Our Offices

15455 Gleneagle Drive, Ste 205

Colorado Springs, CO 80921

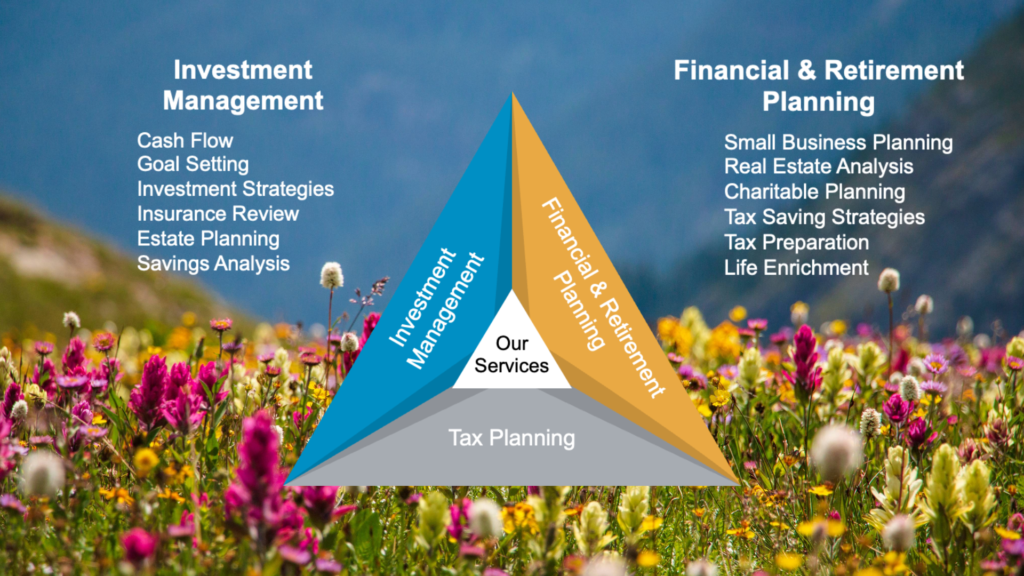

The Robertson Stephens Colorado Springs office integrates all aspects of comprehensive, fiduciary financial planning and wealth management. We provide a variety of services, including retirement planning, investment management, tax planning and preparation, small business planning, real estate analysis, charitable planning, goal setting, insurance reviews, and estate planning investment strategies. Tax planning is at the forefront of our strategies. With current and proposed changes in income and capital gains tax rates and potential changes in estate planning thresholds, we proactively identify tax advantages for clients. We view financial planning as more than your savings and retirement plan. We offer discussions on your personal life enrichment as part of our comprehensive planning.

Successful retirement planning provides confidence that you will have enough money after you stop working. Reaching financial independence means you have more life-enriching options either before or during retirement. Financial independence allows you to spend more time doing things that are important to you and finding new and creative ways to utilize your gifts, talents, and experience.

We believe that retirement isn’t just about money. It is about personal fulfillment, memory makers, health, and enjoyment. We help clients plan for fulfilling retirement years.

We seek to build customized investment portfolios that benefit from market upswings, weather market downswings, provide cash liquidity and achieve long term growth for each client. Addressing these complexities from a fee-only (fiduciary) perspective means we offer recommendations that put your interests first.

Our planning and investment recommendations address issues such as:

As your wealth manager, we:

We specialize in income tax planning and preparation and can help identify tax-saving approaches that apply to your situation, taking every possible deduction you are legally entitled to. We work with clients throughout the year to ensure efficient tax planning for their personal taxes and small businesses.

You might be able to save on taxes by:

For many, taxes represent a large annual expense. Careful tax planning can free up money to apply toward your goals.