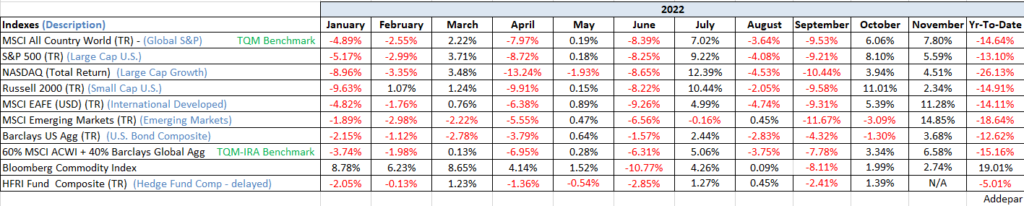

For November, equity markets continued their recovery from October’s lows. The U.S. market in S&P 500 terms (+5.59%), was easily beaten by both the International Developed market and Emerging market Indexes (+11.28% and +14.85%, respectively) for the month. International Indexes are not as heavily exposed to technology as the U.S. indexes, and technology lagged all sectors last month. The bond market also registered a strong month with yields in the US and Europe retreating significantly, leading to a 4.7% rally for the Global Aggregate Bond index.

For the S&P 500 Index, from its October 13th closing low through the end of November, the Index rallied +16.86%, and was down -13.10% YTD at month end. While the rally that began on 10/14 has established itself as the strongest rally of the year and has enough positive momentum to suggest it should continue into year end, it has not yet given a clear technical signal that it can roll well into the first quarter of next year. Without more positive intermediate-term breadth and momentum signals the bear-market-rally label stays with our current rally. As I type this monthly cover letter, mid-day on 12/6, the S&P 500 is off almost -4% for the month in 3.5 trading days. Profit taking after a six week +16% move is not unique market behavior, especially considering this first week of December is a light economic-data week with the Fed is in its quiet period ahead of next week’s meeting. We will give the rally the benefit of the doubt and try get through next week’s CPI data and the Fed meeting before throwing in the towel on our rally prematurely.

Looking ahead, 2023 appears very dependent on a go/no-go recession scenario. NDR’s (Ned Davis Research) macro-economics team recently raised their probability of a recession next year to 75%. Risks are high but a recession is still not a foregone conclusion. They also believe the last Fed rate hike could be as soon at Q1 next year, but do not see rate cuts before September at this time. A recession could mean a break of equity lows in the first half followed by a sharp rebound; no recession could mean a stronger first half and less volatility. I suspect the equity market will give us its recession insight in the next few weeks.

Sources: Addepar, Bloomberg, JP Morgan Asset Management, Ned Davis Research

Be well,

Mike