning Notes), returns for the market 1 month later have risen 80% of the time by a median of 4%. Worth noting is that longer-term (months) sentiment gauges are not nearly as pessimistic. Keep that in mind when we get to the last chart.

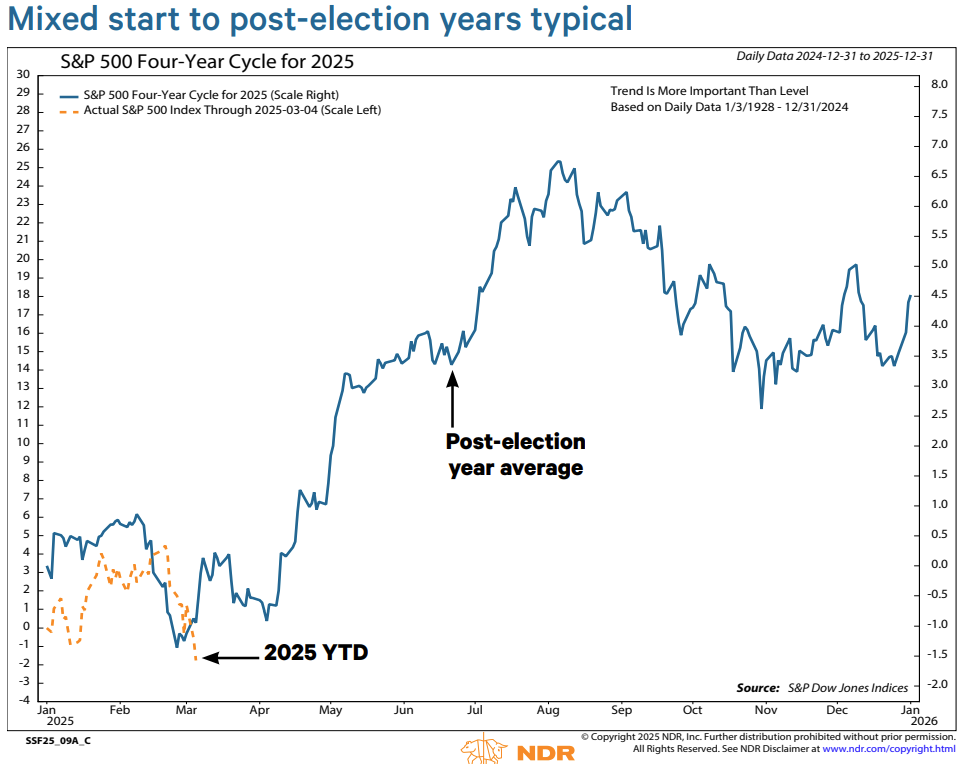

Financial markets are as news-dependent as ever. The White House’s next tariff proclamation could send stocks above last week’s highs or fresh year-to-date lows. Tomorrow’s jobs report has similar potential. While the rapid news flow may feel unprecedented, choppiness (volatility) in a post-election year is not. A weak February has been followed by a sideways March and then a Q2 rally. I’ll leave you with this chart; I hope it soothes some fear just a little bit.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research