February 9, 2023 – The first two weeks of February provided investors with a series of contradicting signals about the state of the economy. It began with the Federal Open Market Committee meeting on February 1st, where the Fed, as expected, raised interest rates by 25bps to a range of 4.5-4.75%. While the decision itself was no surprise, Chairman Jerome Powell’s comments in the subsequent press conference suggested, for the first time, that the Fed might be ready to ease its war on inflation.

To be sure, Powell continued to emphasize that the Fed is determined to get the job done and would not let up until inflation is under control. But he also acknowledged that price disinflation (prices coming down) has begun and that the Fed will respond to changing conditions. Overall, this press conference was the least hawkish delivered by Powell since interest rate hikes began last year and offers a strong argument for the Fed rate settling around 5% later this year.

Complicating the picture, however, are the employment numbers released the following Friday, February 3rd. According to the Bureau of Labor Statistics’ data, the US economy added a net 517,000 jobs in January, an outstanding number by any measure. By comparison, November saw 290,000 net new jobs, and 260,000 were added in December. The surprising figure raised questions about the accuracy of the data and fears that the methodology used to seasonally adjust employment numbers might be distorted by the messy pandemic numbers. Despite all this, the data clearly suggests that the US is not in a recession.

Economists and investors alike are struggling to understand what is happening in the labor market. Daily headlines of large companies laying off thousands of employees appear alongside the lowest unemployment rate in 53 years. As we discussed before, the labor market is undergoing dramatic changes in the wake of the pandemic tied to demographic shifts, changing priorities, and the cycling in demand from services to goods and back.

Though the labor market remains tight, the data shows that wage increases are slowing, and companies are finding it easier to find employees. These are encouraging signs of normalization, suggesting inflation could be halted with only a softening of the job market, as opposed to a high increase in unemployment.

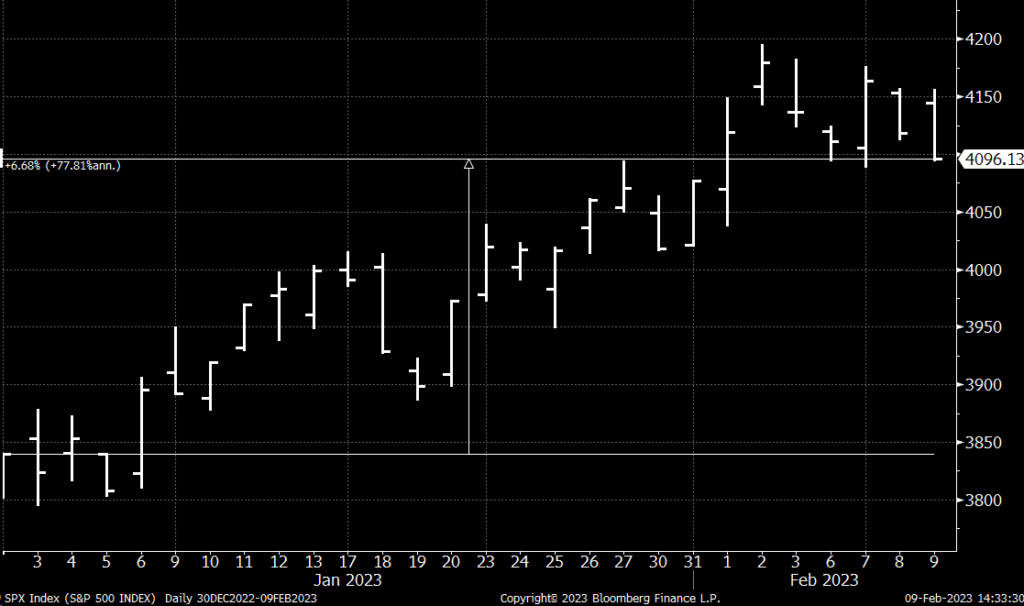

This certainly appears to be the view held by equity investors. In January of 2023, the S&P 500 returned 6.3%, while the tech-heavy NASDAQ returned 10.7%. Earnings are still being released for the fourth quarter of 2022, and although those reported so far by S&P 500 companies are down on average 6.7% from the same period in 2021, 71% of companies are beating expectations. This strong performance suggests that investors believe the Fed may have nailed the elusive ‘soft landing,’ bringing inflation under control without triggering a recession.

Bond market investors remain more circumspect. The spread between the 10-year and 2-year treasuries, a primary recession indicator, sank to -70bps last week, the deepest yield curve inversion since 2002. This would suggest a recession in the coming year, though importantly, the depth of the inversion has no correlation with the depth of the recession. Perhaps in expectation of a recession and the resulting interest rate cuts, interest rates fell across maturities in January, driving bond prices higher (recall the inverse relationship between interest rates and bond prices). At the same time, in another sign of confidence in the economy, the high-yield bond spread, the premium investors require to hold these riskier bonds, fell to its lowest level since May 2022.

It is clear from the Fed and Powell’s statements that we have turned a corner on inflation. Still, a lingering question remains about the Fed’s ability to bring inflation back to its 2% target without significant disruption in the labor market. Investors appear to be split on this question, but the consensus among economists and investors is that if we do see a recession in 2023, it would be a mild one. As always, your asset allocation should reflect this possibility, as well as unforeseen circumstances that could turn a mild recession into a deep one.

Keep an eye out for the next release of the Consumer Price Index (CPI) scheduled for February 14th. This number will be a key input in the Fed’s decisions going forward. In the meantime, wishing you a cozy February!

— AMD

Chart 1— S&P 500 Index Year-to-Date as of January 9th, 2023. Though markets were volatile, equity investors remained bullish with the SPX gaining 6.7% since the begging of the year (Source: Bloomberg).

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2023 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.