By Michael Tierney, September 27, 2021

Using a mathematical model to guide one’s portfolio investment decisions has a record of success and a gain in popularity that correlates almost perfectly with the growth of the computational capacity we have at our fingertips. As computers have been able to handle exponentially growing amounts of data across an increasingly wide variety of sources, modeling to inform portfolios has recently led to some of the greatest investment records in history. James Simons for example, a mathematician who formed Renaissance Technologies to use algorithms to harness big data in computer models has, since its inception in 1988, produced the greatest record of investment success in the history of modern finance. No one in the investment world comes close. Warren Buffet, George Soros, Peter Lynch, and Ray Dalio to name a few greats, all fall short.

Model investing as described here is not to be confused with High Frequency Trading (HFT). HFT also uses powerful computers but the similarities to model investing end there. Securities trading in HFT is conducted by computer networks with the speediest high-speed connections to the various exchanges. HFT traders use their speed advantage in many cases to try to front-run institutional order flow. Simplified; HFT traders try to buy on the bid of a security and sell on the offer price. Their net profit per trade is often less than a penny, but they use the enormous computer capacity to trade many, many millions of shares per day – the fractions of pennies add up. HFT programs are by far the largest volume trade investors in the marketplace. Is it legal? It seems close to the line but ultimately that answer is for market regulators to decide.

The extraordinary success of Simon’s mathematical models and algorithmic trading programs has spawned an entire new industry. Outside of HFT, algo-trading represents the next largest category of daily trading volume on U.S. exchanges. It has become incredibly widespread in a very short period. Beware, however, the expression “model investing” is one of the most overused terms in finance today. Caveat emptor and due diligence are important components to investing in model driven strategies.

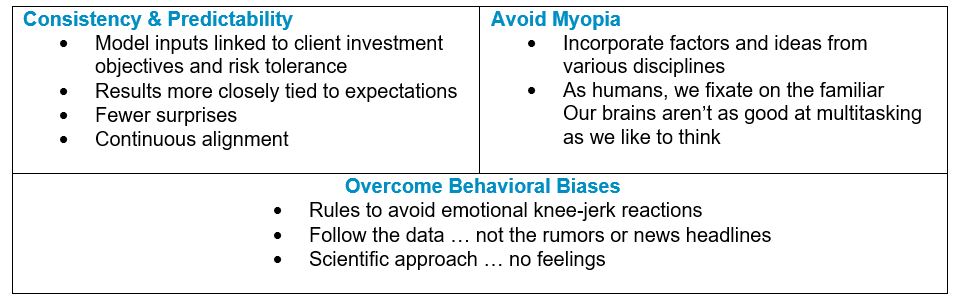

Algorithmic trading models are not a panacea for investment success. Investing is hard, it is difficult to consistently outperform the market, and it is no surprise that many model investment programs have underperformed their targeted benchmarks. But the spectacular success of some does point the initiated in an interesting direction. The reasons to invest under an open, rules-based model methodology are numerous. There is consistency and predictability, the avoidance of myopia, and most importantly, it removes emotion from the investment process and allows the investor to overcome behavioral biases. Furthermore, some model structures are tax advantaged for taxable accounts, and many have an exceedingly low fee structure overall.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere. A1159