By Stuart Katz, Chief Investment Officer, May 28, 2021

While many are still ruminating about a life of international travel, wondering when it might be safe to resume vacation planning overseas, others aren’t waiting to enjoy some of what the world’s destinations have to offer. They haven’t booked a flight to a Greek island or a Tuscan villa, but have allocated some of their financial capital to European equities. And there are a number of economic indicators to suggest that is an astute move to make now.

First, European equities, focused on ESG opportunities as well as value and higher cyclical sector exposures such as financials and industrials, offer different sources of return. Second, diversifying into international stocks could mitigate some of the concentration risk we’ve seen emerge over the last few years in some of the key US stock market indices, large-cap in particular. We know, for example, that at the end of 2020, the top five names in the S&P 500 represented 22% of the index itself, or roughly two-thirds more than the top five names in the MSCI EAFE Index. Finally, valuations in international equities provide a relatively more attractive entry point than US equities.

Value trap or windfall?

For those that fear we will face the anemic European economic growth and market performance we saw in the wake of the Global Financial Crisis, there are indications this time will be different. After the 2007-2008 crash, a weak banking system and massive government, corporate and consumer deleveraging created a headwind for the asset class. Those same forces are not at play. Instead, we have a pandemic that appeared to have gained the upper hand in the battle against vaccine distribution—until now. What seemed like a derailed rollout now appears to be a delayed rollout that is quickly gaining steam with vaccine administration increasingly, leading to a reversal of fortune for European equities. Many skeptics, however, question whether this change will generate attractive returns or if Europe will remain a “value-trap.”

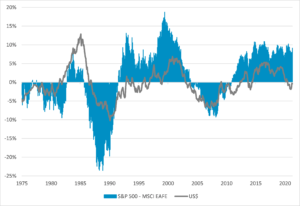

US Equity VS EAFE* Equity

Relative Performance: Monthly rolling 5-year annualized returns

Source: Bloomberg. Annualized 5-year return of the S&P 500 index minus the annualized 5-year return of the MSCI EAFE index. US dollar return based on annualized 5-year return of DXY index. * EAFE = Europe, Austalasia and Far East

“Opportunity of the century”

There is another dynamic to consider when contemplating the value-trap scenario: NextGenerationEU. This economic recovery plan, passed last year in response to Covid-19, along with the European Union’s long-term budget, will make the largest stimulus package Europe has ever financed as a 1.8 trillion-euro infusion (~$2.2 trillion USD).[1] NextGenerationEU may serve as the spark needed to catalyze value creation.

Europe has seen less fiscal stimulus than the US since Covid took hold, though social assistance continues to support the incomes of many workers displaced by the pandemic. But NextGenerationEU, a 750 billion euros plan, is not simply to rebuild the economy—it’s to rebuild a greener and more digital economy. As EU President Ursula von der Leyen said in a recent EU statement, it is a chance “to build a Green Europe, which protects our climate and our environment and which creates sustainable jobs” and “to invest in a digital Europe, innovative and competitive in global markets.”[2] It is, without a doubt, an interesting opportunity for the bloc.

But whether the stimulus is, as von der Leyen states, the “opportunity of the century” for Europe, remains to be seen. That will depend on execution. The EU’s 27 governments were expected to submit plans in April of this year detailing how they intended to spend the billions they will receive from the jointly borrowed EU funds through 2026. The NextGenerationEU requires governments to spend 37% of the money they receive on reducing CO2 emissions in their economies and 20% on digitalizing them through, for instance, improving computer literacy or building high-speed Internet networks. Only about half of the countries, however, have so far submitted their plans.[3]

The EU Commission allotted a few months to review and develop an aggregate consensus plan. For any money to be disbursed, however, the EU’s 27 national parliaments must first ratify a law that increases national guarantees to the EU budget, the ultimate guarantor of the joint EU borrowing. So far, 19 countries have ratified.

We all know that hope is not a strategy. And, several material European elections taking place, including ones in Germany and France, complicates the timing and implementation of this Hamiltonian program. Former European Central Bank (ECB) President Mario Draghi was recently given a mandate to form a unity government in Italy. His appointment has been greeted favorably by markets. In the eurozone, we expect disbursements from the recovery fund to grow over the next two to three years while the ECB considers tapering bond purchases in 2022. However, the back-loaded nature of stimulus relative to the front-loaded approach adopted in the US may mean that the EU economy continues to lag well behind the US over the next six months or so.

View on valuations

Lastly, let’s turn to valuations. The reality is international stocks are trading at a discount versus other, more crowded areas of the US market and we expect US investors to benefit from a weaker US dollar. At the end of 2020, for example, US stocks as represented by the S&P 500 were trading at a material premium compared to other parts of the globe. According to Bloomberg, the MSCI EAFE (Non US Developed Equity Benchmark) trades above its 10-year historic average based on a P/E multiple but still 25% below the US S&P 500 market multiple which may be partially explained by its underlying sector mix which overweights financials, industrials and material sectors at the expense of technology. At 16.6x forward earnings, the Non-US Developed index trades quite rich relative to its 10-year history of 14.4x. It also trades 16% above its 10-year average of MSCI EAFE/S&P 500 relative PE.

It’s always a good idea for investors to examine how their portfolio is positioned from a risk perspective as they seek new opportunities. For example, we are underweight nominal US and European government debt due to our expectations that the positive prospects for global economic growth will push higher inflation and bond yields while fixed-income prices trade lower. We see international equities as fertile ground.

Government Yields: U.S. 10-year German 10-year

German 10-year bund yield and spread vs U.S. 10-year treasury

Source: Bloomberg. As of 5/24/2021.

The landscape for this asset class is looking better than it has in many years, aided by ECB President Christine Lagard’s commitment to accommodative interest rate policies and increasingly large fiscal stimulus packages such as the European recovery fund. And, with progress in reopening the most damaged parts of the economy, corporate profits are climbing out of a deep hole with companies offering clearer outlooks for future profits. Active and passive managers, however, paired as part of a deliberate allocation, are probably still the best tour guides.

3 Fourteen EU Countries Have Submitted Recovery Plans, 13 Still To Go

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax, or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views, and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, the opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services, and fees, is available through the SEC’s website at: www.adviserinfo.sec. gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere. A1130