Understanding the Qualified Small Business Stock (QSBS) Gain Exclusion

The Qualified Small Business Stock (QSBS) gain exclusion, as outlined in Section 1202 of the Internal Revenue Code, is one of the most significant tax benefits available to founders, employees, and investors in certain small, high-growth companies. It’s designed to encourage investment in small American businesses by offering a potential federal income tax exclusion on capital gains when the stock is sold.

The exclusion allows an eligible taxpayer to exclude a portion of the gain from federal income tax when they sell QSBS, provided the stock has been held for the required holding period. This can result in a 0% federal capital gains tax on the excluded amount.

Key Requirements and the OBBBA Changes

To qualify as QSBS, the stock must meet several key criteria at both the corporate and shareholder level. Typically, the easiest way to determine if your stock is eligible for the QSBS exclusion is to consult with your CFO.

To qualify for the QSBS exclusion, the stock must be issued by a U.S. C-Corporation that conducts an active, qualifying trade or business (excluding service, finance, or real estate firms). The company’s total gross assets must not have exceeded $50 million when the stock was issued (or $75 million for stock issued after July 4, 2025). Finally, you must have acquired the stock directly from the company (at original issuance) for cash, property, or services.

Holding Period: New Tiered Exclusion

For stock acquired on or before July 4, 2025, it must be held for more than five years for a 100% exclusion. For stock acquired after July 4, 2025, the law now provides a tiered exclusion schedule, meaning you can receive a partial benefit for holding periods less than five years:

▪ 3 to 4 years: 50% exclusion.

▪ 4 to 5 years: 75% exclusion.

▪ More than 5 years: 100% exclusion.

The Exclusion Cap

The maximum amount of capital gains an individual taxpayer can exclude on the sale of QSBS from a single company is the greater of two limits:

1. $10 Million (per taxpayer, per company). For stock issued after July 4, 2025, the $10 million cap has been increased to $15 million (per taxpayer, per company), and is subject to inflation adjustments.

2. 10 times the taxpayer’s original adjusted cost basis in the stock sold during the year.

- Example: If your basis is $10,000, 10 times your basis is only $100,000. You would choose the greater limit: $15 million (post-OBBBA stock).

- Example: An investor invests $2 million in cash in a qualified small business. Their limit is the greater of the $15 million cap OR 10 times their basis: 10 times $2,000,000 = $20,000,000.

Wealth Planning Strategies While the exclusion limits seem high, a successful exit can easily generate gains that exceed the cap. Strategic wealth planning can help maximize the QSBS benefit.

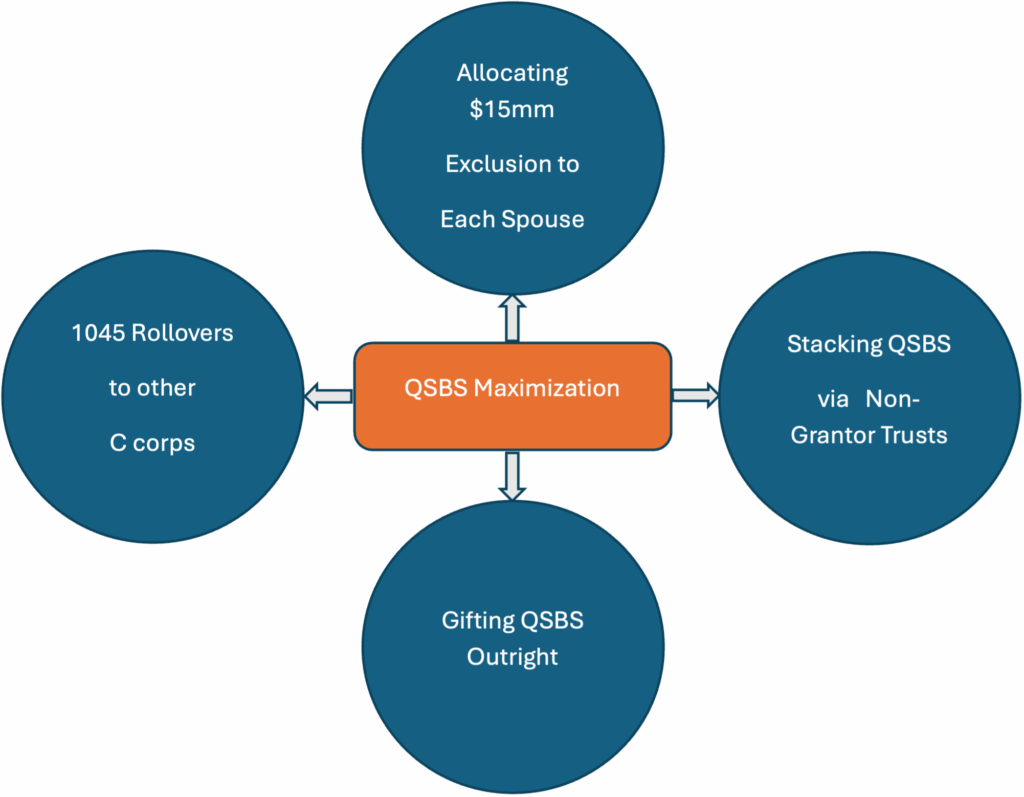

QSBS Maximization

QSBS Stacking (Multiplying the Exclusion)

“Stacking” is a strategy used to multiply the maximum exclusion amount by involving multiple separate taxpayers. Since the exclusion limit ($10M or $15M, or 10x basis) applies per taxpayer and per issuing company, gifting shares to other family members or to separate, irrevocable, non-grantor trusts (not SLATs) before a sale can potentially allow each recipient to claim their own complete exclusion. To minimize the use of your lifetime federal gift tax exemption, complete the gift while the valuation is low.

Special Note for Married Couples

The application of the QSBS exclusion cap for married couples filing jointly remains a complex and ambiguous area of tax law, leading to divided professional opinion. The core question is whether a couple is limited to a single exclusion (e.g., $15 million post-OBBBA) or if each spouse is eligible for their own limit, effectively doubling the potential tax-free gain (up to $30 million).

The Internal Revenue Code (IRC) defines the exclusion on a “per-taxpayer” basis, hinting at individual limits. However, while the IRC explicitly halves the cap for those filing separately ($7.5 million each), it is silent on explicitly granting two full exclusions for a joint return, creating uncertainty.

Despite the lack of direct IRS guidance, some tax advisors may support claiming two full exclusions on a joint return, an aggressive but defensible position based on the “per-taxpayer” rule.

To mitigate risk, a recommended wealth planning strategy is to formally split ownership of the QSBS between spouses early on, ideally when the company’s valuation is low. This step can strengthen the argument for claiming two separate exclusions should the IRS challenge the position, preserving the option to claim the maximum possible benefit. The final reporting decision can then be deferred until the time of sale. Please consult with your tax advisor and estate attorney should you decide to pursue this strategy.

Other Planning Considerations

Section 1045 Rollover:

If a sale is expected before the whole holding period (now three, four, or five years), you can defer capital gains tax by reinvesting the proceeds into new QSBS within 60 days. This allows you to tack on the holding periods to qualify for the exclusion eventually.

State Taxes:

Be mindful that many states, notably California and New Jersey, do not conform to the federal QSBS exclusion, meaning you may still owe state capital gains tax on the excluded federal amount.

Documentation:

Diligent record-keeping is critical. You must be able to prove all requirements were met from the date the stock was issued until it was sold, especially given the new tiered holding periods and increased asset thresholds.

The QSBS exclusion is a complex but exceptionally valuable part of the tax code. We strongly recommend collaborating with your wealth management team, tax, and legal advisors to ensure eligibility and implement strategies, such as stacking, as early as possible in the company’s life to capture the full benefit.