By Stuart Katz, Chief Investment Officer, April 27, 2021

As investors veer from traditional stock and bond portfolio allocations in search of income, one alternative shows signs of penetrating new sectors, generating opportunities in the short-term while sustaining growth in the long-term: real estate.

Real estate has long been touted as a resilient asset class, one with potential to offer stability, diversification, performance and yield. It can serve as an inflation hedge, and has traditionally offered a higher level of income, strong total return and lower volatility than many other asset classes. And yet it is often overlooked by investors seeking alternatives in an income-deprived environment amid rising inflation fears.

Deciphering an emerging real estate landscape

We see new opportunities and strategic allocations in the real estate market emerging this year and beyond. Healthcare growth will fuel demand for life science facilities and medical offices.

Data centers, controlled environment agriculture and mobile phone towers will likely flourish as technology digitizes the real estate sector. Environmental, social and corporate governance factors and impact investing will re-shape portfolios as net zero carbon buildings gain market share.

Covid-19 has accelerated existing underlying trends in real estate, driving momentum with online shopping, the digital economy and migration to Sun Belt markets. However, we anticipate slow growth over the next decade given the high government debt burdens resulting from the pandemic, favoring property types that rely less on economic growth to generate income.

Mining the market with a strategic vision

So how can investors re-evaluating risk and reward in their portfolios spot opportunities in this space? With real estate, our goal is to diversify risk, generate tax-advantaged stable income, provide a hedge against inflation, and achieve differentiated capital appreciation without being tied to the volatility of stocks. For this, we believe investors should embrace a three-pronged approach that prioritizes core income-generating, total return-focused and opportunistic investments.

For income-generating core and core-plus assets, we look for traditional multi-family and budding single-family rental (SFR) units that show potential for long-term operational improvement. We consider perpetual structured funds with certain liquidity intervals to serve as a low-turnover, long-term yield-generating complement to a fixed-income portfolio.

We also focus on total return-focused investments that complement mid-single digit income generation with business plans that will increase property value. We look for value-add opportunities and managers with a history of increasing operating income during hold periods. Here, the value-add may come through operational improvement or targeted capital expenditures.

Finally, we look for opportunistic investors who target distressed properties or sellers. Business plans in this space may include development, redevelopment, repositioning or significant capital expenditures. We believe returns in the opportunistic space will more likely be predicated on property value appreciation than income generation. This paves the way for intentional short-medium term overweight to preferred strategies, markets, asset types and themes.

Locking in on the single-family rental

In this emerging landscape, we see investing in SFR units as a key core income strategy. We anticipate shrinking exposures to the traditional office and retail spaces, making way for alternative sectors, with a focus in the residential sector broadening to SFR units, as well as to industrial, self-storage, affordable housing and student housing units.

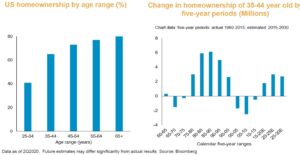

In particular, new economic and demographic factors should provide strong tailwinds for the SFR industry emerging in the U.S.—an opportunity defined by growing demand, reduced affordability and limited availability.

Specifically, we see millennials forming households and renting in higher proportions, in addition to rising home prices and non-mortgage debt burdens with a sustained tight mortgage credit availability.

That comes with housing vacancy hitting 35-year lows and a significant undersupply of new housing, entry-level in particular. These dynamics result in increased occupancies with new households driving up demand and lower turnover rates leading to longer stays. Excess demand and constrained supply bolster new rental growth.

The real estate market is not new, but it is ‘redefined.’ There are opportunities for investors seeking an alternative asset class to identify new sources of income and return—if they know who to partner with and where to look.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, the opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only avail- able to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec. gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robert- son Stephens Wealth Management, LLC in the United States and elsewhere. A1124