By Stuart Katz, Chief Investment Officer, May 27, 2021

As part of the Investment Office’s commitment to communication and information, below please find our current observations and framework to help support our alternative real estate recommendations in multifamily (MF) and single family rental (SFR). Despite the current price environment, the IO maintains its conviction in the durable trends behind these property types and the managers selected to capture the benefits of these themes.

Clearly, home prices cannot continue to appreciate and outstrip income growth forever. However, if we lean on history the current increase in home prices is more moderate than fifteen years ago, particularly given current low mortgage rates of ~3%. We all know real estate is a very fact specific asset class where active management is critically important to understand the deal dynamics of the specific market, property, and seller. However, the overall market arguably is reasonably priced. According to JP Morgan, the average price of an existing single-family home sold in April 2021 at ~ $365,000 – roughly 2.6 times annual household disposable income. This is consistent with its average of the last 20 years and 21% lower than its peak in the summer of 2005 at the height of the early-2000’s housing bubble. Moreover, during the time before the Great Financial Crisis the average 30-year mortgage rate was 5.8% – approximately double today’s level.

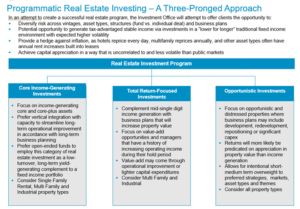

Below is the PowerPoint slide we previously shared which maintains our framework regarding the use of these real estate alternative strategies. The goal is to provide a differentiated source of total return and alpha complementing a typical traditional public portfolio while helping to provide ballast, yield, and an inflation hedge. We describe below our belief there are certain durable trends that will continue to help support multifamily and single-family rental investment strategies as part of a thoughtfully diversified portfolio.

From an investment thesis perspective…

- We believe there is a strong, fundamentally grounded investment case for owning quality MF and SFR housing in certain high-growth sunbelt markets across the U.S. to capitalize on both long-term demographic shifts and a growing mismatch between demand and supply for entry-level housing. Looking forward, we expect higher occupancies, capital improvements and attractive rent growth to help drive margins.

- Since 2010, demand for housing has outpaced new housing construction (single-family or multifamily). The U.S. Census estimates that for the 12-month ended December 31, 2019 household formations were approximately 235,000 higher than net new supply relative to the prior 12-month period, contributing to a decline in housing vacancy rates to a 35-year low through first quarter of 2020.

- As we continue to see population shifts to sunbelt states the demand for housing cannot be met exclusively by single-family homes. Apartments are the most cost-effective way to address the market’s shortage and affordability issues. Plus, apartments are more environmentally friendly, and they have a lower impact on local municipalities. As our country moves towards a greener economy, multifamily and single family rental housing will be part of the solution.

Other considerations

- SFR Demographics and Ownership* The ageing of the Millennial generation (largest generation in U.S. history) is expected to increase aggregate housing demand over the next decade, particularly for single-family housing as this cohort forms incremental households, in particular families with children. After accounting for the Global COVID Recession (“GCR”), the average Millennial has experienced slower economic growth since entering the workforce relative to any other generation and also will bear its economic scars, contributing to delayed milestones such as homeownership, a long-term tailwind for SFR. COVID-19 has also accelerated migration trends from urban to suburban areas, particularly among Millennials, evidenced by the largest quarterly change in homeownership rate among those under 35 going back to 1994 (+3.3% versus +1.3% in June 2004 which is second highest). Coupled with the normalization of remote working, this is likely to be additive for SFR demand, especially for lower density sunbelt markets that are expected to have above-average relative population and employment growth. The institutional SFR industry is entering a maturation phase which we believe resembles the evolution of multifamily in the 1980s and 1990s. Relative to multifamily, SFR remains a nascent industry (less than 3% institutional ownership) with considerable opportunity to leverage technology and best practices to drive cash flow growth over the next several years.

* Sources: US Census, Harvard University, Chicago Tribune, Business Insider, Globest.com

- Rent Pressure. Rising home prices, in the absence of the imbalances that characterized the housing market during the GFC coupled with historically tight mortgage credit availability is likely to be supportive of higher rental demand overall, despite a deep contraction and uneven path of recovery. The Wall Street Journal (April 24, 2021) reported March 2021 rents rose nationwide by 1.1% (in one month). Co-Star, a real estate analytics company, reported MF rents for the first quarter of 2021 were up 4%. When you consider that in 25% of the US markets, rents declined, this is a healthy sign for investors (especially in the sunbelt where ApexOne and Pretium invest). Co-Star survey projected between 2.5% and 3.5% annually between now and 2023. However, in many properties and markets that our managers have acquired or have under contract, they are seeing rent increases ranging from 5% (San Antonio) to 12% (Ft. Meyers, Orlando). While they are generally underwriting at the broad market projections, we believe these sunbelt markets have the potential to outperform. The Wall Street Journal (May 25, 2021) reported rising construction costs are slowing down the development of new apartment communities and forcing higher rents into the ones which are being built. These higher rents in new units will pull rents up in other communities, especially the 2016-2021 vintage assets, which can compete on at a lower basis. Many of the newer units under development have a smaller average unit size to increase density and provide economies of scale to the builder.

- Multi Family Supply/Demand. Absorption over the next few years is projected by Witten Advisors to be approximately 400,000 units per year, and net supply is slated at about 300,000 units. The US nationwide occupancy is currently around 95%; this absorption will have occupancy approaching 97% by the end of 2023. It is also questionable if this development pace is realistic given the current construction costs (lumber up 250%-300%; steel up 18% in March alone, labor cost increases continue, etc.). For the avoidance of doubt, the success of our recommended strategies do not require rising construction costs.

- Summary. Our observations so far suggest to us that multi-family and single-family rental strategies with our recommended managers are suitable complements to a traditional public portfolio in the context of the current and expected market and macroeconomic regimes.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax, or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views, and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, the opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec. gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere. A1129