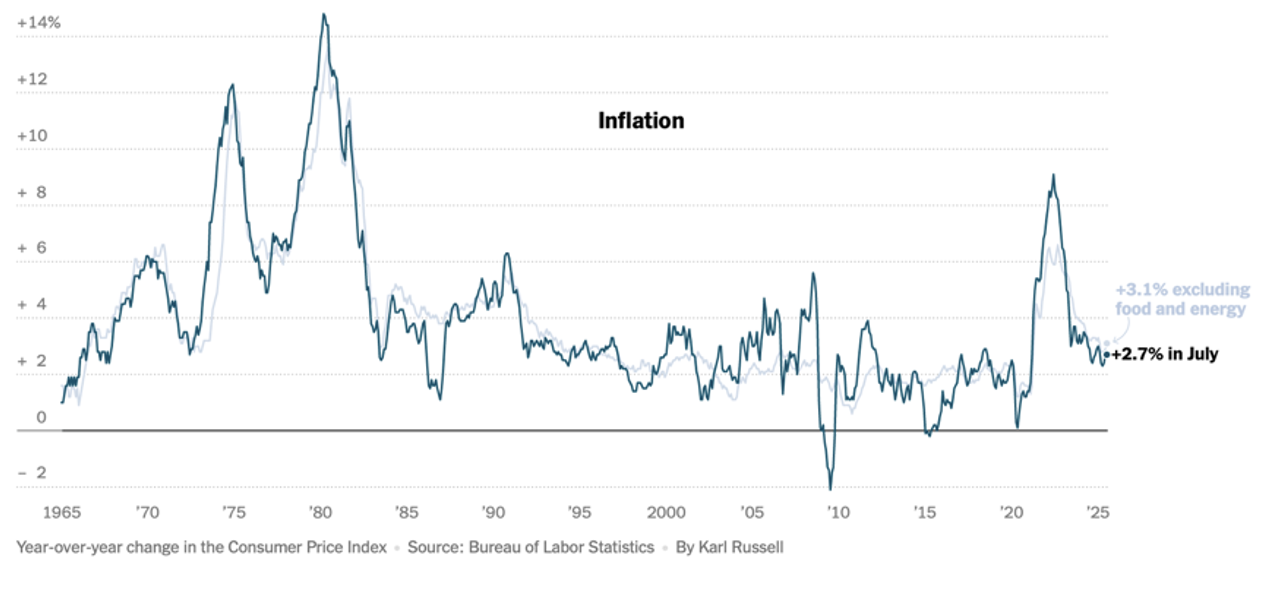

Inflation continues to track at 2.5%-2.75%, although the impact of tariffs can be detected in the higher, 3%+ rate of core inflation and the recent increase in the Producer Price Index; removing food and energy to obtain “core” inflation serves to spotlight the goods that have been the primary focus of trade deficit reduction. Those worried about their tomatoes and avocados will have to wait their turn, which will surely come (thin grocery margins don’t leave much room for maneuver.)

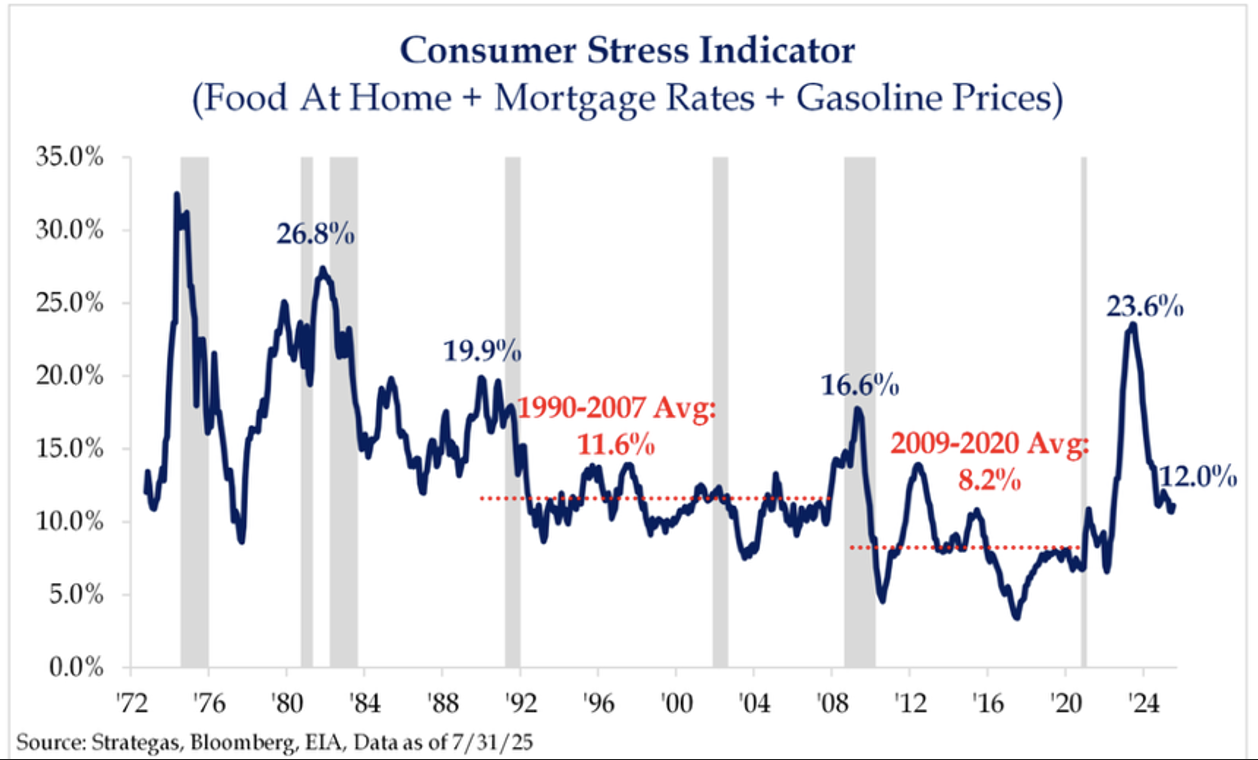

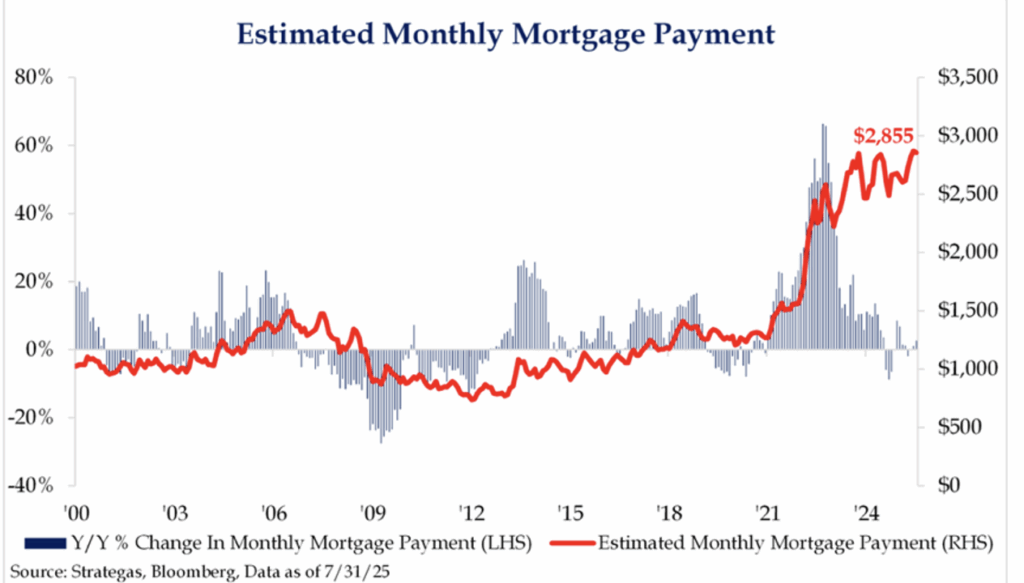

The resilience of the US consumer can be understood in a variety of ways. A number of measures of consumer “stress” indicate that while price levels are pressing on household budgets, the fact that prices are not accelerating as they were earlier in the decade has been a source of relief. Furthermore, disaggregating the components of these types of summary measures helps to illuminate why different demographic groups may experience different levels of stress. If one is looking to buy a home, the chart on mortgage payments explains why the aspirin bottle is kept close at hand. And if one doesn’t like to cook . . .

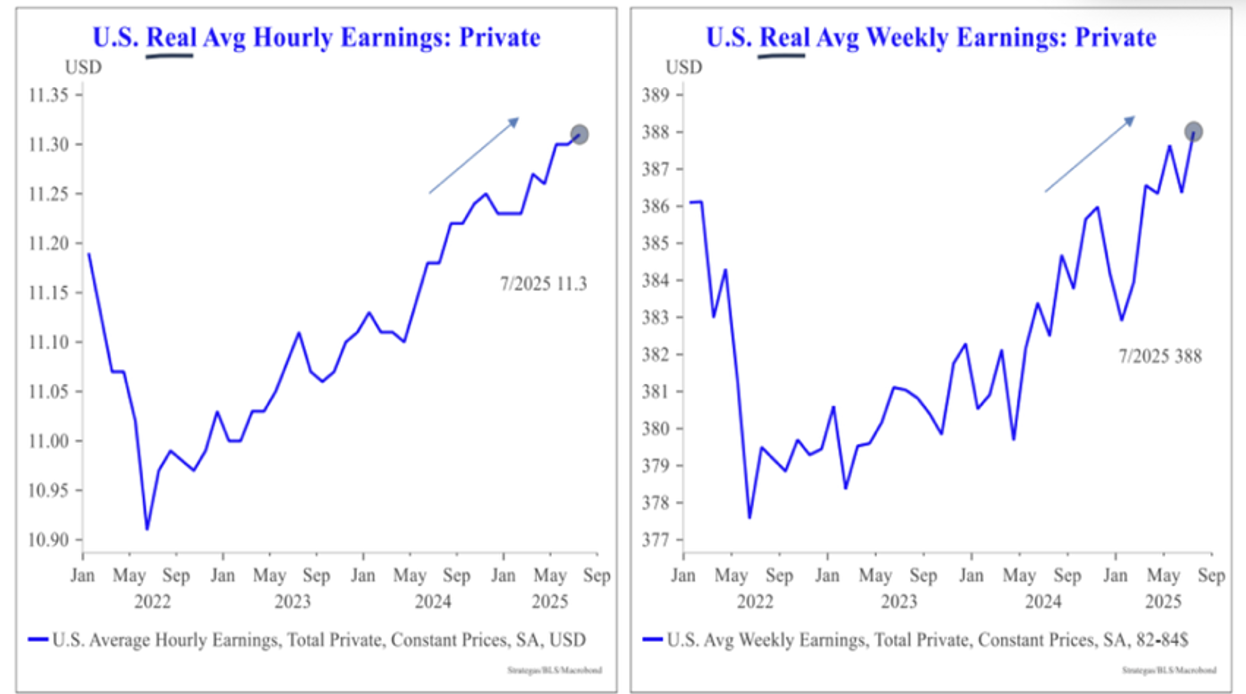

Economic analysis can sometimes be amazingly simple, however. As inflation rates fell in 2022 and the economic recovery from the pandemic generated strong demand for labor, wage growth began to outpace inflation. Three years later, this trend is still in place and is probably the most fundamental explanation for the remarkable growth of the US economy across an extremely challenging half-decade. Any significant change in this trend, either through job losses or a renewed acceleration of inflation or both, will result in completely non-theoretical escalating stress on the consumer and the economy at large.

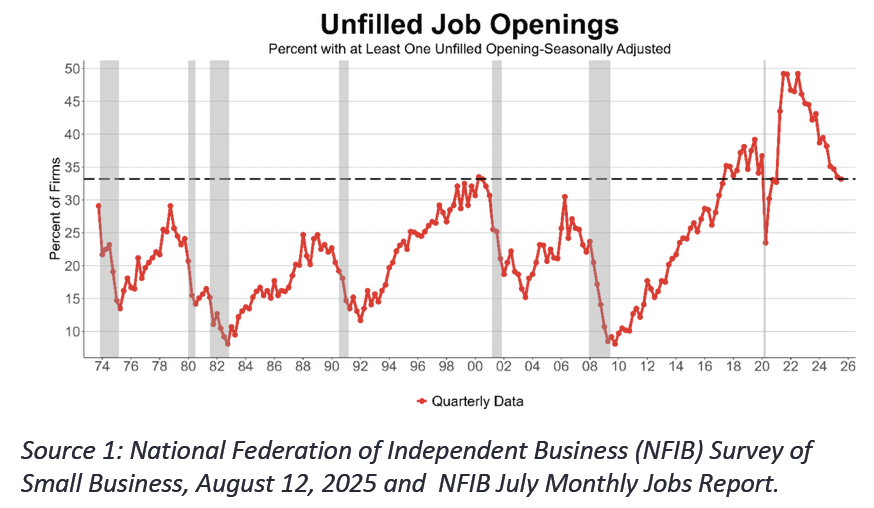

It is often under-appreciated that long economic expansions can be stressful for employers. As businesses must dig deeper and deeper into a limited labor pool, labor quality deteriorates, training costs rise, and productivity falls. The most recent NFIB survey of small businesses cites a moderate improvement in optimism at least partly attributable to greater success in filling job openings; “only” 33% of small business owners had at least one position they could not fill, the lowest level since 2020. Yet slightly more than half of small business owners were actively engaged in hiring or soliciting job applications in July, with a vast majority complaining about insufficient applicants. Not surprisingly, the greatest difficulty mentioned in the survey was in finding qualified applicants for skilled positions.