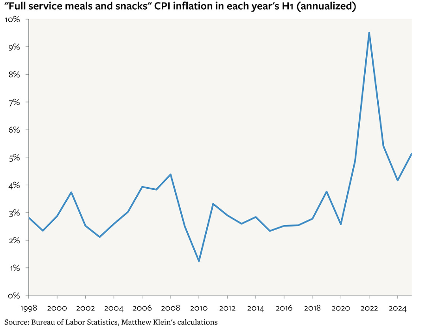

These two charts count as one. The story that the Fed will have to unpack on inflation is about what is going on underneath the top-line CPI numbers. Prices on homes for sale are rising, but sales are lacking. Falling rents contribute to decelerating inflation with a considerable lag. Oil prices may fall again as the Saudis and the Gulf states increase supplies, but tariff costs are mounting and may begin to feed into consumer prices. And what do consumers probably like least of all? Fast food and restaurant inflation, which has been considerable and readily visible, continues to be a problem despite the fact that grocery-aisle snack food sales are weak.

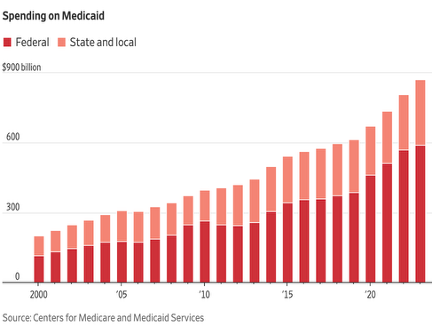

In the ongoing aftermath of the passage of the One Big Beautiful Bill Act (“OBBBA”), Medicaid cuts remain an area of concern. Hospital revenues are considerably dependent upon Medicare and Medicaid support, and states are debating how, and how much, to step into any gaps. It is easy to see why Medicaid spending has become a focus of Washington, DC policymakers, but it is less clear to gauge what one can effectively do in light of rising healthcare costs and an aging population.

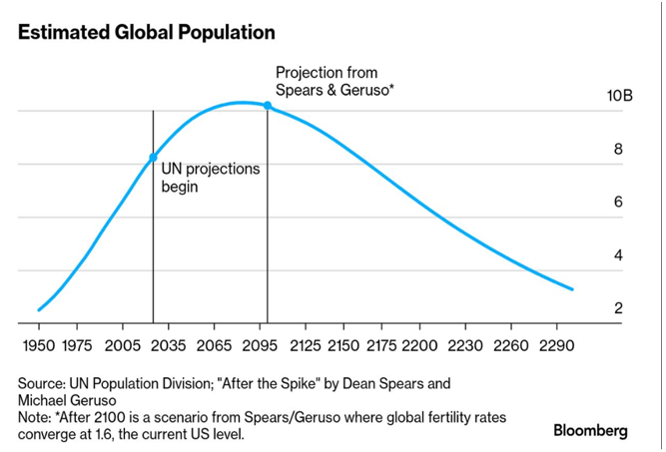

On the topic of aging, another chart to remind us that not only are we getting older, but the world collectively will be getting older as population growth slows and medical care helps people live longer. Individual countries can alter their population growth outlook via immigration policies, but globally, the only effective action is an increased birth rate and increased life span. Very long-range projections are often surprisingly wrong; this one is worth watching and thinking.

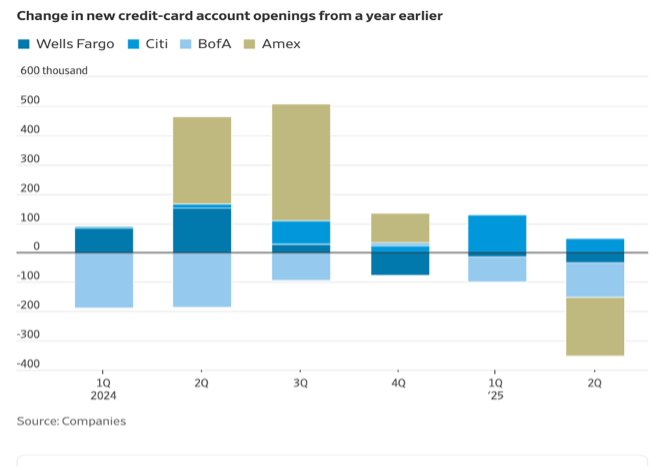

The credit card business is ultimately a function of a bank’s asset & liability committee decisions. Those decisions can vary widely and only partly reflect economic conditions, actual or projected. Nevertheless, it seems that a certain amount of caution has entered the picture, even as credit card balances grow and delinquencies remain relatively low (but rising). Historically, credit card companies have pursued users who are credit-worthy but carry a credit card balance and pay those lovely high interest rates. Credit card fees are becoming increasingly important, however, and some of the deceleration in new account openings is thought to reflect the pursuit of wealthy customers willing to pay high annual fees and to generate ancillary revenues.

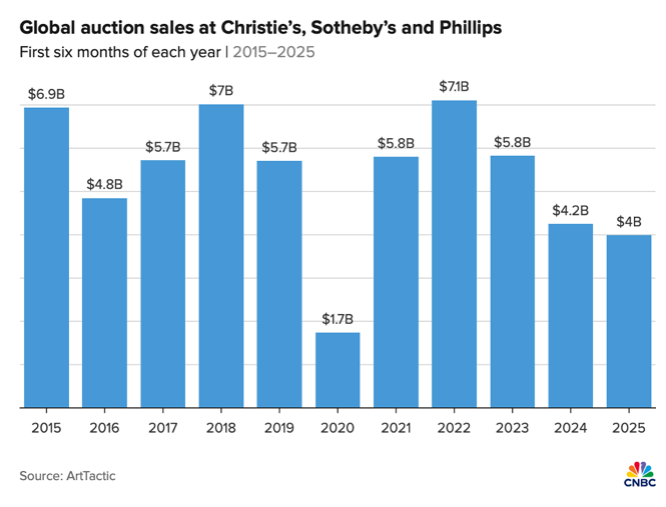

Wealthy households do not seem to be spending in the usual ways, at least with respect to the high-end art market. Global auction sales at the “Big Three” art auction houses have fallen 44% since 2022. The pandemic-influenced numbers for 2020 are considered an anomaly, yet even lowering some of the 2021 and 2022 numbers to reflect a catch-up leaves the art market highly worried about a falling trendline. Circumstantial evidence suggests that generational change may be the culprit; wealthy 30-somethings do not appear to be spending money like their boomer parents – an observation that can be applied to various segments of the luxury marketplace.