August 8 2019 – It’s not good when the online site for the Wall Street Journal features inch high headlines that resemble a supermarket tabloid. Yuan Plunges!! Global Stocks Fall! Giant Asteroid Heads Toward Earth!!

Okay, that last one wasn’t on the front page of the Wall Street Journal, but only because it was crowded out by the other financial news.

More seriously, what happened yesterday is of considerable interest and cause for concern, especially if you are a U.S. farmer, manufacturer or retailer. The dancing elephants (see “Dancing With Elephants”, May 16 2019) have taken off their tutus, strapped on their six-guns and headed for the OK Corral.

The Chinese Central Bank this morning appears to have pegged the Yuan above 7 ( think Alice Through the Looking Glass; down is up and up is down. 6.8 Yuan to $1 USD is stronger, or “above” 7 Yuan per $1 USD). If so, what was behind the Monday action of letting the Yuan break through the psychologically significant 7-1 barrier? Senior China Economist at Capital Economics said it best : China’s central bank “has effectively weaponized the exchange rate..” It was a shot across the bow :“Ya wanna play around with tariffs? Okay, let’s see what ya REALLY got.”

This is a high stakes game where the real consequences are difficult to ascertain in advance. A weaker Yuan introduces consumer inflation in China as the cost of imported goods rises; consumer dissatisfaction in a Communist country is never taken lightly. While some Chinese exporters will benefit from a weaker Yuan, they will suffer if there are retaliatory trade actions by the US. And Chinese importers and exporters may fail, placing great pressure on a perpetually shaky Chinese banking system. Even more difficult to estimate is the degree to which global investors may have placed complicated currency market bets, heavily depending upon traditional currency trading ranges – and what pain may be inflicted as those relationship are blown out of the water.

One year ago at Stanford University, Bo Li, Director General of Monetary Policy for the People’s Bank of China, candidly admitted the need for a better understanding in China of the transmission mechanisms governing the Chinese economy. Said another way, there are considerable analytical deficiencies confronting Chinese policy makers evaluating the impact of various actions. The fact that the economic consequences to China of launching a currency war may be no more relevant to the gunslingers involved than the economic consequences to the United States of imposed tariffs does not mean these consequences are not relevant. As is so often the case, innocent bystanders can be impacted in the most unexpected ways.

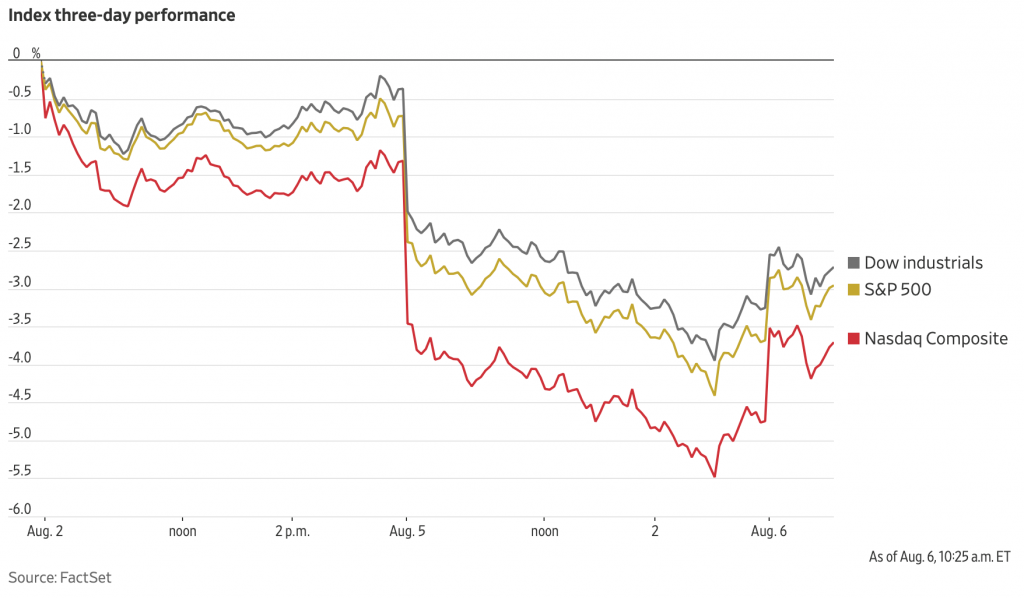

Equity markets are supposed to anticipate economic and financial conditions 7-9 months forward. Sometimes equity markets look and see their own shadow whereas at other times they correctly see a specter on the horizon. It will likely take a few weeks, if not months, for equity investors to reassess the actions and rhetoric in China and the United States and determine the real impact of this fight. US equity markets in August tend to reflect the sentiments of all those unhappily left behind on Wall Street while others relax and party in the Hamptons. It seems palpable, however, that the level of alarm has been raised and that there is a growing feeling that equity markets cannot be sustained by interest rate cuts alone.

Note: There will be a more in-depth analysis of the opportunities and risks of these developments later this week.

Disclosure

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”). Robertson Stephens is an SEC-registered investment advisor and wholly owned subsidiary of Robertson Stephens Holdings, LLC (“RSH”). RSH is majority-owned by investment funds managed by partners of Long Arc Capital, LP (“LAC”), a private equity investment firm, and receives management and strategic advisory services from LAC-related entities. The information contained within this letter was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. This material is for general informational purposes only, does not constitute investment advice or a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Information, views and opinions are current as of the date of this presentation and are subject to change. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Investing entails risks, including possible loss of principal. Robertson Stephens does not provide tax advice and any discussion of U.S. tax matters should not be construed as tax-related advice. © 2019 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.