By Jeanette Garretty, Chief Economist

June 11, 2020 – Consumer spending is 70% of the US economy, as measured by US GDP, and the frequent repetition of this mantra by popular financial media, academics and Wall Street analysts alike is testimony to the sheer power of the fact. While economic sectors with smaller shares of GDP — business investment, net exports (exports minus imports) and government – play powerful roles at the margin, influencing the speed of deceleration or acceleration in economic activity, consumer spending is the fundamental determinant of the economy’s trajectory.

Small wonder, then, that macroeconomic modeling assigns considerable importance — and a large number of equations – to the correct specification of the determinants of consumer spending. Net income, savings rates, household net worth, employment, even home ownership and new home purchases (historically nothing is more significant to makers of major appliances than new and existing home purchases) have all been found to be statistically significant variables influencing consumer spending, with variables relating to income being of overwhelming importance. The best adage for the American consumer has often been “Spend it if you got it”, with the “got” increasingly including access to credit.

Measures of “consumer confidence” have seldom been found to have dominant statistical weight in the formulation of models of consumer spending. Part of the problem is that “confidence” is one of those terms that everyone knows when they see it – but can’t quite define. Complicating the statistical formulation issues is the understanding that the more directly measured income, asset and employment factors are themselves contributors to this thing called “consumer confidence.” Nevertheless, there is a reluctance to let measurement challenges override the sense that consumer confidence must surely have something to do with consumer spending. And, if perception is nine-tenths of reality . . . no wonder equity traders have at various times gone to great lengths to obtain consumer confidence metrics (In 2013, Thompson Reuters agreed to stop selling the University of Michigan Consumer Sentiment monthly index to selected computerized trading customers — for a considerable fee – a few seconds ahead of the official press release.)

There are two widely accepted measures of consumer confidence and there is importance in understanding their differences, starting with their names. Both of the measures are derived from surveys. The oldest survey is the University of Michigan Consumer Sentiment Survey (now called the Survey of Consumers), which was founded in 1946 by George Katona, a professor of psychology, with funding and motivation from the US auto industry. Five hundred households are surveyed monthly (in the middle of each month) for attitudes regarding personal financial conditions and short- and long- term outlooks for the general economy. There are 50 questions and the results are broken down into various categories which can be thought of broadly as “Are you better off today than you were?” (Current Conditions) and “Will you be better off in the future than you are today?” (Future Expectations.) In 1985, The Conference Board, a non-profit business membership group, started the Consumer Confidence Index (CCI) taken from a five-question survey of 5,000 households, also in the middle of each month. The CCI similarly seeks to distinguish between current and future conditions. The Conference Board assumed the publication of Leading Economic Indicators (LEI) from the US Department of Commerce in 1995 and the CCI has become an important component of the LEI (there is no shortage of acronyms in this space.) Due to its comprehensiveness and, probably, its academic roots, economists and macroeconomic forecasters favor the University of Michigan Consumer Sentiment Survey, while at various times investors have been more inclined to watch the Conference Board number.

Generally, while there can be and have been monthly differences in the direction of measured sentiment, both surveys are relatively consistent in identifying the overall trends. And both surveys support the often-overlooked reality that consumers are much better at evaluating current economic and personal financial conditions than they are about predicting future economic conditions. Notably, the detailed questions of the University of Michigan survey document that consumers tend to overestimate inflation and interest rate changes and overstate employment prospects.

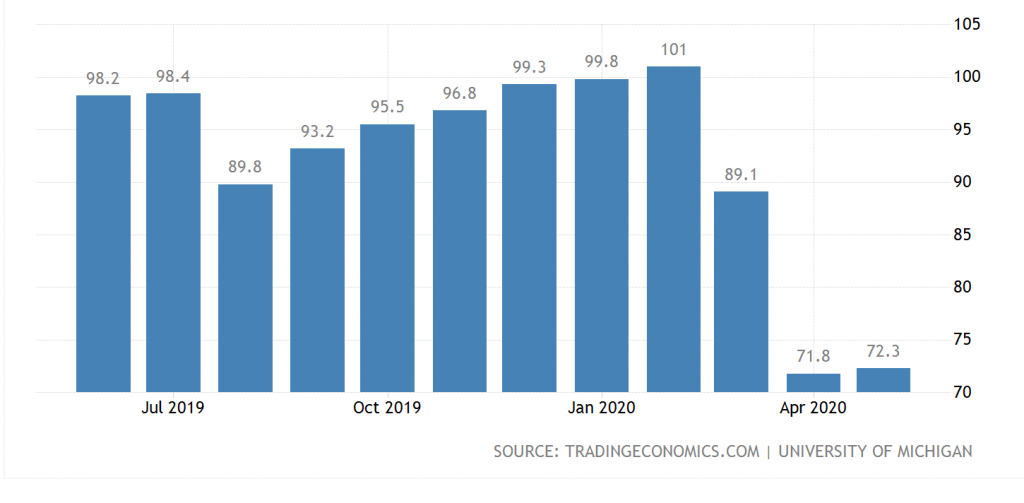

University of Michigan Consumer Sentiment Survey

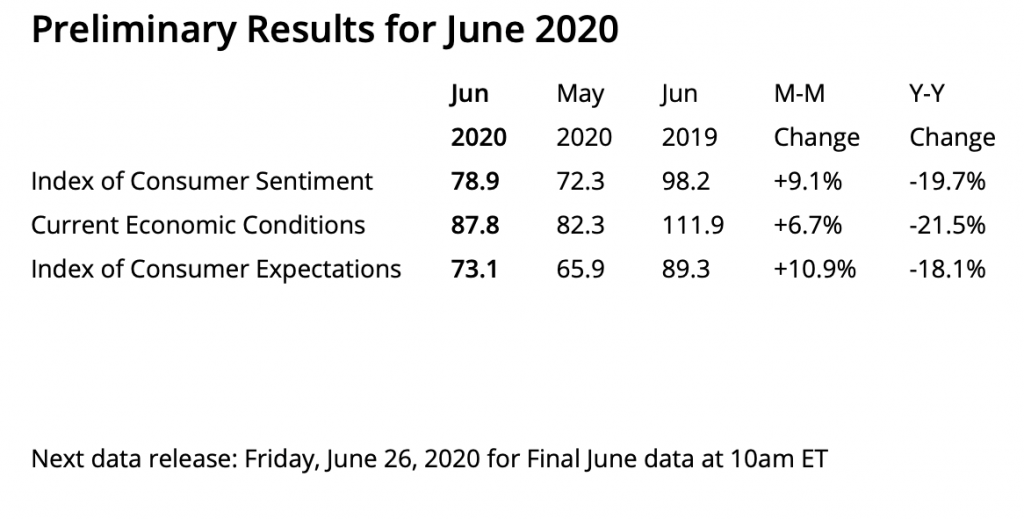

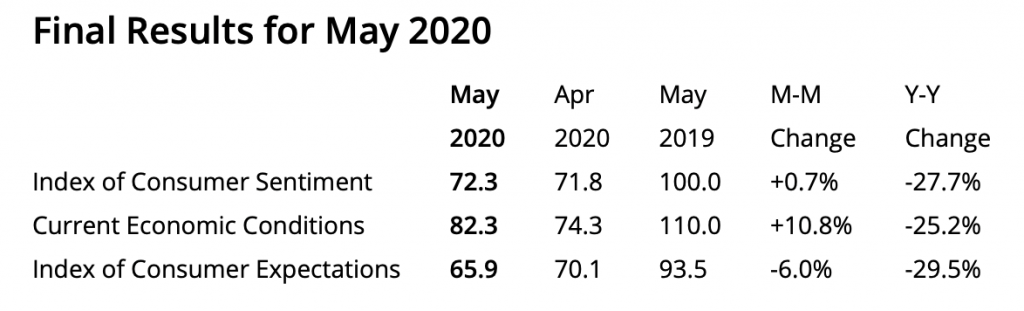

The University of Michigan provides a useful breakdown of their survey each month, in tabular format. The numbers for May 2020, which in the aggregate showed a surprising, if minor, rebound in consumer confidence, highlight the challenge in forecasting consumer spending over the next few months:

Source: Survey of Consumers, University of Michigan

Source: Survey of Consumers, University of Michigan

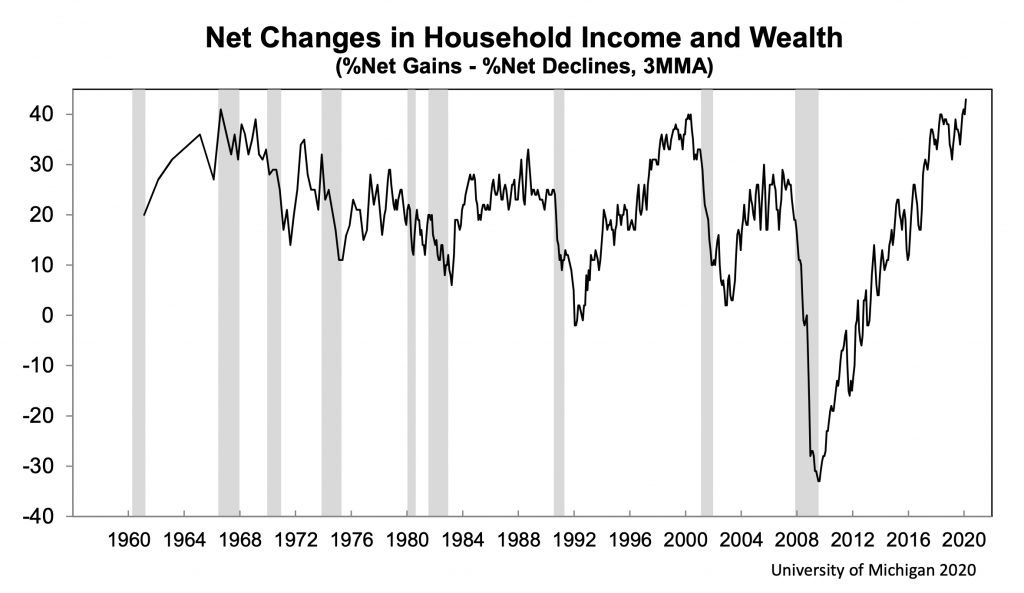

If consumers do the best job at assessing current economic conditions, then optimism about the rebound of the US economy can be found in the sharp improvement in consumer attitudes about the present environment. This would suggest that consumer spending might begin to rise, in keeping with a picture of household wealth that has not noticeably deteriorated–yet.

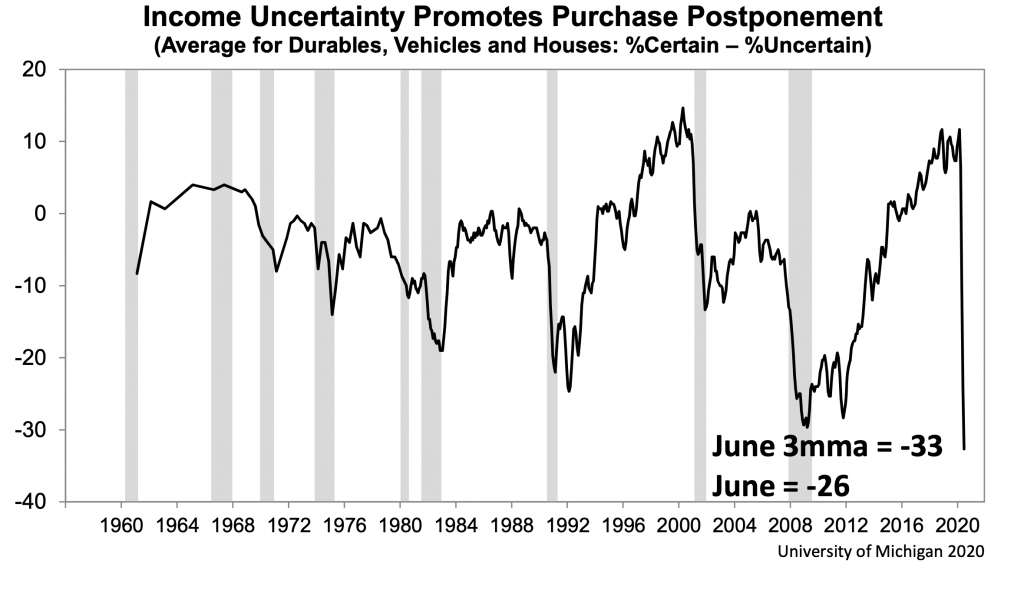

But the divergence in consumer sentiment about the future is worrisome. Typically, consumers will parse such divergent attitudes with increased caution about spending, especially on “big-ticket” consumer goods. In April 2020, the US personal savings rate hit a record high of 33% according to the Bureau of Economic Analysis and Bank of America reported that balances in checking and savings accounts were 30%-40% higher than earlier in the year. The associated report for monthly retail sales (representing approximately 40% of total consumer spending) showed a 13.6% decline. As the economy opens up and opportunities become more available to spend down the accumulated savings, the near term path for the US economy may be determined, at least in part, by the degree to which consumers choose to believe their own forecasts.

But the divergence in consumer sentiment about the future is worrisome. Typically, consumers will parse such divergent attitudes with increased caution about spending, especially on “big-ticket” consumer goods. In April 2020, the US personal savings rate hit a record high of 33% according to the Bureau of Economic Analysis and Bank of America reported that balances in checking and savings accounts were 30%-40% higher than earlier in the year. The associated report for monthly retail sales (representing approximately 40% of total consumer spending) showed a 13.6% decline. As the economy opens up and opportunities become more available to spend down the accumulated savings, the near term path for the US economy may be determined, at least in part, by the degree to which consumers choose to believe their own forecasts.

The next report of the University of Michigan Consumer Sentiment Index, the preliminary report on consumer attitudes in June, will be June 12. The next report of the Conference Board CCI will be June 30. For global financial markets already on a nervous edge, these numbers and especially the detail provided, will carry above-average importance.

Addendum: University of Michigan Consumer Sentiment Press Release for early June 2020, Survey of Consumers, Friday, June 12, 2020

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. This material is for general informational purposes only. It does not constitute investment advice or a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, the opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Any discussion of U.S. tax matters should not be construed as tax-related advice. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. © 2020 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere