By Stuart Katz, Chief Investment Officer, Feb 11 2021

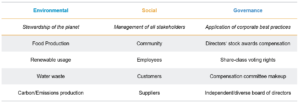

Fifteen years ago, environmental, social and governance (ESG) criteria would have been a foreign concept to most investors. Now, ESG strategies are a ubiquitous presence on the investment landscape, with the market seeing nearly $50 billion in monthly inflows by the end of 2020. (1)

Fifteen years ago, environmental, social and governance (ESG) criteria would have been a foreign concept to most investors. Now, ESG strategies are a ubiquitous presence on the investment landscape, with the market seeing nearly $50 billion in monthly inflows by the end of 2020. (1)

As the planet’s climate changes, the fastest-growing fortunes in the world are adapting, creating a new green generation of billionaires in the U.S. and China with the growth of electric vehicles, batteries, carbon capture technology, wind and solar power. Nine of the 10 largest economies are committing to net-zero emissions goals. Hundreds of companies worldwide have also pledged to neutralize their carbon output by midcentury or sooner.

But that doesn’t mean everyone has approached these funds with the discerning eye they require. Despite the mounting data in the space, there remains a broad spectrum of investment approaches, including many that fail to grasp the details of underlying business fundamentals and valuations.

Integrated Approach to ESG Investing

At Robertson Stephens, we seek to maximize risk-adjusted returns over the long-term by integrating ESG principles into our traditional investment process. We incorporate material ESG factors into our analysis across risk assets to identify investment opportunities because we know sustainability helps drive company performance.

We believe ESG criteria largely hinge on quality, defined by a firm’s profitability, financial leverage, operating cash flow stability, competitive position, growth potential and management team expertise. ESG-focused companies committed to managing nontraditional risks and opportunities are often better positioned to withstand new regulations, evolving customer preferences, and catastrophic events such as the pandemic and other changes.

Research shows that ESG-rated companies can strengthen a portfolio in various ways, including through lower stock-specific tail risks and less systemic volatility. MSCI determined, for example, the frequency of tail-risk events was roughly three times higher for companies that score poorly on ESG metrics compared to their higher-ranking peers. (2)

The growth in green bonds is also a strong indication that investors believe ESG integration in fixed income helps companies lower capital costs and create shareholder value. MDPI published research suggesting green bond financing incentivizes issuers with improved debt service coverage ratios while simultaneously aligning their objectives with those of stakeholders. (3)

Applying the ESG Framework to Uncover Opportunities

To build portfolio resilience, we need to go beyond traditional allocations and consider alternative ESG return sources that can provide ballast, diversification and income. But to do so, we need to stop thinking about ESG as an isolated play–or as a trend that can be reduced to a savvy marketing ploy.

These factors don’t exist in silos apart from the traditional investing process. For public and private investments, we need to view ESG through a practical lens that’s part of a deeper set of analytical and qualitative judgments.

We believe that with the scarcity of yield, investors can seek greater returns by merging traditional allocations of mutual funds and exchange-traded funds with alternative ESG funds. The “60/40 portfolio” needs to be redesigned to consider alternative Investments such as renewable infrastructure.

Key Themes Defining the ESG Space

Currently, we are more constructive on equities as the outlook for vaccines, fiscal stimulus, monetary policy and earnings fundamentals create a positive backdrop. We have the highest conviction in a largely barbell portfolio construction of U.S. and emerging market risk assets and trends. Short-term risks and volatility will always exist, but we construct portfolios to capture longer-term durable themes we believe will help outperformance over a longer timeframe.

Electrification and decarbonization are reshaping the global economy, shipping and transportation industries. Other themes include healthcare innovation, digital infrastructure and remote education.

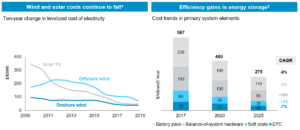

Studies have shown that declining wind and solar costs combined with increasing energy storage efficiencies are changing the investing landscape. As a result, the renewables theme can play an increasing role in traditional portfolios. As with many asset classes and industries, expanding valuation multiples are creating concerns regarding a renewables bubble. We believe the green transformation is a durable trend, but requires a disciplined investment process to build resilient portfolios.

Studies have shown that declining wind and solar costs combined with increasing energy storage efficiencies are changing the investing landscape. As a result, the renewables theme can play an increasing role in traditional portfolios. As with many asset classes and industries, expanding valuation multiples are creating concerns regarding a renewables bubble. We believe the green transformation is a durable trend, but requires a disciplined investment process to build resilient portfolios.

The pandemic forced us to adapt our lives in countless ways, so our investment portfolios need to adapt too. Companies that meet ESG criteria are better positioned to thrive over the long-term. By the same token, portfolios that include ESG-related strategies are better prepared to capture returns and mitigate risk.

__________________________________________

1. Morgan Stanley Research as of December 13, 2020 titled “Sustainability & ESG in 2021”

2. Giese, Guido; Lee, Linda-Eling; Melas, Dimitris; Nagy, Zoltan; Nishikawa, Laura. “Foundations of ESG Investing–Part 1: How ESG Affects Equity Valuation, Risk and Performance,” MSCI, Vol. 45, No. 5, 2019

3. Multidisciplinary Digital Publishing Institute (MDPI) The Effect of Green Bonds on the Profitability and Credit Quality of Project Financing Ana-Belén Alonso-Conde Department of Business Administration, Rey Juan Carlos University, Paseo de los Artilleros s/n, 28032 Madrid, Spain; Received: 12 July 2020; Accepted: 15 August 2020; Published: 18 August 2020

4. BlackRock, using data from Bloomberg New Energy Finance, March 2019. Note: All LCOE calculations are unsubsidized. MWh: megawatt hour

5. McKinsey, June 2018. Cost of a 1-megawatt energy storage system with a 1-hour duration by segment. EPC: Engineering, procurement and construction. Battery pack: cost includes battery-management system, cells and modules. CAGR: Compound annual growth rate, 2017 to 2025